Today saw the broader market close at session highs in the highest one-day advance in three months.

About 95% of S&P 500 stocks moved higher with energy leading the way by 2.7%.

Commodities in general took advantage of dollar weakness as that currency plunged 0.9%. That was a pretty steep drop considering the bail-out issues plaguing the EU and makes this move suspicious.

I took advantage of several days of strength since the Seven Sentinels issued a buy signal last Wednesday and went to cash for the remainder of the month. That move may perplex some of you who read my daily blog, especially when you hear that all Seven Sentinels are flashing buys signals today. But once on a buy, successive buy signals are relatively irrelevant. I have my reasons for taking profits, which I will explain below.

Here's today's charts:

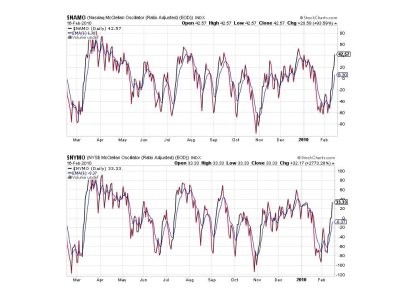

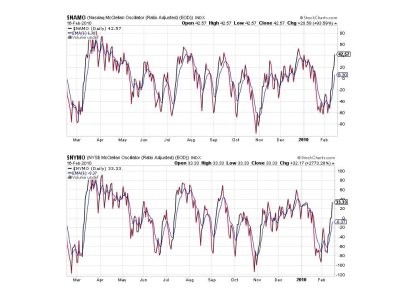

NAMO and NYMO are now hitting the high end of their range from the past year. This does not mean they can't move higher, they can and they may, but at this level and given recent low volume buying pressure, the risk of a short term sell-off is now elevated.

As I expected, NAHL and NYHL are beginning to move higher now that we're seeing significant upside follow-through. But these signals are not as important in the short term as NAMO and NYMO are.

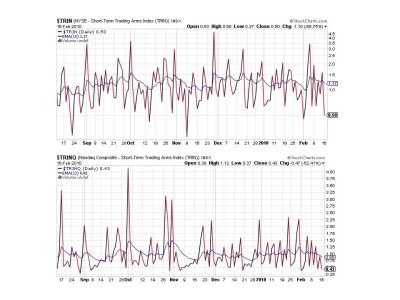

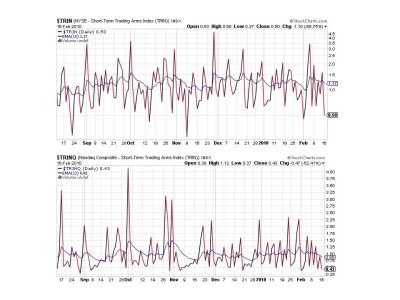

TRIN and TRINQ are both on a buy and suggest some short term weakness is coming very soon.

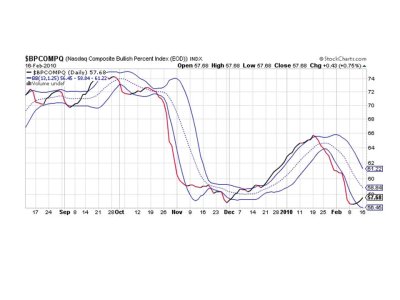

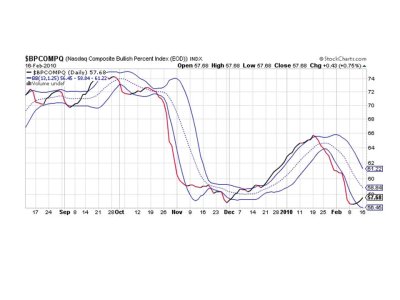

BPCOMPQ looks bullish here and continues to slowly inch higher. But whether the market can go parabolic at this point remains to be seen. I'm betting it won't.

So all 7 Sentinels are on a buy, which keeps the system on a buy. If you are less risk averse than I am you can continue to maintain market exposure at this point. The SS can remain on a buy even with some moderate selling pressure. I chose to avoid what I believe will be some short term selling very soon as I am reminded of the difficulty I had last year holding onto gains in the face of very volatile action off the tops and bottoms. It takes precious time to get a good set-up like we've just had and I don't want to walk away without locking in some gains. I also reminded myself that 2 new IFTs are coming soon, so I took a chance that the easy money has been made on this current swing high and I'll re-set for the next opportunity in March.

The flip side is that we may not consolidate much at all and continue to tack on gains in spite of overbought indicators. That's a higher risk play though. So good luck on whatever you decide to do. See you tomorrow.

About 95% of S&P 500 stocks moved higher with energy leading the way by 2.7%.

Commodities in general took advantage of dollar weakness as that currency plunged 0.9%. That was a pretty steep drop considering the bail-out issues plaguing the EU and makes this move suspicious.

I took advantage of several days of strength since the Seven Sentinels issued a buy signal last Wednesday and went to cash for the remainder of the month. That move may perplex some of you who read my daily blog, especially when you hear that all Seven Sentinels are flashing buys signals today. But once on a buy, successive buy signals are relatively irrelevant. I have my reasons for taking profits, which I will explain below.

Here's today's charts:

NAMO and NYMO are now hitting the high end of their range from the past year. This does not mean they can't move higher, they can and they may, but at this level and given recent low volume buying pressure, the risk of a short term sell-off is now elevated.

As I expected, NAHL and NYHL are beginning to move higher now that we're seeing significant upside follow-through. But these signals are not as important in the short term as NAMO and NYMO are.

TRIN and TRINQ are both on a buy and suggest some short term weakness is coming very soon.

BPCOMPQ looks bullish here and continues to slowly inch higher. But whether the market can go parabolic at this point remains to be seen. I'm betting it won't.

So all 7 Sentinels are on a buy, which keeps the system on a buy. If you are less risk averse than I am you can continue to maintain market exposure at this point. The SS can remain on a buy even with some moderate selling pressure. I chose to avoid what I believe will be some short term selling very soon as I am reminded of the difficulty I had last year holding onto gains in the face of very volatile action off the tops and bottoms. It takes precious time to get a good set-up like we've just had and I don't want to walk away without locking in some gains. I also reminded myself that 2 new IFTs are coming soon, so I took a chance that the easy money has been made on this current swing high and I'll re-set for the next opportunity in March.

The flip side is that we may not consolidate much at all and continue to tack on gains in spite of overbought indicators. That's a higher risk play though. So good luck on whatever you decide to do. See you tomorrow.