10/31/25

The market experienced a double dose of trouble yesterday with the Powell hangover lingering and then the Microsoft and Meta failures pushed the large cap indices down sharply. The broader market tried to hold up as the small cap indices were actually up most of the morning, but the selling became contagious and they fell in sympathy. Amazon and Apple's earnings will try to right the ship today.

Before we get all bearish after a day of negative pressure triggered by sell off of Magnificent 7 stocks Microsoft and Meta yesterday, another two Mag 7 stocks, Apple and Amazon, were up sharply after hours yesterday, and it may provide a positive catalyst today for the major indices. At least it will be a test of the market's resilience as some index charts challenge their support again.

But first, we saw yields and the dollar rise and that added to the pressure of the disappointing earnings releases, and right here the 10-year Treasury Yield is testing the resistance of the 50-day moving average again. It wouldn't be the end of the world if it broke above it, as long as it stays within the recent range. I'd get concerned about this if we see 4.3% but even a quick move to 4.2% could cause some short-term anxiety.

The dollar added to the selling pressure by rallying again.

Yesterday we talked about the odds of another 0.25% interest rate cut from the Fed falling from 92% to 68% after Powell's comments on Wednesday. That number moved up to 73% yesterday so there is still a pretty good chance that rates will come down again in December. When the Fed is cutting rates, ending their quantitative tightening program, while the M2 money supply is still moving higher, I think we are supposed to be buying the dips.

We know rates have been coming down. This next chart is what I'd expect to happen if quantitative tightening ends. The stock market did fine with the tightening, but without it there will be yet another helpful breeze at the back of the stock market.

And here is the M2 Money Supply chart. It just keeps going up, so while this could be inflationary, it is also bullish for the stock market.

Big money managers welcome these declines in stocks under these conditions so they can put more money to work, while mom and pop get worried when they see the headlines and big declines and they tend to sell at the exact wrong time.

Selling is not a bad idea at times to take profits, but in a bull market you have to be quick to buy those dips again - that is until the charts start to tell us otherwise. We're not there yet, but we are seeing more vulnerable tests in some of those charts.

The S&P 500 (C-fund) was down yesterday, and we really shouldn't be too surprised with the index sitting at the top of its trading channel with two open gaps below. It's just startling when stocks sell off like yesterday, and it gets investors uneasy. Is this the top? Anything is possible, but I doubt it. We'll know more if support starts to break. Apple and Amazon should help this chart today.

Last I checked, Amazon was up 13% after hours, and Apple was +3% after releasing earnings. This could flip the Nasdaq and S&P 500 right back around. The question is whether it will hold as the bears have become more emboldened. We have seen before were the companies that deliver good earnings do well, but the rest of the market can't hold up under the new downside momentum. It's probably too soon to call this momentum, but today will be a good test of the bulls' willingness to buy the the dips at support.

We get the key inflation PCE Prices Personal Spending data this morning, which will have an impact on yields and the Fed's decision on whether to cut interest rates again in December.

The DWCPF Index (S-Fund) was holding up well in early trading but it eventually conceded to the bears' pressure and tanked in the afternoon, closing at the lows of the day and near the bottom of its trading channel. The perceived strong opening that we could see today based on Amazon and Apple's earnings could have it bouncing at this convenience support line, but that PCE Prices data will be almost as important to this interest rate sensitive fund.

ACWX (I-fund) actually held up rather well considering the rally in the dollar and the sell off in the US stocks. The chart looks fine and any short-term profit taking seems reasonable considering how much it has risen.

BND (bonds / F-fund) took another hit yesterday although it closed well off the morning lows. The problem is, it fell through support and there are open gaps below that may be luring it down in the short-term.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

The market experienced a double dose of trouble yesterday with the Powell hangover lingering and then the Microsoft and Meta failures pushed the large cap indices down sharply. The broader market tried to hold up as the small cap indices were actually up most of the morning, but the selling became contagious and they fell in sympathy. Amazon and Apple's earnings will try to right the ship today.

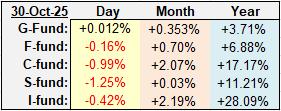

| Daily TSP Funds Return More returns |

Before we get all bearish after a day of negative pressure triggered by sell off of Magnificent 7 stocks Microsoft and Meta yesterday, another two Mag 7 stocks, Apple and Amazon, were up sharply after hours yesterday, and it may provide a positive catalyst today for the major indices. At least it will be a test of the market's resilience as some index charts challenge their support again.

But first, we saw yields and the dollar rise and that added to the pressure of the disappointing earnings releases, and right here the 10-year Treasury Yield is testing the resistance of the 50-day moving average again. It wouldn't be the end of the world if it broke above it, as long as it stays within the recent range. I'd get concerned about this if we see 4.3% but even a quick move to 4.2% could cause some short-term anxiety.

The dollar added to the selling pressure by rallying again.

Yesterday we talked about the odds of another 0.25% interest rate cut from the Fed falling from 92% to 68% after Powell's comments on Wednesday. That number moved up to 73% yesterday so there is still a pretty good chance that rates will come down again in December. When the Fed is cutting rates, ending their quantitative tightening program, while the M2 money supply is still moving higher, I think we are supposed to be buying the dips.

We know rates have been coming down. This next chart is what I'd expect to happen if quantitative tightening ends. The stock market did fine with the tightening, but without it there will be yet another helpful breeze at the back of the stock market.

And here is the M2 Money Supply chart. It just keeps going up, so while this could be inflationary, it is also bullish for the stock market.

Big money managers welcome these declines in stocks under these conditions so they can put more money to work, while mom and pop get worried when they see the headlines and big declines and they tend to sell at the exact wrong time.

Selling is not a bad idea at times to take profits, but in a bull market you have to be quick to buy those dips again - that is until the charts start to tell us otherwise. We're not there yet, but we are seeing more vulnerable tests in some of those charts.

The S&P 500 (C-fund) was down yesterday, and we really shouldn't be too surprised with the index sitting at the top of its trading channel with two open gaps below. It's just startling when stocks sell off like yesterday, and it gets investors uneasy. Is this the top? Anything is possible, but I doubt it. We'll know more if support starts to break. Apple and Amazon should help this chart today.

Last I checked, Amazon was up 13% after hours, and Apple was +3% after releasing earnings. This could flip the Nasdaq and S&P 500 right back around. The question is whether it will hold as the bears have become more emboldened. We have seen before were the companies that deliver good earnings do well, but the rest of the market can't hold up under the new downside momentum. It's probably too soon to call this momentum, but today will be a good test of the bulls' willingness to buy the the dips at support.

We get the key inflation PCE Prices Personal Spending data this morning, which will have an impact on yields and the Fed's decision on whether to cut interest rates again in December.

The DWCPF Index (S-Fund) was holding up well in early trading but it eventually conceded to the bears' pressure and tanked in the afternoon, closing at the lows of the day and near the bottom of its trading channel. The perceived strong opening that we could see today based on Amazon and Apple's earnings could have it bouncing at this convenience support line, but that PCE Prices data will be almost as important to this interest rate sensitive fund.

ACWX (I-fund) actually held up rather well considering the rally in the dollar and the sell off in the US stocks. The chart looks fine and any short-term profit taking seems reasonable considering how much it has risen.

BND (bonds / F-fund) took another hit yesterday although it closed well off the morning lows. The problem is, it fell through support and there are open gaps below that may be luring it down in the short-term.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.