After Friday's big short squeeze it will be interesting to see what Monday brings. Lots of buy signals being triggered, but bearishness persists. I can understand being bearish, but not shorting into a market that's bent on moving higher.

Let's take a look at how we're collectively positioned going into the new week.

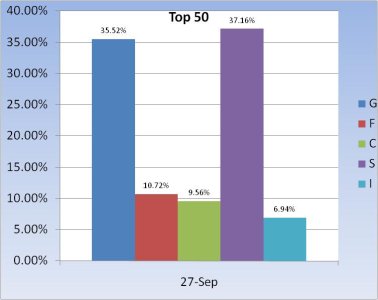

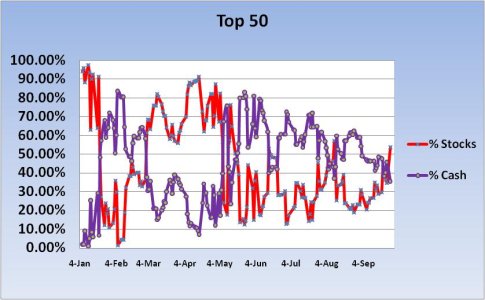

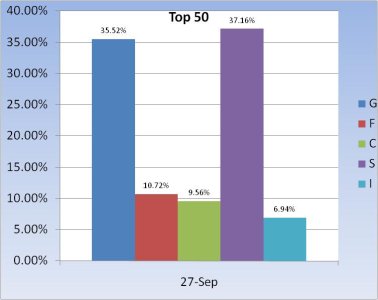

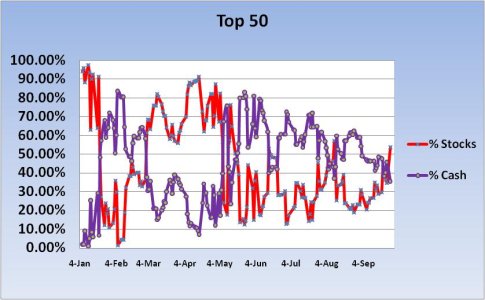

The Top 50 had a big shift into stocks last week. A big move. We haven't seen that much stock exposure in a month. Bond allocations are way down and the S fund is heavily favored.

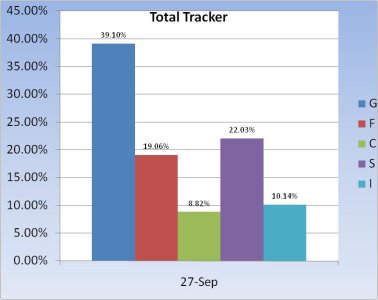

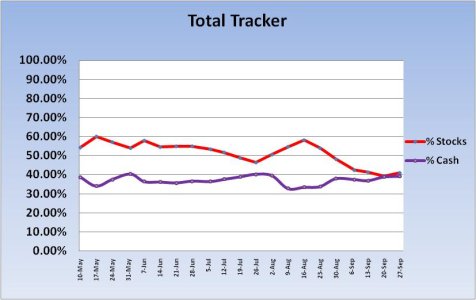

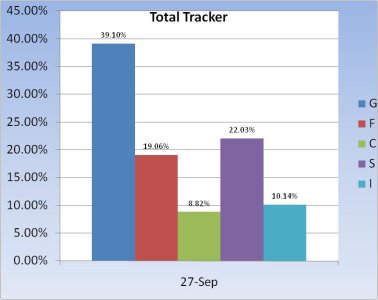

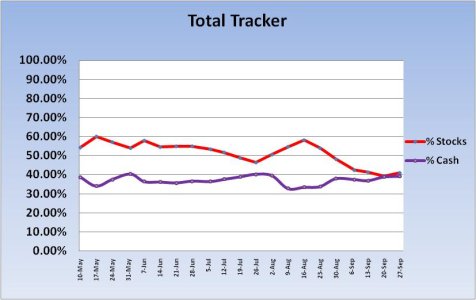

Interestingly, the Total Tracker charts show little movement, although there is a modest up-tick in stock exposure. The volatility and pervasive bad news environment seems to be keeping many of us on the sidelines.

The Top 15, which is comprised of TSP traders who did well over the two year period of 2007-2008, are flipping back and forth. You can't see it on these charts, but there's more movement than is apparent. Often, one trader will go 100% stocks on the same day another will go all cash. When that happens the charts don't change. And I've seen it happen a few times in the past few weeks. But overall, they've been selling into this rally as cash levels have been rising.

Let's take a look at how we're collectively positioned going into the new week.

The Top 50 had a big shift into stocks last week. A big move. We haven't seen that much stock exposure in a month. Bond allocations are way down and the S fund is heavily favored.

Interestingly, the Total Tracker charts show little movement, although there is a modest up-tick in stock exposure. The volatility and pervasive bad news environment seems to be keeping many of us on the sidelines.

The Top 15, which is comprised of TSP traders who did well over the two year period of 2007-2008, are flipping back and forth. You can't see it on these charts, but there's more movement than is apparent. Often, one trader will go 100% stocks on the same day another will go all cash. When that happens the charts don't change. And I've seen it happen a few times in the past few weeks. But overall, they've been selling into this rally as cash levels have been rising.