Yesterday I mentioned that I thought we'd see no surprises from the FOMC announcement and that the market would probably march higher as a result. Bingo, no surprises and fresh highs were established.

There are two economic reports on tap prior to tomorrow's open, Core PPI, and PPI. I'm not expecting any surprises from this release, so the trend should remain up, minor pullback notwithstanding.

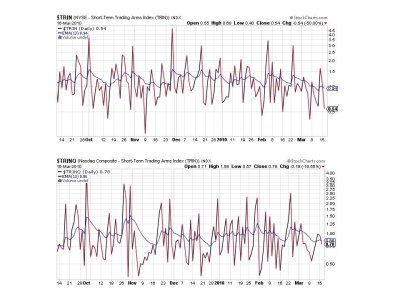

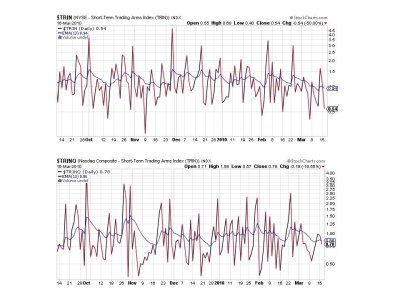

The Seven Sentinels are now moving away from a potential sell signal given today's action, but any market surprises could change that. Here's today's charts:

Still on a sell here, but I'm inclined to think we move sideways for a bit.

Both signals flipped back to a buy today.

Same here, two buy signals.

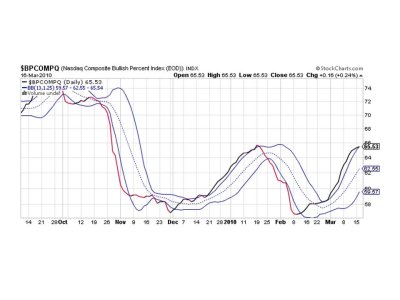

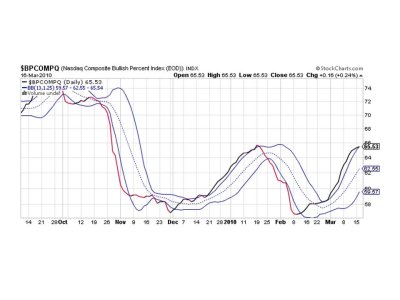

Here's where it gets interesting. BPCOMPQ has intersected the upper bollinger band, but has not dropped below it. This makes me cautious as this is a trend signal which could flip to a sell with moderate selling pressure. But that does not necessarily mean the system itself will roll over should weakness come.

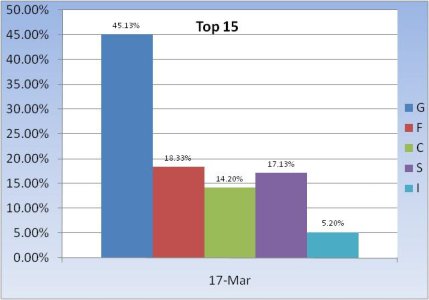

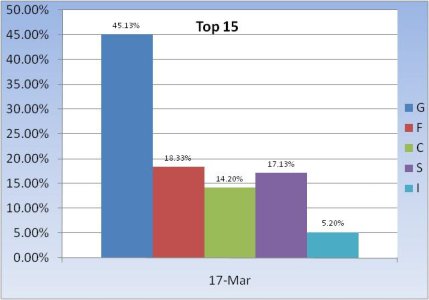

The Top 15 raised more cash today. Here's a quick chart so you can see how they are positioned for tomorrow's trading activity.

So 5 of 7 sentinels are flashing a buy, which keeps the system on a buy. I am watching BPCOMPQ carefully now as it could flip to a sell quickly if enough weakness is generated. Then things could get dicey. But I am not yet looking for a system sell signal. If the market can work off its overbought condition with at least some sideways action I think we'll spring higher within the next few trading days. Or we could melt higher with the same result. That's it for today. See you tomorrow.

There are two economic reports on tap prior to tomorrow's open, Core PPI, and PPI. I'm not expecting any surprises from this release, so the trend should remain up, minor pullback notwithstanding.

The Seven Sentinels are now moving away from a potential sell signal given today's action, but any market surprises could change that. Here's today's charts:

Still on a sell here, but I'm inclined to think we move sideways for a bit.

Both signals flipped back to a buy today.

Same here, two buy signals.

Here's where it gets interesting. BPCOMPQ has intersected the upper bollinger band, but has not dropped below it. This makes me cautious as this is a trend signal which could flip to a sell with moderate selling pressure. But that does not necessarily mean the system itself will roll over should weakness come.

The Top 15 raised more cash today. Here's a quick chart so you can see how they are positioned for tomorrow's trading activity.

So 5 of 7 sentinels are flashing a buy, which keeps the system on a buy. I am watching BPCOMPQ carefully now as it could flip to a sell quickly if enough weakness is generated. Then things could get dicey. But I am not yet looking for a system sell signal. If the market can work off its overbought condition with at least some sideways action I think we'll spring higher within the next few trading days. Or we could melt higher with the same result. That's it for today. See you tomorrow.