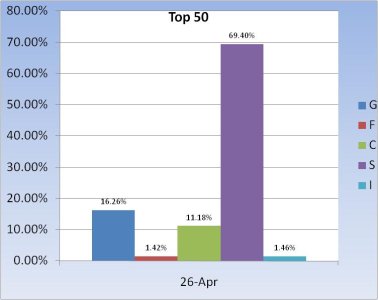

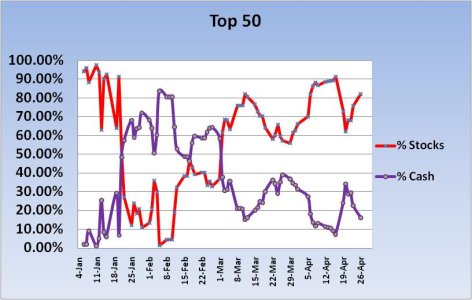

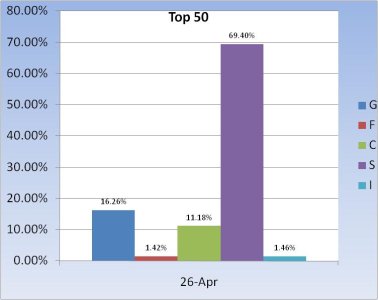

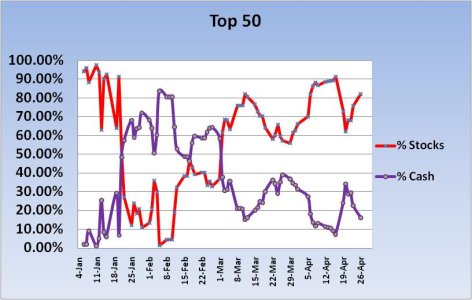

Time to check in on our Top 15 and Top 50. First up, Top 50:

After a brief, moderate push for the exits a week ago, the Top 50 have moved most of their cash back into the stock funds. Or should I say "the" stock fund. Their collective I fund exposure is almost non-existent, they have a modest C fund exposure, and the S fund is overweighted big-time. Sounds like something I'd do.

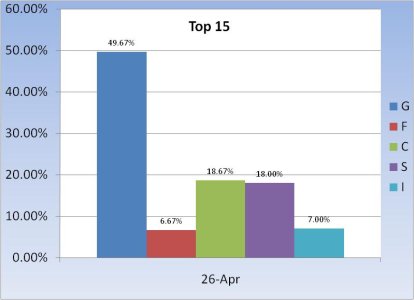

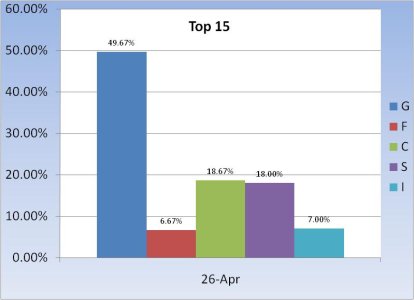

On the other hand, the Top 15 remain largely in cash, which surprises me. After almost 4 months this group has kept a fairly consistent blend of cash/stocks exposure. They have a collective 4.47% return so far, which puts them about 222 on the tracker.

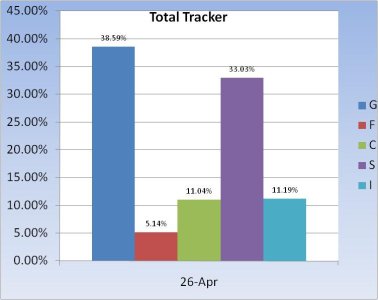

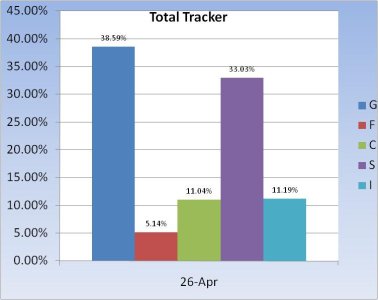

Here is a look at the collective position of the total tracker. They are leaning towards S fund, but still hold a fair amount of cash in reserve.

That's it for the weekend. See you Monday.

After a brief, moderate push for the exits a week ago, the Top 50 have moved most of their cash back into the stock funds. Or should I say "the" stock fund. Their collective I fund exposure is almost non-existent, they have a modest C fund exposure, and the S fund is overweighted big-time. Sounds like something I'd do.

On the other hand, the Top 15 remain largely in cash, which surprises me. After almost 4 months this group has kept a fairly consistent blend of cash/stocks exposure. They have a collective 4.47% return so far, which puts them about 222 on the tracker.

Here is a look at the collective position of the total tracker. They are leaning towards S fund, but still hold a fair amount of cash in reserve.

That's it for the weekend. See you Monday.