I had mentioned yesterday that I was leaning toward a down day today, but that I wasn't convinced the upside was over. And I'm still not convinced, as today's action may simply be a healthy pullback after some sizable gains. For the day the DOW retreated 0.67%, the S&P 500 was down 0.97%, and the Nasdaq dropped 1.24%. The Wilshire 4500 fell the hardest of our three TSP equity funds and that was down 1.62%, while the I fund wasn't far behind with a loss of 1.46%.

News over on the other side of the pond continues to be uninspiring as news that Germany's second quarter only saw a growth rate of 0.1% and the eurozone overall grew just 0.2%. Those numbers are far from healthy and could spell trouble for the global economy down the road should they persist.

On the domestic front, Fitch reaffirmed its AAA rating on US debt, while July industrial production saw an increase of 0.9%.

Among the other economic data, July housing starts totaled 604,000 units (annualized), which was a bit under estimates, while building permits dropped to an annualized rate of 597,000, which was also under estimates.

Here's today's charts:

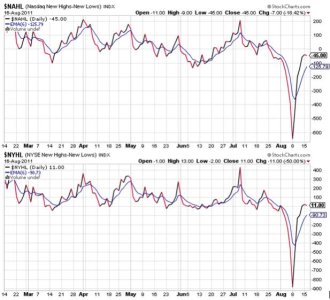

NAMO and NYMO took a breather today, but they both remain on buys.

Same with NAHL and NYHL.

TRIN just did flip to a sell on today's action, while TRINQ remained on a buy. Both are fairly neutral now.

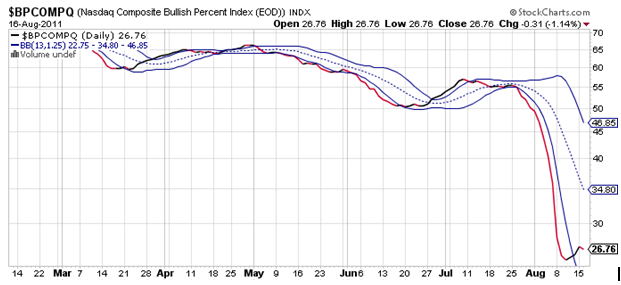

BPCOMPQ ticked a bit lower today, but remains on a buy.

So the Seven Sentinels are in an unconfirmed buy condition, but officially remain on a sell.

It's hard to say which way the market goes next, although I'm leaning to the downside given the signals have a turned down a bit. But even with more follow-through downside action tomorrow, that doesn't mean the rally is over. At least not yet. But I also don't think any further upside will be as robust as we saw during the initial bounce. I'm anticipating more chop and less spike. So let's see what tomorrow brings as it may better define the next few trading days.