Our sentiment survey remains on a buy and the tracker charts confirm an upwardly bullish bias. Here's the charts:

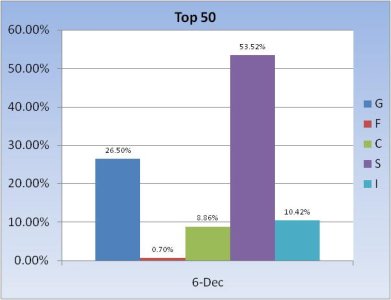

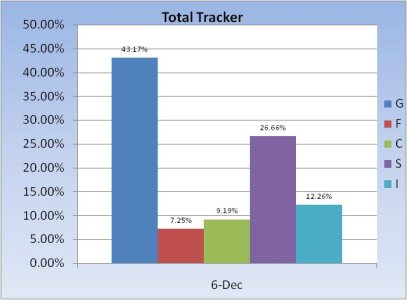

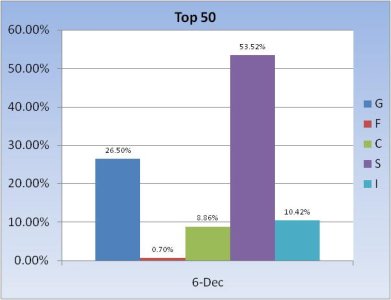

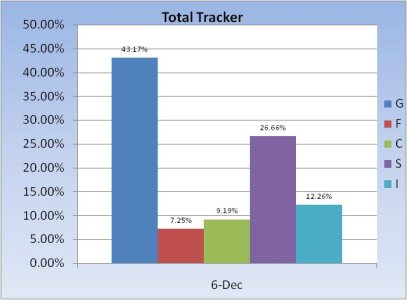

Not much has changed. Very little bond exposure, and the S fund continues to be the fund of choice.

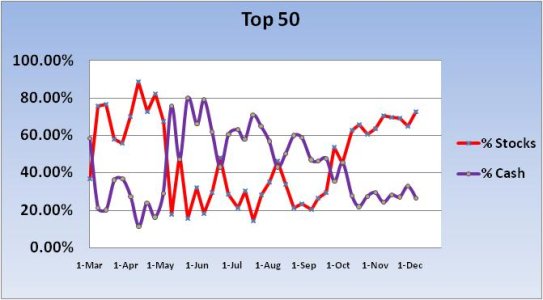

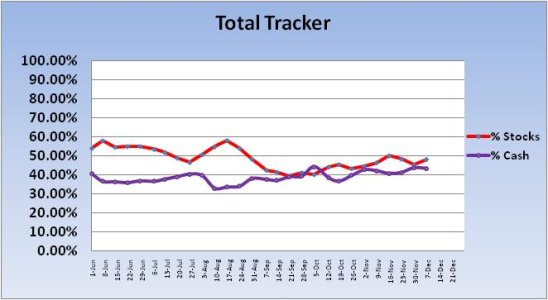

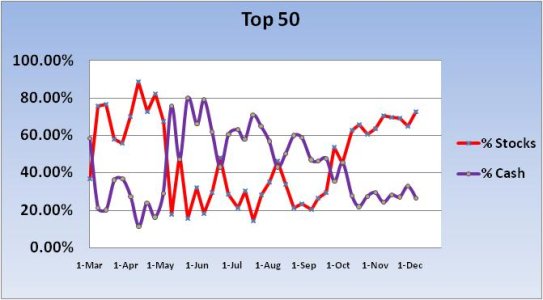

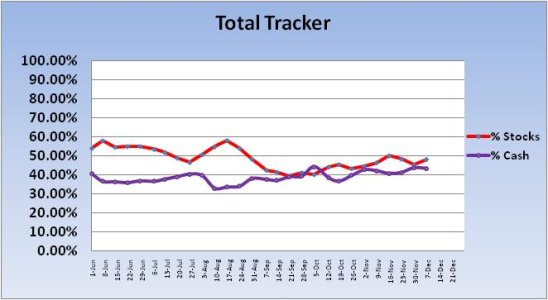

Bit of a rise in stock exposure for this week, but still plenty of cash on the sidelines.

Technically, the Seven Sentinels remain on a sell as NYMO has not yet hit a new 28 day trading high, but our sentiment survey says buy. Maybe the smart money is banking on the Bush tax cuts being extended, but if they are will we see a "sell-the-news" reaction?

Of course that's just one "issue" in a sea of issues for this market. But it is the end of the year and tax season is on the horizon.

Not much has changed. Very little bond exposure, and the S fund continues to be the fund of choice.

Bit of a rise in stock exposure for this week, but still plenty of cash on the sidelines.

Technically, the Seven Sentinels remain on a sell as NYMO has not yet hit a new 28 day trading high, but our sentiment survey says buy. Maybe the smart money is banking on the Bush tax cuts being extended, but if they are will we see a "sell-the-news" reaction?

Of course that's just one "issue" in a sea of issues for this market. But it is the end of the year and tax season is on the horizon.