-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

WorkFE's Account Talk

- Thread starter WorkFE

- Start date

WorkFE

TSP Legend

- Reaction score

- 525

Couldn't convince myself to run and hide, maybe tomorrow.

This don't hurt:

New Home Construction Unexpectedly Rises To 6-Month High As Slipping Mortgage Rates Boost Housing Market (msn.com)

This don't hurt:

New Home Construction Unexpectedly Rises To 6-Month High As Slipping Mortgage Rates Boost Housing Market (msn.com)

WorkFE

TSP Legend

- Reaction score

- 525

From a financial standpoint, not a big fan of staying in during long weekends in the current world environment.

However, since my risk allocation is fairly small, I will probably not make a move unless today is sharply up.

Have a great Christmas Weekend all.

However, since my risk allocation is fairly small, I will probably not make a move unless today is sharply up.

Have a great Christmas Weekend all.

WorkFE

TSP Legend

- Reaction score

- 525

May not even be a roller coaster.

We've made an all-time high for the DOW, getting really close to the S&P all-time high. I do believe we will breach that.

The NASDAQ would be a tougher nut to crack.

FWIW. Without taking on extreme risk, I also believe making 7% in 2024 will be smoother than 2023.

We've made an all-time high for the DOW, getting really close to the S&P all-time high. I do believe we will breach that.

The NASDAQ would be a tougher nut to crack.

FWIW. Without taking on extreme risk, I also believe making 7% in 2024 will be smoother than 2023.

FireWeatherMet

Market Veteran

- Reaction score

- 247

- AutoTracker

With a short week coming up and probably light trading. What kind of roller coaster ride will we have?

Probably more like an Elevator on autopilot. Going straight up, lol.

At least for the rest of this Santa Rally week.

Epic

TSP Pro

- Reaction score

- 365

If we could just not give away money by the Quadrillions to solve other countries problems and redirect all of that back here to the Homeland to which we all live, that might be a good start..............but what do I know.One third of Global Debt belongs to the US.

Dang this is going to hurt eventually.

I do agree though.........the PAIN is coming :smashfreakB: in one way or another. The question is, when.

WorkFE

TSP Legend

- Reaction score

- 525

Labor market continues to cool, unemployment benefit claims rise, equities seem overvalued, debt continues to rise etc. etc. etc.

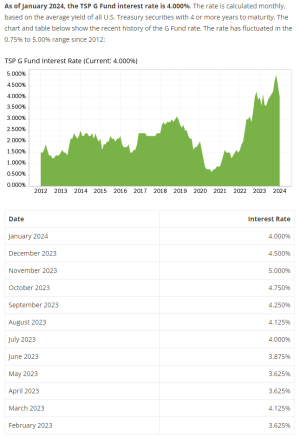

Now for the good news. My line in the sand is S&P 4800 which I think we hit. At that point I will continue to buy into the C, S, & I but my current investments have done their job and are coming to the garage. The G Fund rate has a hand in my decisions, so I’ll be watching that as well.

Interest rates dropping should help things, especially home sales. There will most likely be some failures and successes as business adjust to the continued disappearance of cheap money. Good companies (well organized) will continue to perform but most likely we will continue to see our share of failures of companies that relied on cheap money to survive. We should also see some emerging markets get their act together as well.

IMO 2024 will be a tale of two halves. Which one we see first is anyone’s guess.

Now for the good news. My line in the sand is S&P 4800 which I think we hit. At that point I will continue to buy into the C, S, & I but my current investments have done their job and are coming to the garage. The G Fund rate has a hand in my decisions, so I’ll be watching that as well.

Interest rates dropping should help things, especially home sales. There will most likely be some failures and successes as business adjust to the continued disappearance of cheap money. Good companies (well organized) will continue to perform but most likely we will continue to see our share of failures of companies that relied on cheap money to survive. We should also see some emerging markets get their act together as well.

IMO 2024 will be a tale of two halves. Which one we see first is anyone’s guess.

WorkFE

TSP Legend

- Reaction score

- 525

[FONT="]Once the S&P 500 hits a new record high after not doing so for more than a year, the index has gone on to rise the following year 93% of the time with a median gain of 13.4%, according to the note.

[/FONT]The S&P 500 is about to notch a new all-time high. Here's what could come next. (msn.com)

This wouldnt bother me a bit.

[/FONT]The S&P 500 is about to notch a new all-time high. Here's what could come next. (msn.com)

This wouldnt bother me a bit.

WorkFE

TSP Legend

- Reaction score

- 525

Market Futures down this morning. Not really surprised, between profit takers and folks waiting to see a few key reports this week. Might push a bit more in if we are down hard today.

Wednesday:

December policy meeting minutes

Job-openings figures for the month of November

Thursday:

ADP's National Employment report

Friday:

Labor Department's December nonfarm-payrolls report

Wednesday:

December policy meeting minutes

Job-openings figures for the month of November

Thursday:

ADP's National Employment report

Friday:

Labor Department's December nonfarm-payrolls report

WorkFE

TSP Legend

- Reaction score

- 525

Expecting a good enough year in the market that our choices within the TSP will keep me mildly interested, going to let the G Fund be one of my drivers. I will probably spend a bit more time with our dividend paying individual stocks. Going to hold my position at least one more day. The major indices didn’t show me enough downside to add to my position and at noon cutoff was to sharply down for me to retreat to the G fund.

We were going to build another home, our last one, but I may hold off. I expect home prices as well as building materials to retreat some, if supply and demand improves, which could save me $10K-$20K. While they are predicting mortgage rates to fall that won’t help me much, I plan on paying for it outright.

We were going to build another home, our last one, but I may hold off. I expect home prices as well as building materials to retreat some, if supply and demand improves, which could save me $10K-$20K. While they are predicting mortgage rates to fall that won’t help me much, I plan on paying for it outright.

WorkFE

TSP Legend

- Reaction score

- 525

going to let the G Fund be one of my drivers.

No sooner did I type that and the G-Fund rate dips to 4%.

Going to force my hand early in 2024. :notrust:

Epic

TSP Pro

- Reaction score

- 365

What is the current TSP G Fund interest rate?No sooner did I type that and the G-Fund rate dips to 4%.

Going to force my hand early in 2024. :notrust:

Yeah, it sure did.......but at the moment the G-Fund Crew is almost Totally Dominating in the top 200 in the Tracker Standings for the year so far...:arms:... LOL :lmao::lmao:

WorkFE

TSP Legend

- Reaction score

- 525

Yeah, it sure did.......but at the moment the G-Fund Crew is almost Totally Dominating in the top 200 in the Tracker Standings for the year so far...

No surprise there. Some consolidation/analysis/breather going on until they get back on the horse.

Similar threads

- Replies

- 3

- Views

- 608

- Replies

- 9

- Views

- 558