Four days down in a row, three days up (and counting). I had thought over the weekend that the market would find a short term low by mid-week this week, but that's not looking too likely now. Now I'm thinking the weakness comes later in the week, but I'm not so sure we'll be filling those gaps anytime soon so any weakness will probably fall short of those targets. That's assuming we get weakness of course.

Liquidity continues to trump negative news and getting invested on a dip has been a great strategy for a couple of years now. Too bad we can only play that game once or twice a month at best.

But another dip could be getting close at hand, and I've spotted a troubling, albeit somewhat subtle, sign that all may not be as rosy as it appears, so let's take a look at the charts:

NAMO and NYMO continued their moves higher, which was not surprising given today's strength, but they are once again approaching an area of momentum that has typically seen reversals. Another day of gains could put it firmly in that area. Of course we could reverse any time now, but I'll give it another day or two.

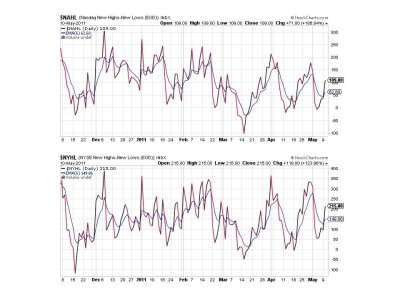

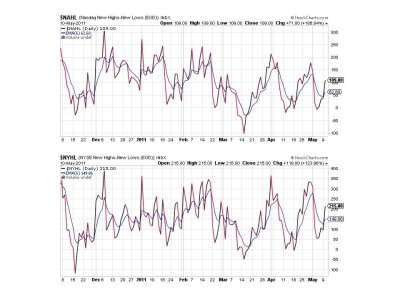

NAHL and NYHL remain in a buy condition.

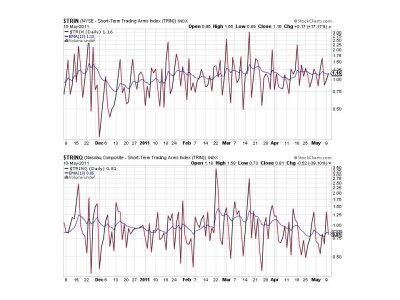

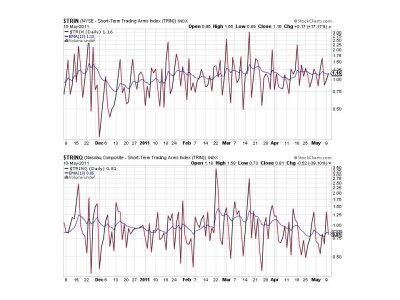

Technically, TRIN is on a sell, while TRINQ is on a buy, but both are sitting right at the neutral line.

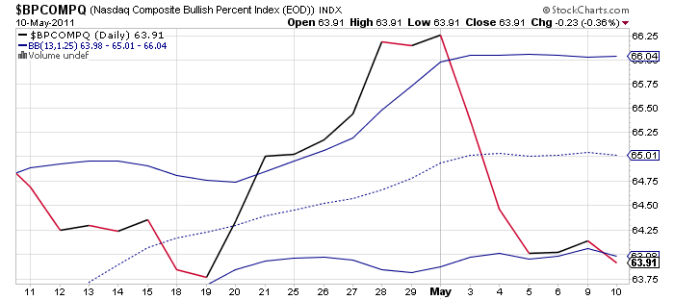

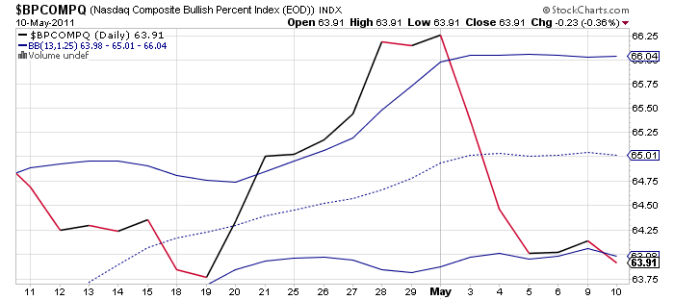

Here's where things begin to look suspect. The market has rallied three days in a row and BPCOMPQ actually declined a bit. That's unusual given the advance was healthy and it raises my suspicion of what this market is really up to. Bull trap comes to mind. I've said this many times before and it bears repeating, this is an intermediate term trend indicator and probably the most important of the seven sentinels. I don't like what it's telling me right now, but it could be an anomaly. We'll see.

So the system remains in a buy condition overall, although I think we're within a day or two of some selling pressure. As I stated earlier, buying the dips has been working for a long time now and the next one may be just a another opportunity if timed just right. Piece of cake, right? :cheesy:

Liquidity continues to trump negative news and getting invested on a dip has been a great strategy for a couple of years now. Too bad we can only play that game once or twice a month at best.

But another dip could be getting close at hand, and I've spotted a troubling, albeit somewhat subtle, sign that all may not be as rosy as it appears, so let's take a look at the charts:

NAMO and NYMO continued their moves higher, which was not surprising given today's strength, but they are once again approaching an area of momentum that has typically seen reversals. Another day of gains could put it firmly in that area. Of course we could reverse any time now, but I'll give it another day or two.

NAHL and NYHL remain in a buy condition.

Technically, TRIN is on a sell, while TRINQ is on a buy, but both are sitting right at the neutral line.

Here's where things begin to look suspect. The market has rallied three days in a row and BPCOMPQ actually declined a bit. That's unusual given the advance was healthy and it raises my suspicion of what this market is really up to. Bull trap comes to mind. I've said this many times before and it bears repeating, this is an intermediate term trend indicator and probably the most important of the seven sentinels. I don't like what it's telling me right now, but it could be an anomaly. We'll see.

So the system remains in a buy condition overall, although I think we're within a day or two of some selling pressure. As I stated earlier, buying the dips has been working for a long time now and the next one may be just a another opportunity if timed just right. Piece of cake, right? :cheesy: