We may have given up much of yesterday's gains today, but the reality is it was still a healthy pullback. Prior to the last few days of volatility we had rallied hard, so some consolidation would be good prior to a push higher. While I may be expecting higher prices it is also true that we are hitting resistance and this back and forth action could be an indication that lower prices are coming instead. That would be okay if we can have some confidence that lower prices would be relatively short lived. We still have until the end of next week before we close out October and I do not want to risk getting taken out of my Intermediate Term position on a short lived seven sentinels sell signal. So while I may be bullish, I am still watching the SS for a clue as to how much of a correction could be forthcoming (assuming we get one).

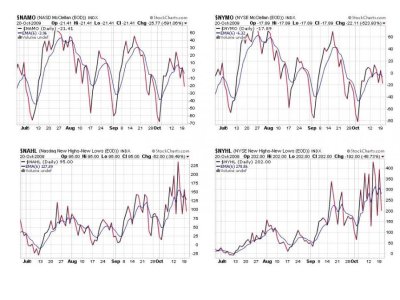

Todays charts:

All four are back to a sell condition after today's weakness, but they are still not too far from their 6 day EMA. Another whipsaw higher tomorrow could put them back in a buy condition. A push lower and we need to watch how low the signals go. If NAMO and NYMO go much below -70 without a bounce there may be a deeper correction in the works. Otherwise, I'm looking for a bounce between where we closed today and -70.

Even though NAHL and NYHL are below their respective 6 day EMA they are still bullish in terms of the H/L activity. Stocks are still advancing overall, but if that trend continues to deteriorate I'll be watching to see whether NAHL bounces without dropping below 25 or NYHL dropping below 60. If we get that low without bouncing bigger trouble may be in the offing.

TRIN flipped back to a sell, but not by much and TRINQ is still on a buy. BPCOMPQ showed a very modest decline, but is still on a buy. The bollinger bands continue to collapse on this signal so it can easily cross either the upper or lower band right now depending on market action.

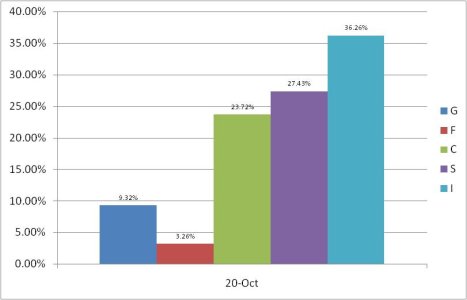

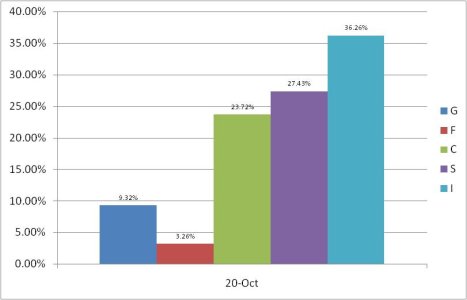

This is how our Top 25% were positioned this morning going into today's trading action. No changes worth noting here.

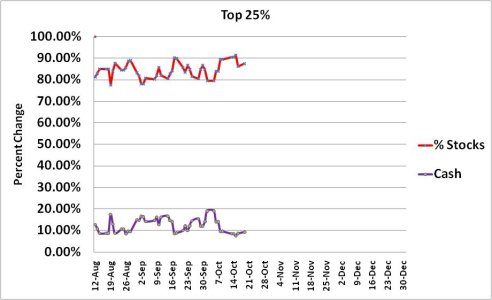

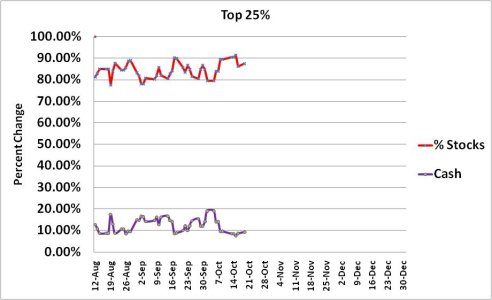

Same with this chart. Our best performers are still looking higher in the Intermediate to Long Term.

So that's where we stand today. We could see more selling at this point, but I need to watch the level of deterioration in the seven sentinels in order to try and avoid whipsaw action where we get a sell signal that only lasts for a week or so before another significant rally takes the market higher before another buy signal can get issued. I'm not looking for a deep pullback, but it could come and I need to be ready for it even if I'm looking higher.

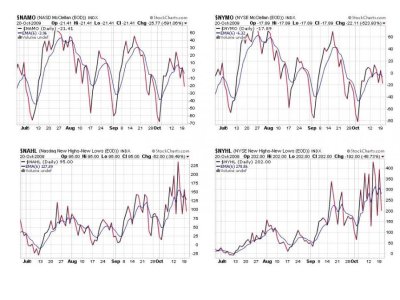

Todays charts:

All four are back to a sell condition after today's weakness, but they are still not too far from their 6 day EMA. Another whipsaw higher tomorrow could put them back in a buy condition. A push lower and we need to watch how low the signals go. If NAMO and NYMO go much below -70 without a bounce there may be a deeper correction in the works. Otherwise, I'm looking for a bounce between where we closed today and -70.

Even though NAHL and NYHL are below their respective 6 day EMA they are still bullish in terms of the H/L activity. Stocks are still advancing overall, but if that trend continues to deteriorate I'll be watching to see whether NAHL bounces without dropping below 25 or NYHL dropping below 60. If we get that low without bouncing bigger trouble may be in the offing.

TRIN flipped back to a sell, but not by much and TRINQ is still on a buy. BPCOMPQ showed a very modest decline, but is still on a buy. The bollinger bands continue to collapse on this signal so it can easily cross either the upper or lower band right now depending on market action.

This is how our Top 25% were positioned this morning going into today's trading action. No changes worth noting here.

Same with this chart. Our best performers are still looking higher in the Intermediate to Long Term.

So that's where we stand today. We could see more selling at this point, but I need to watch the level of deterioration in the seven sentinels in order to try and avoid whipsaw action where we get a sell signal that only lasts for a week or so before another significant rally takes the market higher before another buy signal can get issued. I'm not looking for a deep pullback, but it could come and I need to be ready for it even if I'm looking higher.