Friday's sell-off certainly has created some uncertainty about where this market goes next. I've been trying to gauge sentiment to get some idea how much more downside (if any) is left. Our TSP sentiment poll was very bullish for this coming week and flipped to a sell for the first time in 12 weeks. We have to go back to the week of 19Jan to find a sell based on this survey. And this survey has been doing very well so far this year, so I don't think we want to ignore it.

But wait.

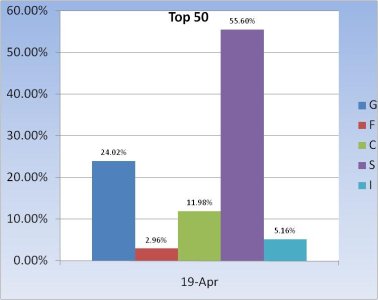

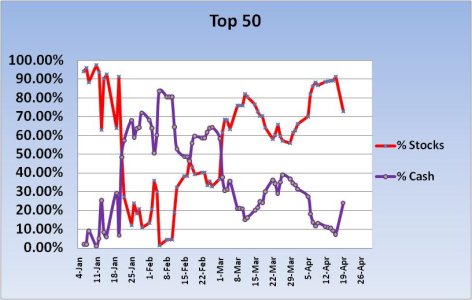

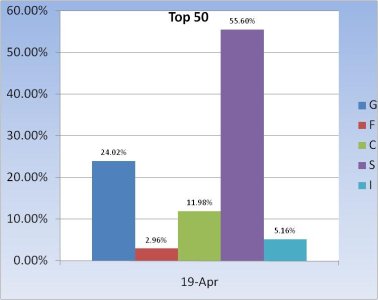

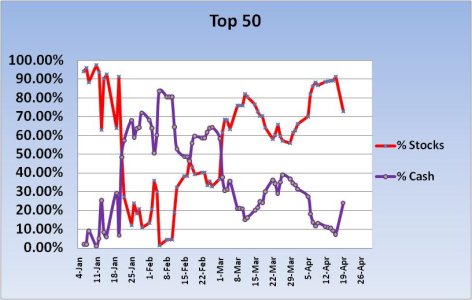

The survey came out on Thursday and results are posted on Friday. The sell-off didn't occur until Friday. And looking at the Top 50 charts I don't get the impression we're still as bullish as the survey would have us believe. You see, if sentiment gets too bullish across the market on a pullback like Friday, we could certainly see more downside, and I'd expect it. But how quickly does sentiment turn given the GS news Friday along with the biggest market drop in over month?

Sentiment Trader is neutral after Friday's close for the Short Term, but Longer Term they are solidly bullish.

Tickersense was neutral to bullish for this past week, but no data for this coming week has been posted as of yet. The daily Trader's Talk poll hasn't seen nearly enough voters yet to know how the day traders stand for Monday either. As of 4/14 AAII reported 48.88% Bulls and 29.7% Bears. That's bullish, but not enough to be a problem, and after Friday's weakness I'd expect to see more bears. But that's just my expectation.

It's just a bit too early to know if sentiment is a problem, but given the action of the Top 50 I suspect bearish levels are rising in other pockets.

So far it's only one day of weakness and the Sentinels are still on a buy, but we still have 2 weeks until May, so depending on how many IFTs you have this decision could be very tricky if the Seven Sentinels flip to a sell early next week. Here's the charts:

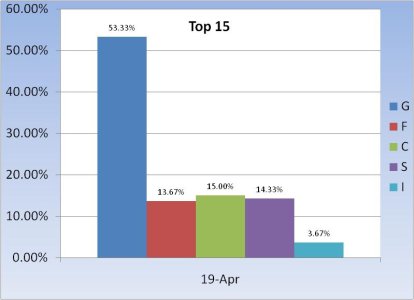

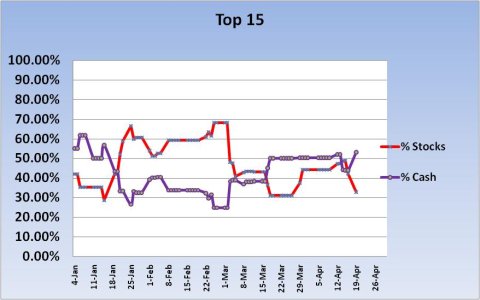

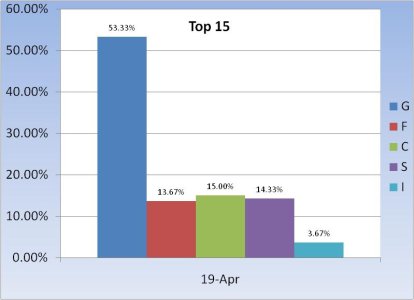

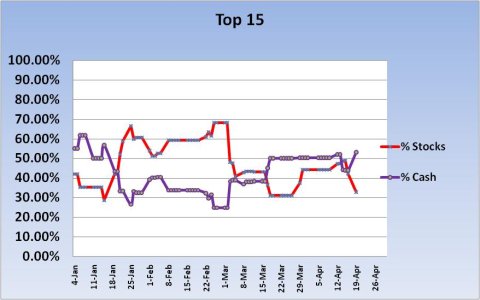

It wasn't just the Top 50 who began to pull back. The Top 15 did too.

Look at the knee-jerk shift in that second chart. On Thursday only 7.32% of total funds were sitting in the G fund. One day later it shot to 24.02. I'm sure a fair number of tracker members are going to be watching Monday's action very carefully. More weakness will probably see more cash raised.

I am 50/50 G and S and not quite sure whether I'm a buyer or seller. I'd like to be a buyer, but I need to see how the first part of this week goes before I think about making another move, and that includes watching BPCOMPQ for futher clues. See you tomorrow.

But wait.

The survey came out on Thursday and results are posted on Friday. The sell-off didn't occur until Friday. And looking at the Top 50 charts I don't get the impression we're still as bullish as the survey would have us believe. You see, if sentiment gets too bullish across the market on a pullback like Friday, we could certainly see more downside, and I'd expect it. But how quickly does sentiment turn given the GS news Friday along with the biggest market drop in over month?

Sentiment Trader is neutral after Friday's close for the Short Term, but Longer Term they are solidly bullish.

Tickersense was neutral to bullish for this past week, but no data for this coming week has been posted as of yet. The daily Trader's Talk poll hasn't seen nearly enough voters yet to know how the day traders stand for Monday either. As of 4/14 AAII reported 48.88% Bulls and 29.7% Bears. That's bullish, but not enough to be a problem, and after Friday's weakness I'd expect to see more bears. But that's just my expectation.

It's just a bit too early to know if sentiment is a problem, but given the action of the Top 50 I suspect bearish levels are rising in other pockets.

So far it's only one day of weakness and the Sentinels are still on a buy, but we still have 2 weeks until May, so depending on how many IFTs you have this decision could be very tricky if the Seven Sentinels flip to a sell early next week. Here's the charts:

It wasn't just the Top 50 who began to pull back. The Top 15 did too.

Look at the knee-jerk shift in that second chart. On Thursday only 7.32% of total funds were sitting in the G fund. One day later it shot to 24.02. I'm sure a fair number of tracker members are going to be watching Monday's action very carefully. More weakness will probably see more cash raised.

I am 50/50 G and S and not quite sure whether I'm a buyer or seller. I'd like to be a buyer, but I need to see how the first part of this week goes before I think about making another move, and that includes watching BPCOMPQ for futher clues. See you tomorrow.