Here's the latest Top 15 and Top 50 tracker charts going into the new week:

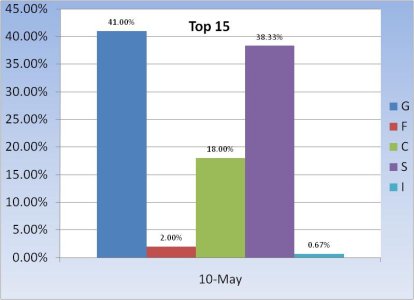

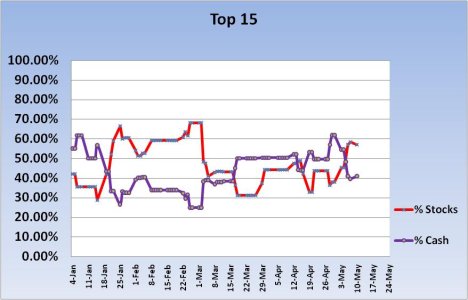

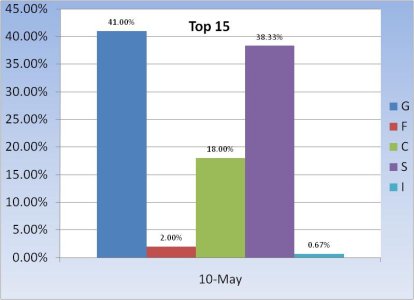

The Top 15 have moved a bit more cash into stocks this week, but nothing dramatic. A little over 10% or so. F and I are not favored, and S is more than double C. Still a fair amount of cash held back.

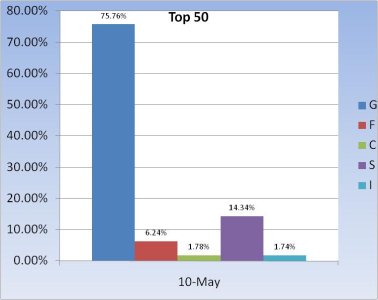

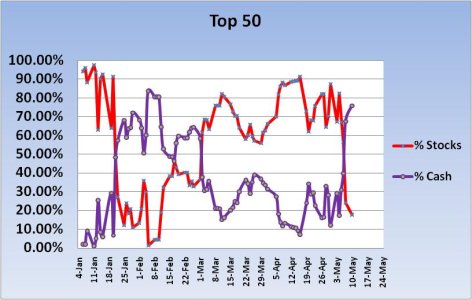

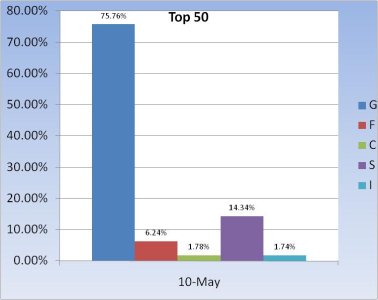

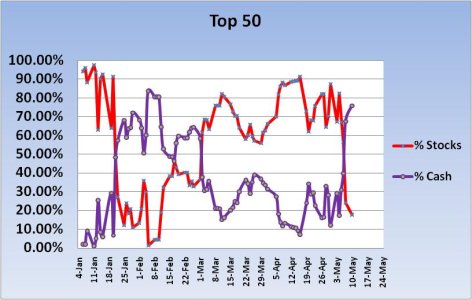

The Top 50 saw some radical changes from the previous week. Lots of cash raised, while C and I are pretty light. This is a conservative position now.

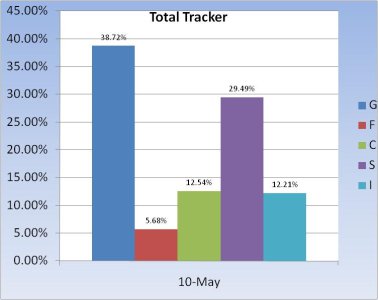

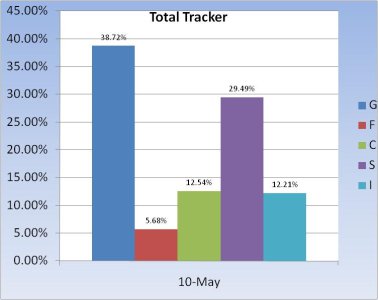

I'm going to start posting Total Tracker info on a weekly basis. In other words, every Friday I will total all the members positions and see how they are positioned for each new week. For this week coming up we can see the board has a moderate stock position, with S leading both C and I. This appears to be a moderately bullish stance compared to the Top 50.

The Top 15 have moved a bit more cash into stocks this week, but nothing dramatic. A little over 10% or so. F and I are not favored, and S is more than double C. Still a fair amount of cash held back.

The Top 50 saw some radical changes from the previous week. Lots of cash raised, while C and I are pretty light. This is a conservative position now.

I'm going to start posting Total Tracker info on a weekly basis. In other words, every Friday I will total all the members positions and see how they are positioned for each new week. For this week coming up we can see the board has a moderate stock position, with S leading both C and I. This appears to be a moderately bullish stance compared to the Top 50.