In my blog last Tuesday, I talked about the relatively high level of NAMO and NYMO's 6 day EMA and how risk was now evident in the market, but that a decline wasn't necessarily imminent given liquidity levels were high. Now that a week has passed it's obvious liquidity can only do so much and caution was indeed warranted at the time.

It's a bit disconcerting that while oil prices spiked 3.3% lower today, it wasn't enough to entice dip buyers back into the market. Oil prices closed at $106.25 per barrel after hitting $113/barrel yesterday morning. No doubt, news that analysts at Goldman Sachs predicted oil prices will see a substantial pullback in coming months contributed to the selling pressure.

Dow component Alcoa announced its fourth consecutive upside earnings surprise, but a light revenue figure suggested softer demand and as a result AA closed about 6% lower on the day.

Trading volume was unimpressive today, as it was yesterday, so there's reason to doubt this decline has any legs.

Let's take a look at the charts:

Lower still for NAMO and NYMO. They are now firmly in negative territory and remain in a sell condition.

NAHL and NYHL took another hit today too, and also remain on sells.

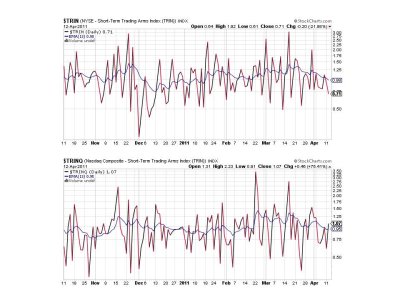

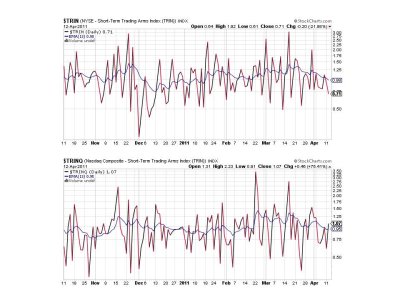

TRIN remained on a buy, but TRINQ flipped to a sell.

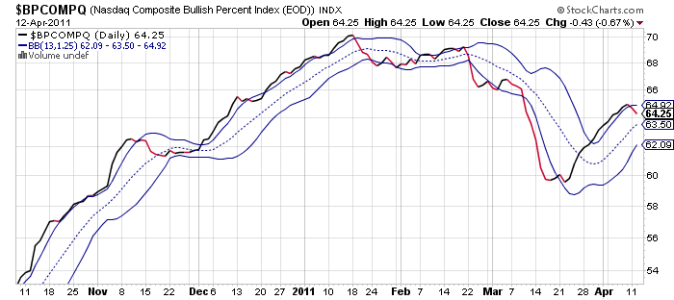

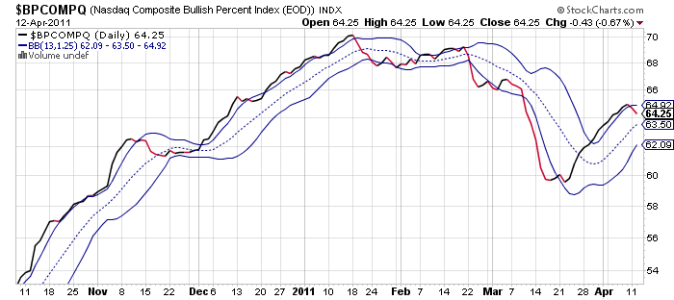

BPCOMPQ dipped a bit lower today and remains on a sell.

So only 1 signal remains on a buy, but that still keeps the Seven Sentinels in a buy condition.

I wasn't looking for this much weakness, although I wasn't surprised we got some. But the charts are deteriorating again. It wouldn't surprise me if the market dropped low enough to flip the Sentinels into a sell condition and then begin another up-leg, but that would require a good deal more selling pressure. Am I looking for lower prices? No. But we may need to shake a few more weak hands before the market turns back up. Our sentiment survey is back on a buy this week, so perhaps a turn is not far off.

It's a bit disconcerting that while oil prices spiked 3.3% lower today, it wasn't enough to entice dip buyers back into the market. Oil prices closed at $106.25 per barrel after hitting $113/barrel yesterday morning. No doubt, news that analysts at Goldman Sachs predicted oil prices will see a substantial pullback in coming months contributed to the selling pressure.

Dow component Alcoa announced its fourth consecutive upside earnings surprise, but a light revenue figure suggested softer demand and as a result AA closed about 6% lower on the day.

Trading volume was unimpressive today, as it was yesterday, so there's reason to doubt this decline has any legs.

Let's take a look at the charts:

Lower still for NAMO and NYMO. They are now firmly in negative territory and remain in a sell condition.

NAHL and NYHL took another hit today too, and also remain on sells.

TRIN remained on a buy, but TRINQ flipped to a sell.

BPCOMPQ dipped a bit lower today and remains on a sell.

So only 1 signal remains on a buy, but that still keeps the Seven Sentinels in a buy condition.

I wasn't looking for this much weakness, although I wasn't surprised we got some. But the charts are deteriorating again. It wouldn't surprise me if the market dropped low enough to flip the Sentinels into a sell condition and then begin another up-leg, but that would require a good deal more selling pressure. Am I looking for lower prices? No. But we may need to shake a few more weak hands before the market turns back up. Our sentiment survey is back on a buy this week, so perhaps a turn is not far off.