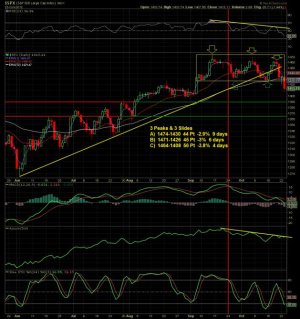

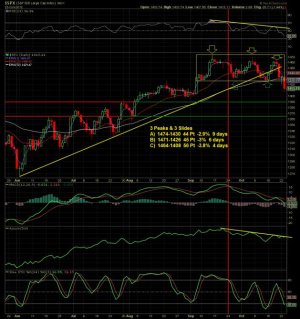

The SPX 500 daily has made a series of three highs in the last month as shown on the accompanying chart. Daily closes were inside the box, until today. We can see a declining top with 1474, 1471 and 1464 highs. Time elapsed from these highs to the lows were 9, 6 and 4 trading days with a drawdown of 2.9%, 3.0% and 3.8%. So, the downside momentum is intensifying. The stochastic is nearing oversold, but the RSI has a ways to go to reach 30 or below. Remember, markets can stay oversold for periods of time, just as markets can stay overbought longer than one would expect.

The recent weakness may be a fluke or have some sort of explanation such as:

The recent weakness may be a fluke or have some sort of explanation such as:

- Nothing to worry about as this is a fake-out by savvy traders. Robot trading models are programmed to confuse.

- Fiscal cliff ahead and no moves are in the works to stop looming “automatic cuts”. Market participants see this as responsible, and the US dollar should rally.

- Third quarter earnings are not living up to expectations and forward guidance is troubling.

- Expectation that Governor Romney will win the presidential race and implement business like decisions in government. The US dollar should rally with anticipated spending cutbacks.

- Expectation that President Obama will be reelected and market is consolidating with needed profit taking, before a surge higher. The US dollar strength is temporary, but should decline.