We're on another sell this week based on our weekly sentiment survey. It was a great call last week and now the Seven Sentinels have issued a sell based on last Friday's close. It is OPEX week so I would not be surprised with some volatile action.

Let's take a look at how the tracker charts are allocated for this week:

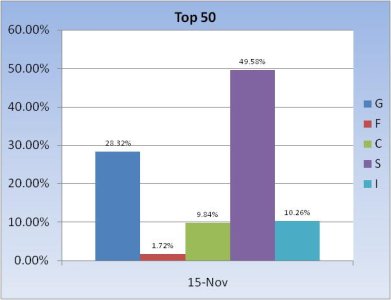

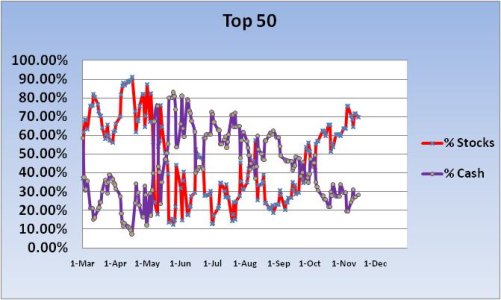

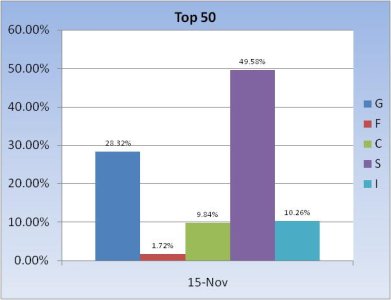

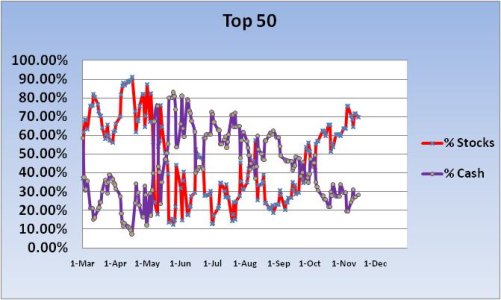

The Top 50 are showing little fear in the face of deteriorating technicals as they are maintaining a 70% stock exposure going into Monday's trade. Not surprisingly the S fund continues to be the fund of choice. Very little bond exposure, which is not surprising given the selling pressure we've seen in that sector of late.

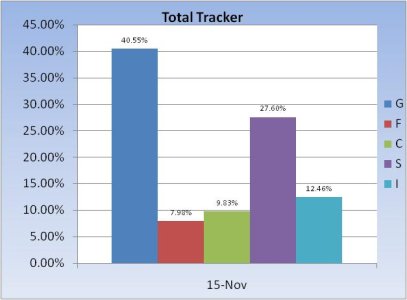

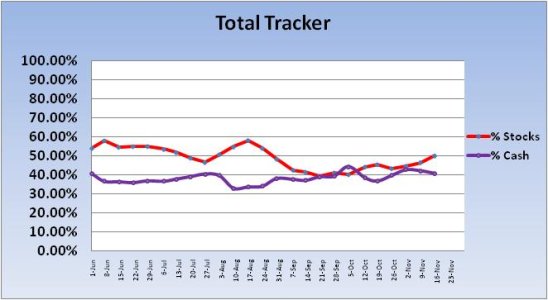

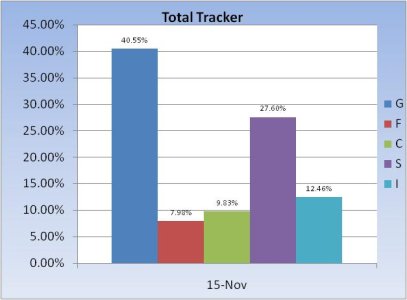

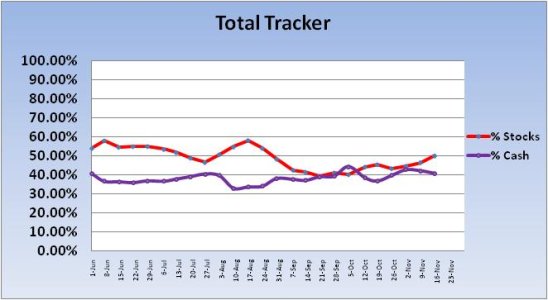

The Total Tracker shows some active dip buying activity as stock allocations picked up a bit more from the previous week. Again, the S fund is the fund of choice overall.

Out of curiosity, I checked how the Top 25 were allocated and they were only slightly more bullish than the Top 50 (less than 2%). But the Top 6, which includes the sentiment survey, are only 33% allocated to stocks.

If anyone else has any interesting observations regarding our TSP Tracker, please share them.

Let's take a look at how the tracker charts are allocated for this week:

The Top 50 are showing little fear in the face of deteriorating technicals as they are maintaining a 70% stock exposure going into Monday's trade. Not surprisingly the S fund continues to be the fund of choice. Very little bond exposure, which is not surprising given the selling pressure we've seen in that sector of late.

The Total Tracker shows some active dip buying activity as stock allocations picked up a bit more from the previous week. Again, the S fund is the fund of choice overall.

Out of curiosity, I checked how the Top 25 were allocated and they were only slightly more bullish than the Top 50 (less than 2%). But the Top 6, which includes the sentiment survey, are only 33% allocated to stocks.

If anyone else has any interesting observations regarding our TSP Tracker, please share them.