If the market is going to run higher in the days or weeks ahead, it really needed to take a break first. And Friday's action gave us that.

Debt downgrades overseas prompted the negative tone, but the broader market was able to close well off its lows of the day in any event. Of course the downgrades didn't actually come until after the closing bell, but the rumors were swirling.

Here at home, the U.S. trade deficit grew to $47.8 billion in November, from $43.3 billion the previous month (October). Analysts say its primarily due to a rise in oil imports, but our exports were also down. Estimates had called for a deficit of $45.0 billion. Exports fell 0.9% in November, while imports rose by 1.3%.

The latest Consumer Sentiment Survey rose from 69.9 in December to 74.0 for January. That beat estimates looking for a reading of 71.2. It was also the highest reading since May 2011.

Here's how the charts ended the week:

NAMO and NYMO both flipped back to sell conditions.

NAHL also flipped to a sell, but NYHL retained its buys status.

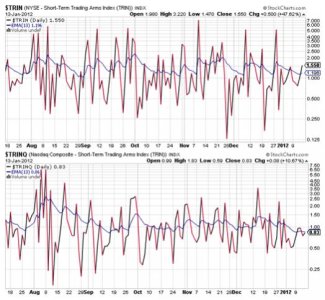

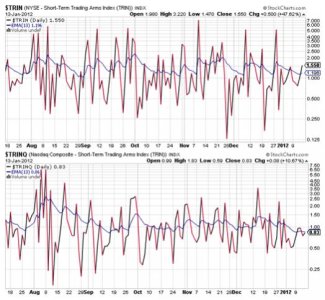

TRIN flipped to a sell, while TRINQ remained on a buy.

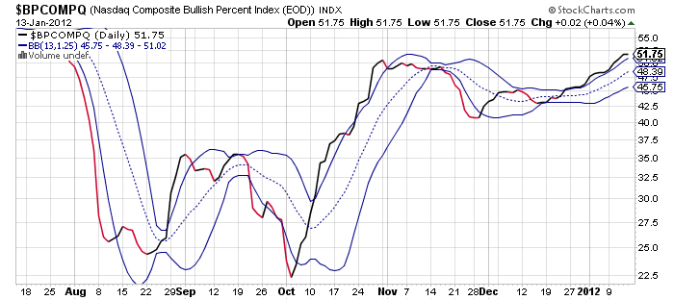

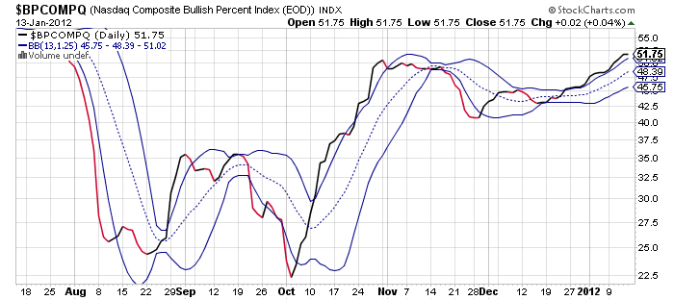

BPCOMPQ tracked mostly sidelines and remains in a buy condition.

So the Seven Sentinels are mixed, but the system remains in an official buy condition.

To my eye, the charts still look bullish, although a bit more weakness early on next week would not be out of the question. Friday's action didn't do much damage at all from a technical standpoint. And next week is OPEX, which means we'll probably continue to see volatility. It will be interesting to see how the market reacts to the downgrades come Tuesday, but I suspect it was already priced in.

Stop by tomorrow evening, which is when I'll have the tracker charts posted. See you then.

Debt downgrades overseas prompted the negative tone, but the broader market was able to close well off its lows of the day in any event. Of course the downgrades didn't actually come until after the closing bell, but the rumors were swirling.

Here at home, the U.S. trade deficit grew to $47.8 billion in November, from $43.3 billion the previous month (October). Analysts say its primarily due to a rise in oil imports, but our exports were also down. Estimates had called for a deficit of $45.0 billion. Exports fell 0.9% in November, while imports rose by 1.3%.

The latest Consumer Sentiment Survey rose from 69.9 in December to 74.0 for January. That beat estimates looking for a reading of 71.2. It was also the highest reading since May 2011.

Here's how the charts ended the week:

NAMO and NYMO both flipped back to sell conditions.

NAHL also flipped to a sell, but NYHL retained its buys status.

TRIN flipped to a sell, while TRINQ remained on a buy.

BPCOMPQ tracked mostly sidelines and remains in a buy condition.

So the Seven Sentinels are mixed, but the system remains in an official buy condition.

To my eye, the charts still look bullish, although a bit more weakness early on next week would not be out of the question. Friday's action didn't do much damage at all from a technical standpoint. And next week is OPEX, which means we'll probably continue to see volatility. It will be interesting to see how the market reacts to the downgrades come Tuesday, but I suspect it was already priced in.

Stop by tomorrow evening, which is when I'll have the tracker charts posted. See you then.