-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

WorkFE's Account Talk

- Thread starter WorkFE

- Start date

- Reaction score

- 821

The G Fund rate inched up to 4.250%

Good to know. I'll most likely be in the "G" fund next week. Going to transfer all my TSP into my Edward Jones account before the end of the month. Hope the "S" fund gets a little greener though.

- Reaction score

- 821

I met my goal this year, can stay in the G for some pudding.

Not sure if I'm going to manage my own or move it and let someone do it for me. I know the TSP fees went up I just haven't done a cost benefits analysis yet.

For me it will be the convenience of talking to someone and getting it done. The other is when I have to start drawing out the money I don't want to deal with TSP.

WorkFE

TSP Legend

- Reaction score

- 517

Yesterday may have been a tip your toe in day, too early to tell.

Futures indicate continued downward movement. The 7 Fear & Greed indicators are a smorgasbord at the moment. My head says Arm the Torpedoes Full Speed Ahead. My gut says Lets See Where This Thing Goes.

Futures indicate continued downward movement. The 7 Fear & Greed indicators are a smorgasbord at the moment. My head says Arm the Torpedoes Full Speed Ahead. My gut says Lets See Where This Thing Goes.

- Reaction score

- 821

Maybe we will see the tide turn a bit this week.

That would be nice. Didn't give all back last week but it was close.

WorkFE

TSP Legend

- Reaction score

- 517

Lots to chew on in the next 2 weeks.

Will the UAW go on strike this week? Oh, and that other strike, Hollywood.

Can China get back on track economically?

Japan possibly ending negative interest rates.

Inflation and its strangle hold on rate hikes.

CPI comes out Wednesday.

The Fed meeting next week will be front and center.

Fun couple of weeks coming up.

Will the UAW go on strike this week? Oh, and that other strike, Hollywood.

Can China get back on track economically?

Japan possibly ending negative interest rates.

Inflation and its strangle hold on rate hikes.

CPI comes out Wednesday.

The Fed meeting next week will be front and center.

Fun couple of weeks coming up.

- Reaction score

- 2,477

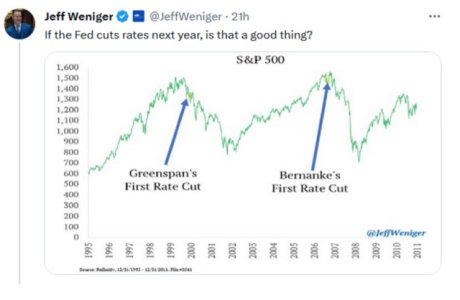

The reason they'd cut at any speed would because of signs of a recession. So, it's not the cuts that are bad, it's why they cut.

View attachment 58827

Might be something to think about as well. Saw this on a Lance Roberts daily I read just moments ago.

Scott Harrison

Senatobia, MS

WorkFE

TSP Legend

- Reaction score

- 517

Well, August and September are in the rearview mirror. Thank goodness.

I suppose, for me to continue my cautiousness, I should expect some seasonal weakness in October.

For now, I will remain mostly in the garage (98% vs. 2%) except for my bimonthly new purchases (25% each to G, C, S & I)

I was looking at mid-month before any possible move but can't rule out an earlier move. There is interesting commentary referencing a strong October after declining AUG-SEPT. Something I might be inclined to jump on should the opportunity present itself.

I suppose, for me to continue my cautiousness, I should expect some seasonal weakness in October.

For now, I will remain mostly in the garage (98% vs. 2%) except for my bimonthly new purchases (25% each to G, C, S & I)

I was looking at mid-month before any possible move but can't rule out an earlier move. There is interesting commentary referencing a strong October after declining AUG-SEPT. Something I might be inclined to jump on should the opportunity present itself.

Similar threads

- Replies

- 3

- Views

- 490

- Replies

- 9

- Views

- 481