The Seven Sentinels are on a sell, and the charts aren't looking bullish, but time and time again we see this market put in sharp reversals that leave slower traders in the dust. We could be seeing this playing out once again as the market has been hitting lower lows for about a month now. The right catalyst could see prices propel to new highs. I'm of the opinion that the market is winding up for just such an event. It's the timing that's in question. So how are we positioned for the first full trading week of June?

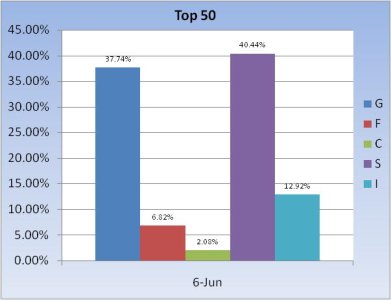

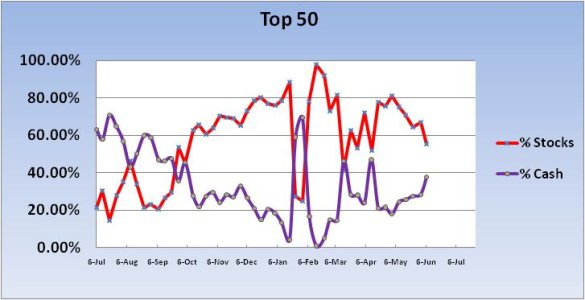

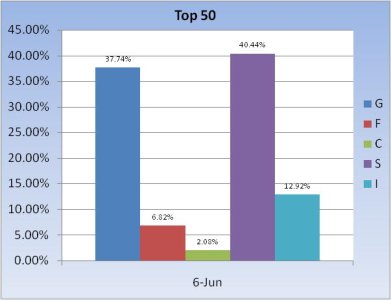

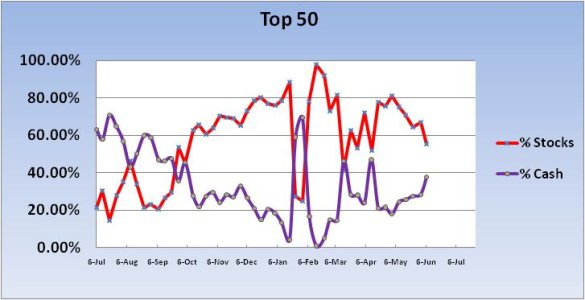

The Top 50 dropped their collective stock exposure by -11.34% to 55.44% overall. I can't say that this bearish shift in this group is a good indicator though, as they have only been right 9 out of 17 times that stock allocations shifted by more than 10% (since last July 6th).

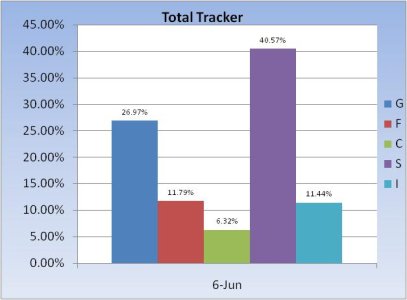

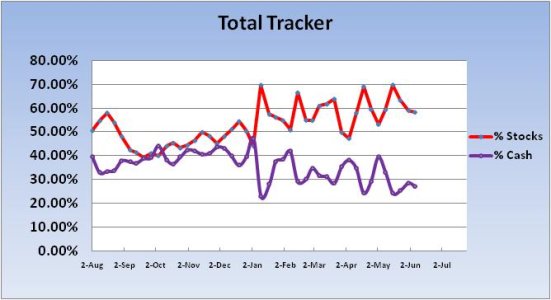

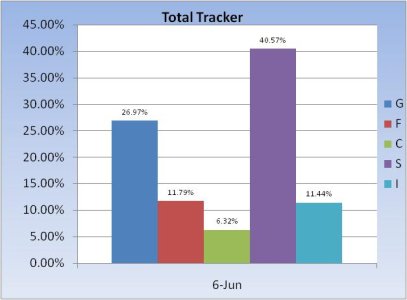

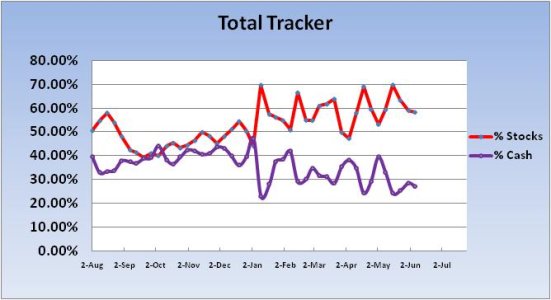

The herd is holding relatively steady by comparison. Their stock exposure sits at 58.33%.

So that's where we're at. There's a lot of speculation going on on the message boards about positive divergences everywhere (meaning a rally may be close at hand), and given this market's penchant for sharp reversals, I can at least agree that a reversal would not be unusual. The only problem is that any reversal may come from several percentage points lower than where we are now. Be that as it may, I am considering making a partial entry early this week to at least have some exposure, but want to hold something in reserve in case I'm too early. I'm still looking for the week of OPEX to give us that low, but the Fed will almost certainly be making an announcement at any time to allay fears about the end of QE2, and that could come at any time. Of course, I'm making an assumption that the market will cheer any announcement.

Futures are flat so far this evening, but it's early. I'll be watching Asian and European markets for clues on what kind of tone may be set to begin the week.

The Top 50 dropped their collective stock exposure by -11.34% to 55.44% overall. I can't say that this bearish shift in this group is a good indicator though, as they have only been right 9 out of 17 times that stock allocations shifted by more than 10% (since last July 6th).

The herd is holding relatively steady by comparison. Their stock exposure sits at 58.33%.

So that's where we're at. There's a lot of speculation going on on the message boards about positive divergences everywhere (meaning a rally may be close at hand), and given this market's penchant for sharp reversals, I can at least agree that a reversal would not be unusual. The only problem is that any reversal may come from several percentage points lower than where we are now. Be that as it may, I am considering making a partial entry early this week to at least have some exposure, but want to hold something in reserve in case I'm too early. I'm still looking for the week of OPEX to give us that low, but the Fed will almost certainly be making an announcement at any time to allay fears about the end of QE2, and that could come at any time. Of course, I'm making an assumption that the market will cheer any announcement.

Futures are flat so far this evening, but it's early. I'll be watching Asian and European markets for clues on what kind of tone may be set to begin the week.