WorkFE

TSP Legend

- Reaction score

- 533

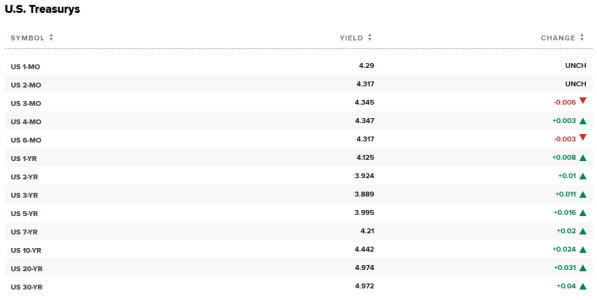

In roughly 1 month, that 10% I Fund move went up $1.69 for a net gain of $2,889. Back in the G Fund now, we will see if the May rate changes enough for me to make another move.I went 100% G Fund today, hope it stays steady at least, $1.56 on the upside if it holds. Sitting at +3.09% on the year, got no complaints.