WorkFE

TSP Legend

- Reaction score

- 516

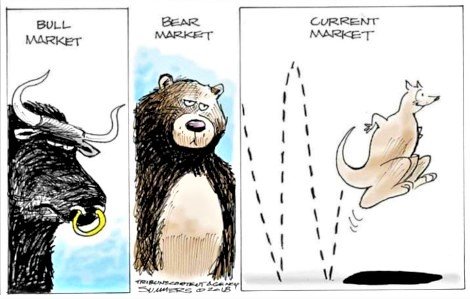

Futures are wishy washy this morning.

This has been obvious over that passed few weeks.

"Market volatility is not going away anytime soon as the buy the dip crowd has a new motto: 'sell the rally,'" Edward Moya, senior market analyst at OANDA

US stock futures whipsaw as traders digest a mix of Fed-induced anxiety, strong GDP growth, and solid Apple earnings (msn.com)

This has been obvious over that passed few weeks.

"Market volatility is not going away anytime soon as the buy the dip crowd has a new motto: 'sell the rally,'" Edward Moya, senior market analyst at OANDA

US stock futures whipsaw as traders digest a mix of Fed-induced anxiety, strong GDP growth, and solid Apple earnings (msn.com)