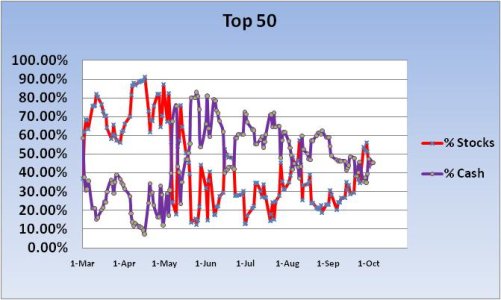

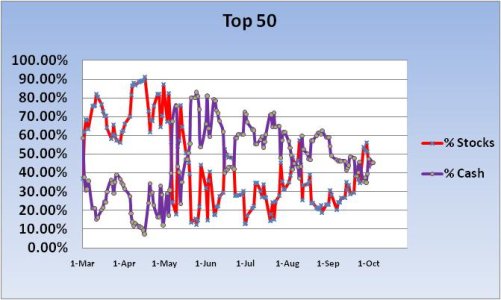

Well, now that the historic September rally is behind us many traders and investors are wondering if the market can continue to move higher. There's no shortage of bull/bear arguments and looking at our TSP tracker positions it's obvious that we are in caution mode. The generally bearish sentiment that's been hanging over the market for some time is reflected in these charts. Let's take a look.

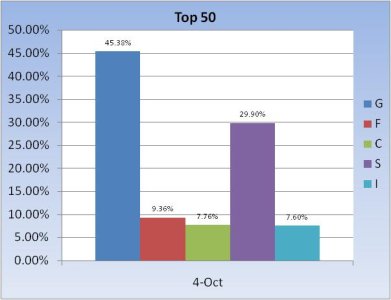

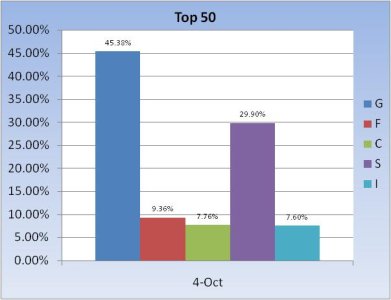

The Top 50 are evenly split between stocks and cash. That sounds moderately bullish until you look at the Top 25 in this list and notice that they are 72% in cash or bonds.

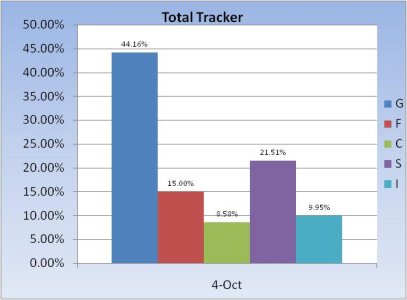

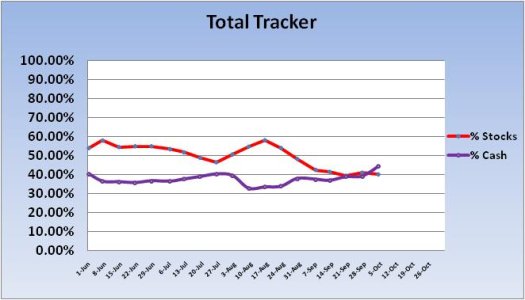

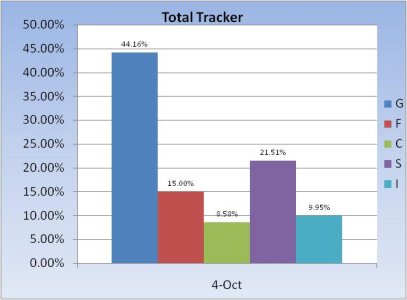

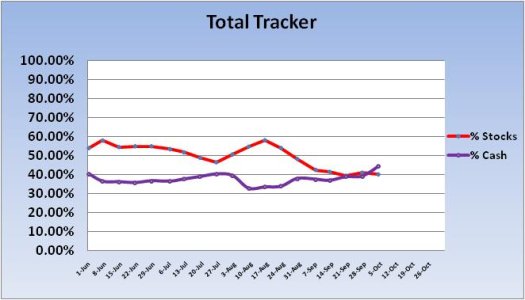

The Total Tracker shows a modest rise in cash and slight dip in stock allocation. But the percentages are very similar to the Top 50 overall.

So keep in mind that the Top 25 are decidely bearish in a generally bearish market. Are they correct? This coming week should provide the answer.

The Top 50 are evenly split between stocks and cash. That sounds moderately bullish until you look at the Top 25 in this list and notice that they are 72% in cash or bonds.

The Total Tracker shows a modest rise in cash and slight dip in stock allocation. But the percentages are very similar to the Top 50 overall.

So keep in mind that the Top 25 are decidely bearish in a generally bearish market. Are they correct? This coming week should provide the answer.