Here's the Top 15 and 50 charts for Monday's trading activity:

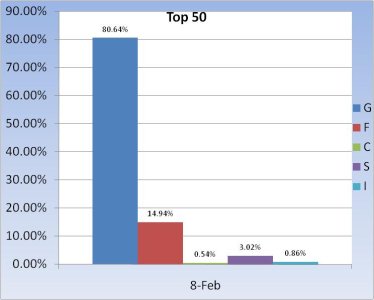

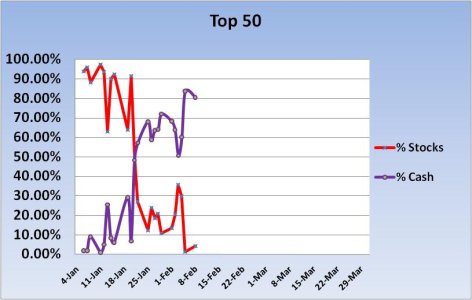

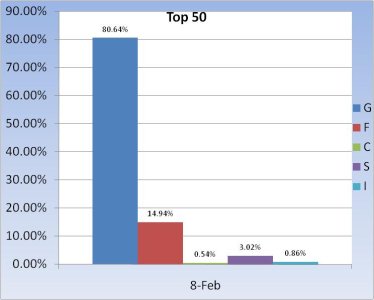

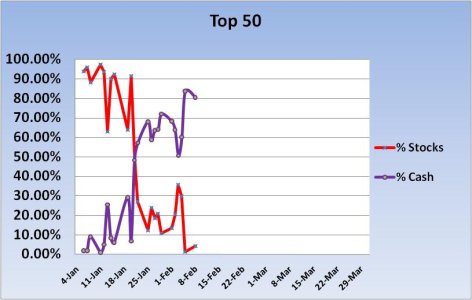

Cash is still the place the be at the moment, and the Top 50 are sitting on a lot of it. Bonds have found favor here too.

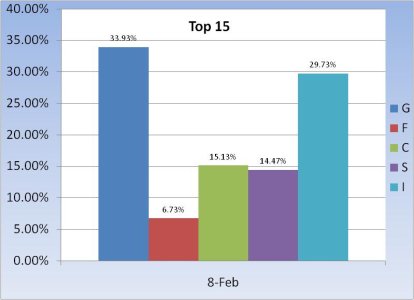

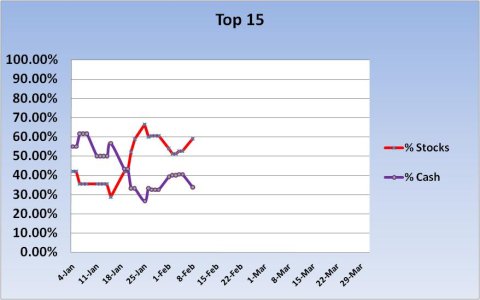

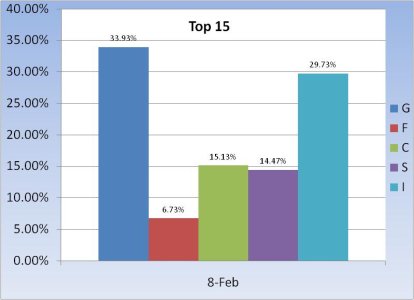

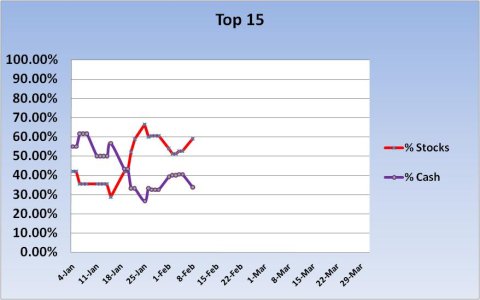

The Top 15 on the other hand are mostly in the market, and more weighted towards the I fund at that. The risk/reward factor is fairly high with this group at the moment, meaning only that these traders are a more aggressive lot. I like that kind of attitude.

A couple weeks ago I checked on the Top 15's collective return for the year and they were positioned about in the middle of the tracker poll. As of today, they have a collective -3.56% return. That puts them at about number 163 on the tracker. That's still right about the middle of the pack.

I am going to be in the Norfolk, VA area this coming week, departing at noon tomorrow and leaving Thursday morning. My posting will be limited to the late afternoon and evening hours during that time. See you Monday.

Cash is still the place the be at the moment, and the Top 50 are sitting on a lot of it. Bonds have found favor here too.

The Top 15 on the other hand are mostly in the market, and more weighted towards the I fund at that. The risk/reward factor is fairly high with this group at the moment, meaning only that these traders are a more aggressive lot. I like that kind of attitude.

A couple weeks ago I checked on the Top 15's collective return for the year and they were positioned about in the middle of the tracker poll. As of today, they have a collective -3.56% return. That puts them at about number 163 on the tracker. That's still right about the middle of the pack.

I am going to be in the Norfolk, VA area this coming week, departing at noon tomorrow and leaving Thursday morning. My posting will be limited to the late afternoon and evening hours during that time. See you Monday.