Another light trading day and another up day, which makes 6 of 7 days for the month of September green.

The bias may be up, but I continue to bide my time on the sidelines. Of course the SS have been on a sell throughout this rally and remain in sell mode after today's close.

Here's the charts:

NAMO and NYMO are holding their own and remain on buys.

I do find it a bit odd that NAHL and NYHL are struggling to move higher in spite of the buying pressure. Two sells here.

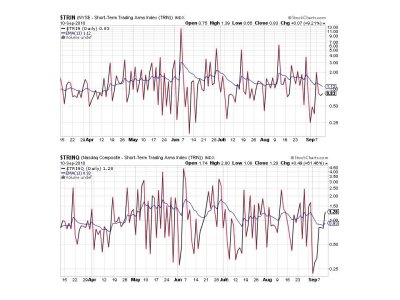

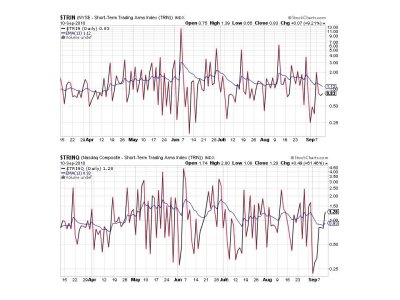

TRIN remains on a buy, but TRINQ flipped to a sell today.

BPCOMPQ sideways today, but remains on a buy. Those bollies are starting to collapse. I suspect another big move is nearing, but I don't know which way it might go.

So we have 4 of 7 signals flashing buys, but the system remains on a sell. This market has already moved higher than many expected and it may be due to the approach of mid-term elections, along with persistent bearishness.

I've updated the tracker charts and will post them over the weekend. They're pretty telling as far as how we collectively feel about this market. See you then.

The bias may be up, but I continue to bide my time on the sidelines. Of course the SS have been on a sell throughout this rally and remain in sell mode after today's close.

Here's the charts:

NAMO and NYMO are holding their own and remain on buys.

I do find it a bit odd that NAHL and NYHL are struggling to move higher in spite of the buying pressure. Two sells here.

TRIN remains on a buy, but TRINQ flipped to a sell today.

BPCOMPQ sideways today, but remains on a buy. Those bollies are starting to collapse. I suspect another big move is nearing, but I don't know which way it might go.

So we have 4 of 7 signals flashing buys, but the system remains on a sell. This market has already moved higher than many expected and it may be due to the approach of mid-term elections, along with persistent bearishness.

I've updated the tracker charts and will post them over the weekend. They're pretty telling as far as how we collectively feel about this market. See you then.