A Rare November: Gaps, Post-Performance & Time Clustered Performance.

I have a lot of data in the pipeline, way too much for one blog, so this will be a multipart series.

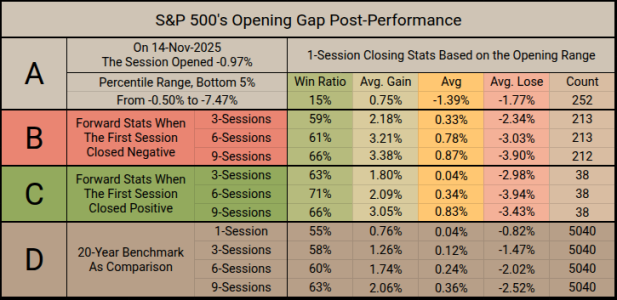

Friday's -0.97% Opening gap fell into the Bottom 5% Bucket

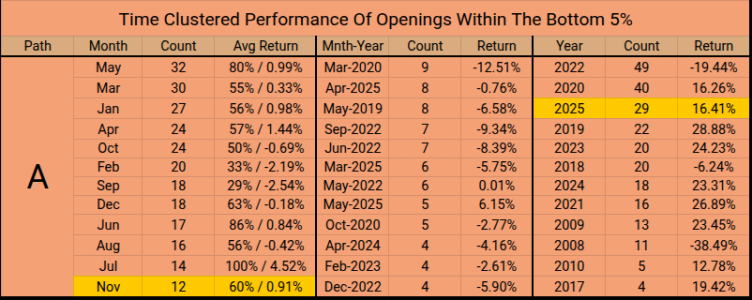

What is most interesting, with the total count of 252 Bottom 5% gaps sorted by month, November ranks last.

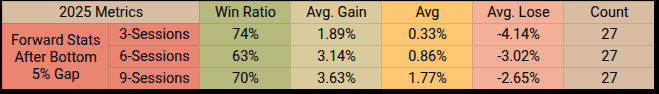

As mentioned, for 2025, we've had 29 Bottom 5% gaps. 27 of those gaps have completed their 3-6-9 session stats.

____

Closing this out: The issue with opening gaps to the downside, we rarely ever escape them, and most of the time when we do, it's just dumb luck.

I have a lot of data in the pipeline, way too much for one blog, so this will be a multipart series.

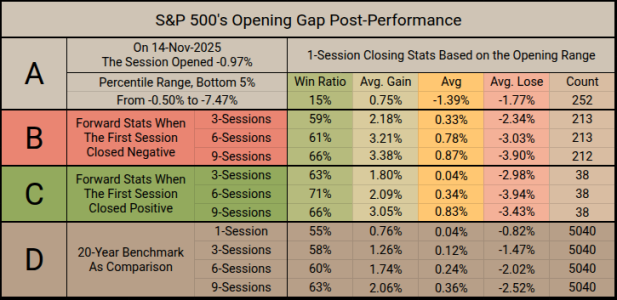

Friday's -0.97% Opening gap fell into the Bottom 5% Bucket

- This event occurs 252 times across the past 5,040 rolling sessions (20-years)

- Such an opening has very low closing stats with a 15% Win Ratio and Average -1.39% return

- While we did close down, the session was flat at -.05%.

- Regardless of how the session closed (up/down)

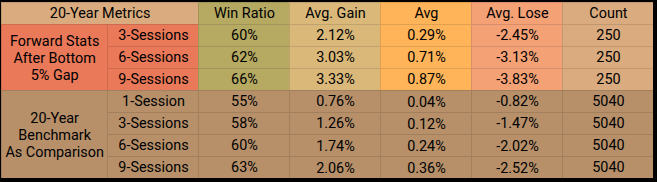

- Across 20-years, Bottom 5% gaps have performed well when looking forward.

- 3-6-9 sessions after a Bottom 5% gap have respectable win ratios.

- For the chart below, we are on path A & B

- A the opening stats (Friday's Open)

- B when the opening closed the session down

- This places this Wednesday as the 3rd Session.

- Across 20-years, Bottom 5% gaps have performed well when looking forward.

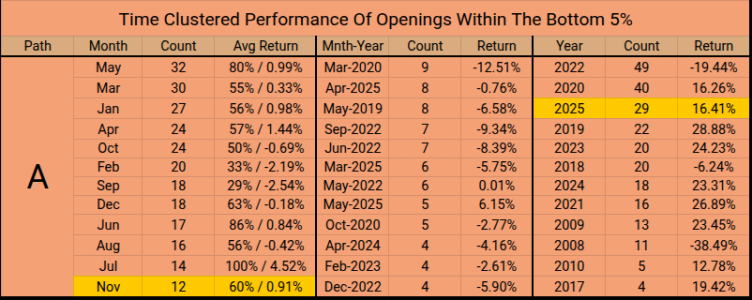

What is most interesting, with the total count of 252 Bottom 5% gaps sorted by month, November ranks last.

- November has a small count of 12 gaps over the past 20 years

- Two from Nov-2025, ten from other Novembers.

- Those ten have a monthly 60% Win Ratio and average .91% from 5 Monthly returns.

- Thus far, 2025 has a very high Bottom 5% gap count, but it does not imply poor performance.

- At 29 Gaps, (2 in November) it's the 3rd Highest of 20 years

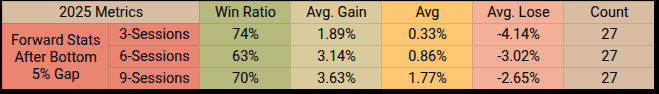

As mentioned, for 2025, we've had 29 Bottom 5% gaps. 27 of those gaps have completed their 3-6-9 session stats.

- Those 27 3-6-9 sessions stats after the big gap down have respectable win ratios.

____

Closing this out: The issue with opening gaps to the downside, we rarely ever escape them, and most of the time when we do, it's just dumb luck.

- The last 250 of the worst opens of the past 20 years show statistically it's better to ride out the storm, or jump into it.

Last edited: