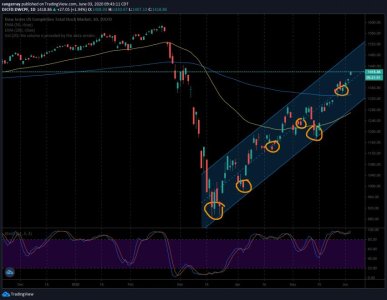

Whipsaw

Market Veteran

- Reaction score

- 239

Oh No!

Hope I didn't spook you last week. :worried:

No... I had several indicators and analysis to back up the move... its up there in the thread.

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Oh No!

Hope I didn't spook you last week. :worried:

Yes but you help by getting other's opinions and thanks for another Whipsaw Wednesday.As far as posting goes... I guess I talk a good game, but according to the autotracker, I really SUCK at this! ;damnit

As far as posting goes... I guess I talk a good game, but according to the autotracker, I really SUCK at this! ;damnit

Ok I checked your return. You got trapped in the down trend like many but fear kept you from reengaging. I went through this before and had to do IT's system until I built up my confidence. The other thing you can do is be a secondary trader for a while. Follow somebody that is stable in their conviction and regularly post their thoughts. Coolhand and Dreamboatannie are a couple of people that are both willing to help everyone. Go to the autotracter and look in the group beating the G fund or near it. Also next month look at the bottom of the autotracter and see how the premium plans are doing. We all get caught in a news event drop. So good luck. I have been there.As far as posting goes... I guess I talk a good game, but according to the autotracker, I really SUCK at this! ;damnit

Ok, so nothing is going according to any indicators, news, anything... I'm going to have to say *%&$ it! and jump in. I'm bleeding to death in the G fund.