If this is a bull market, it sure doesn't act like one. It seems as if the market is going from one technical extreme to another. Just when it looks to breakout or breakdown, it seems to reverse course.

A dangerous market for the non-nimble indeed.

The sellng began with a gap down from which the market never looked back. After yesterday's tepid NYSE trading volume of less than 1 Billion shares, today saw more than a 50% incease of trading activity as the NYSE saw 1.6 Billion shares traded. What drove this decline?

For starters, China had its leading economic indicators for April cut to show a modest 0.3% increase from the previously reported 1.7% surge.

Then, the European Central Bank refused to extend liquidity measures to banks.

Here in the U.S. today's data was also of concern as the Consumer Confidence Index for June was pegged at 52.9, well short of the 62.0that was expected.

Treasuries haven't backed off either. The yield on the 10-year Note broke under 3.00% for the first time in more than one year and the yield on the 2-year Note broke below 0.60 to a record low.

The dollar finished 0.5% higher, while the euro dropped 0.7%.

I would think after today's action we are either going to fall into the abyss or rally hard once again.

Perhaps Mr. Hyde is about to transform again. I wouldn't be surprised.

The Seven Sentinels are very close to issuing a sell signal. Let's take a look at the charts:

We're falling apart here, but it's not ugly yet.

After seeming to shine some hope yesterday both NAHL and NYHL spike lower, flipped back to sells.

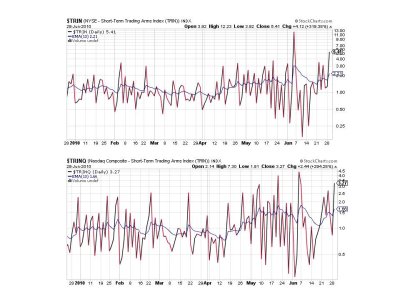

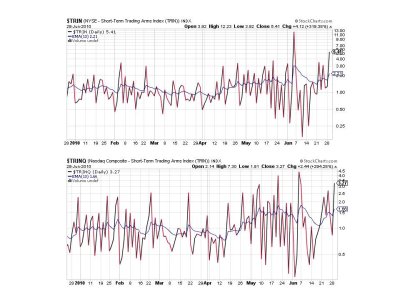

TRIN and TRINQ also flipped back to sells today.

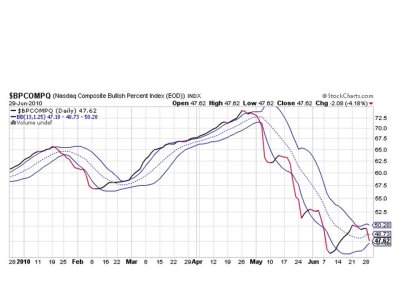

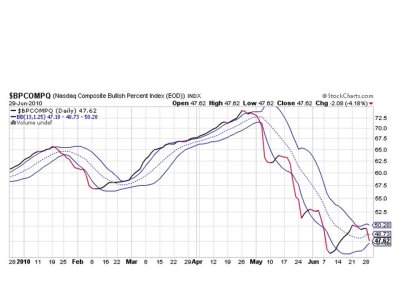

And BPCOMPQ is finally showing the results of significant selling pressure as it is now getting close to crossing the lower bollinger band. That would trigger a sell for this indicator.

But BPCOMPQ remains on a buy, if just barely. And the market once again appears poised to breakdown. But we are at a point where reversals tend to happen in this market environment. At least that's been the story line so far. Has the script changed? I don't know, but I'm now looking for Dr. Jekyll.

A dangerous market for the non-nimble indeed.

The sellng began with a gap down from which the market never looked back. After yesterday's tepid NYSE trading volume of less than 1 Billion shares, today saw more than a 50% incease of trading activity as the NYSE saw 1.6 Billion shares traded. What drove this decline?

For starters, China had its leading economic indicators for April cut to show a modest 0.3% increase from the previously reported 1.7% surge.

Then, the European Central Bank refused to extend liquidity measures to banks.

Here in the U.S. today's data was also of concern as the Consumer Confidence Index for June was pegged at 52.9, well short of the 62.0that was expected.

Treasuries haven't backed off either. The yield on the 10-year Note broke under 3.00% for the first time in more than one year and the yield on the 2-year Note broke below 0.60 to a record low.

The dollar finished 0.5% higher, while the euro dropped 0.7%.

I would think after today's action we are either going to fall into the abyss or rally hard once again.

Perhaps Mr. Hyde is about to transform again. I wouldn't be surprised.

The Seven Sentinels are very close to issuing a sell signal. Let's take a look at the charts:

We're falling apart here, but it's not ugly yet.

After seeming to shine some hope yesterday both NAHL and NYHL spike lower, flipped back to sells.

TRIN and TRINQ also flipped back to sells today.

And BPCOMPQ is finally showing the results of significant selling pressure as it is now getting close to crossing the lower bollinger band. That would trigger a sell for this indicator.

But BPCOMPQ remains on a buy, if just barely. And the market once again appears poised to breakdown. But we are at a point where reversals tend to happen in this market environment. At least that's been the story line so far. Has the script changed? I don't know, but I'm now looking for Dr. Jekyll.