The EU sovereign debt crisis reared its head again today (not that it ever really disappeared), but it's being blamed in large measure for today's weakness. The dollar benefitted from the action as it hit a 10 month high and ended the day up 1.4%. That's why the I fund got hit so hard.

Today's market data was viewed by traders as a non-event and didn't appear to move the averages much at all.

You might remember that yesterday I said the Seven Sentinels were a borderline buy and that if you felt aggressive you might consider acting on it, although I also said that I would not consider it a full buy signal until NYMO pushed up past its 6 day EMA (it was very close).

Well, that didn't happen today. We reversed some of those buy signals back to sells and my fear of some whipsaw action is taking shape. There is only 5 trading days left until the end of the quarter and I think the market is very vulnerable after this multi-week rally. End of quarter window dressing may be enticing many traders to stick around and that might invite some early selling if today was any indication.

Here's today's charts:

Both NAMO and NYMO have flipped back to sells, but notice they are sitting very close to the zero line on both charts. It's a neutral reading, but I can't help but think the end of quarter may provide an excuse to take the market down at least enough to shake out some of the bulls.

Back to sells here too.

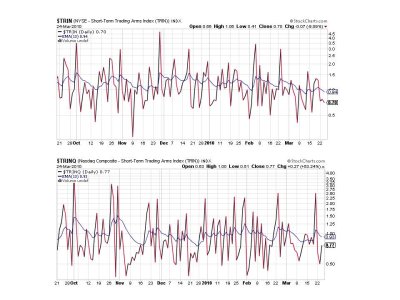

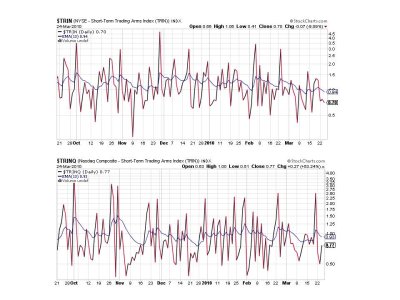

TRIN and TRINQ are both still flashing buys.

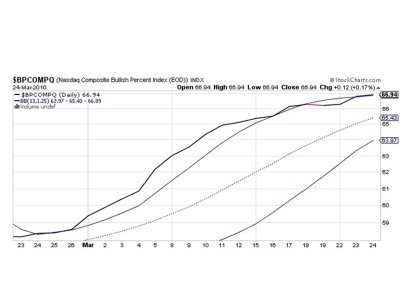

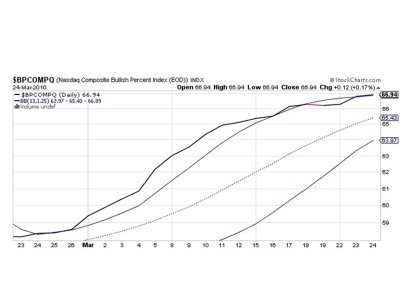

I called BPCOMPQ a buy yesterday, but it was really a borderline buy after taking a second look today. We can see the signal is resting right on top of the upper bollinger band.

So a die-hard bull may want to interpret yesterday's borderline buy as a reason to stay the course, but if you're in cash or risk averse now may not be the time to take a chance. There's good reason to believe we'll see more weakness by the end of the quarter, which is next Wednesday.

The Top 50 have added some stock exposure the past two days, but the Top 15 have not made a move in over a week. They are still sitting on lots of cash and bonds.

That's it for tonight. See you tomorrow.

Today's market data was viewed by traders as a non-event and didn't appear to move the averages much at all.

You might remember that yesterday I said the Seven Sentinels were a borderline buy and that if you felt aggressive you might consider acting on it, although I also said that I would not consider it a full buy signal until NYMO pushed up past its 6 day EMA (it was very close).

Well, that didn't happen today. We reversed some of those buy signals back to sells and my fear of some whipsaw action is taking shape. There is only 5 trading days left until the end of the quarter and I think the market is very vulnerable after this multi-week rally. End of quarter window dressing may be enticing many traders to stick around and that might invite some early selling if today was any indication.

Here's today's charts:

Both NAMO and NYMO have flipped back to sells, but notice they are sitting very close to the zero line on both charts. It's a neutral reading, but I can't help but think the end of quarter may provide an excuse to take the market down at least enough to shake out some of the bulls.

Back to sells here too.

TRIN and TRINQ are both still flashing buys.

I called BPCOMPQ a buy yesterday, but it was really a borderline buy after taking a second look today. We can see the signal is resting right on top of the upper bollinger band.

So a die-hard bull may want to interpret yesterday's borderline buy as a reason to stay the course, but if you're in cash or risk averse now may not be the time to take a chance. There's good reason to believe we'll see more weakness by the end of the quarter, which is next Wednesday.

The Top 50 have added some stock exposure the past two days, but the Top 15 have not made a move in over a week. They are still sitting on lots of cash and bonds.

That's it for tonight. See you tomorrow.