♗ Weekly Recap

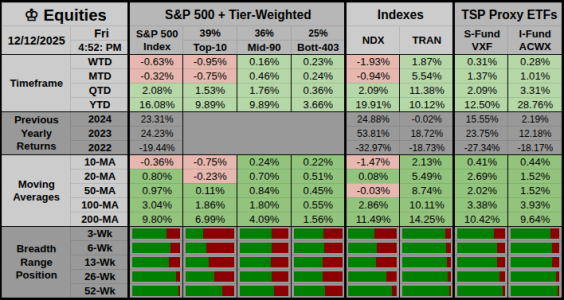

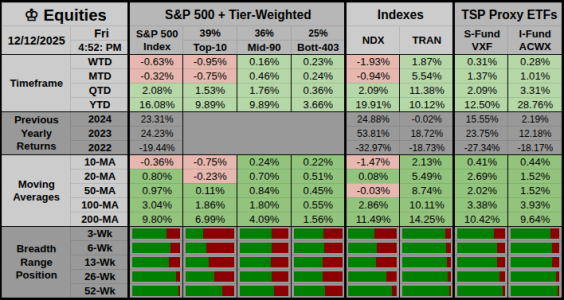

● WTD Overview: Risk-off: SPX −0.63%, but breadth was mixed as Mid-90 +0.16% and Bott-403 +0.23% stayed green.

Key Takeaway: If long bonds stabilize and volatility cools, risk can broaden beyond the Top-10.

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series (ici.org)

♔ Equities

WTD Overview: Risk-off index tape: SPX −0.63%, with mega-caps lagging while the broader list held up.

Leaders & Relative Holds

● Risk Bias: Risk-off. Bott-403 +0.23% and Mid-90 +0.16% cushioned while Top-10 slipped −0.95%.

● Breadth: Participation widened. VXF +0.31% held up while NDX fell −1.93%.

Key Takeaway: If VIX stops rising and long bonds stop sliding, the “rest of market” can keep carrying.

Key Takeaway: If VIX stops rising and long bonds stop sliding, the “rest of market” can keep carrying.

♛ Barometer

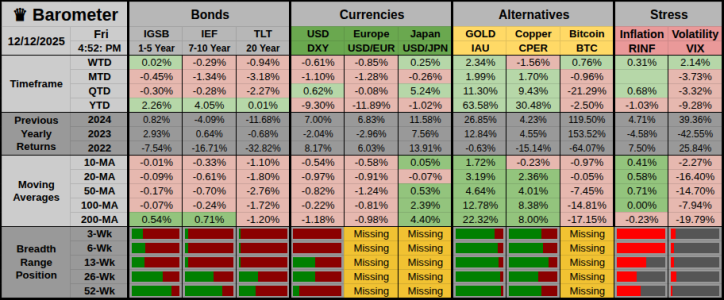

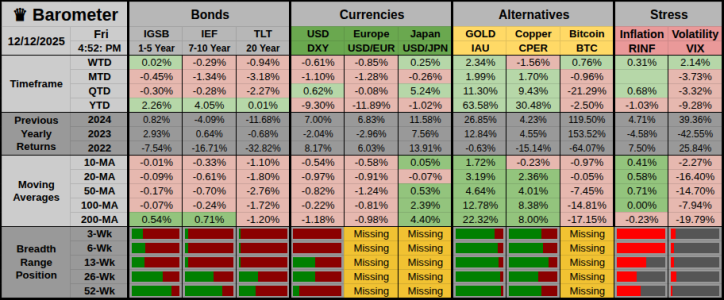

WTD Overview: Duration sold off (long bonds down) while the dollar eased and gold caught a bid; volatility rose and copper slipped.

Hedges & Risk Bias

● Risk Bias: Risk-off. TLT −0.94% with DXY −0.61%, IAU +2.34%, and VIX +2.14%.

● Breadth: Mixed. Safety bid showed in gold, but CPER −1.56% flagged slower growth while BTC +0.76% stayed resilient.

Key Takeaway: Conviction improves if long bonds firm and volatility falls while the dollar stays soft.

Key Takeaway: Conviction improves if long bonds firm and volatility falls while the dollar stays soft.

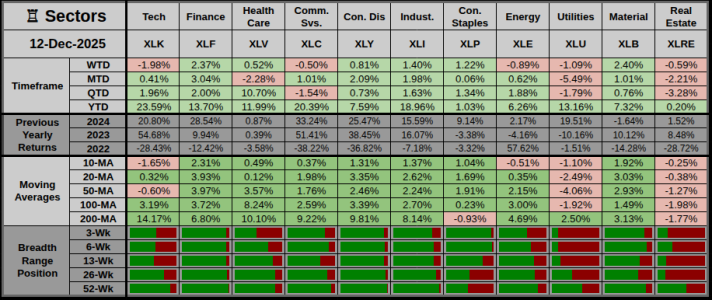

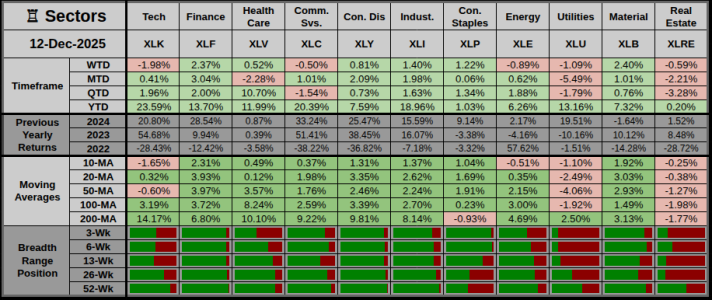

♖ Sectors & Rotation

Weekly Sector Overview: Cyclicals outperformed; breadth wide, but tech was the main drag.

Offensive Assets

● Top WTD gainers: XLB +2.40%, XLF +2.37% — materials and banks led the tape.

● Breadth/outperformance: Cyclicals > SPX; participation widened as XLI +1.40% and XLY +0.81% stayed green.

Defensive Assets

● Standout hedge/defense: XLP +1.22% — staples held up despite long-rate pressure.

● Safety tone or drag: Utilities lagged at XLU −1.09%, a headwind from higher yields.

Key Takeaway: If financials and materials keep leading while tech stabilizes, the rally can broaden even in a choppy tape.

Key Takeaway: If financials and materials keep leading while tech stabilizes, the rally can broaden even in a choppy tape.

4–6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Mid: mixed spread; trend mixed; breadth neutral.

● ● Alternate: Early: cyclicals led; trend firm; breadth early tilt.

● ● ● Confidence: High: Timeframe, Trend, and Breadth lenses all read Mid.

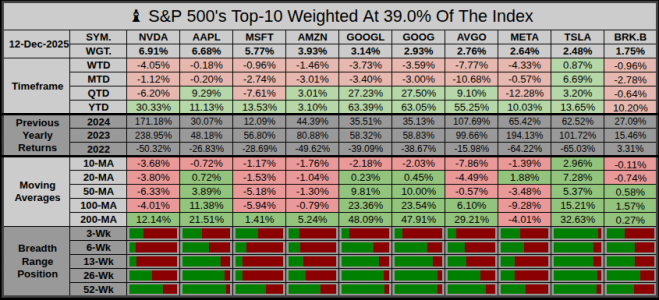

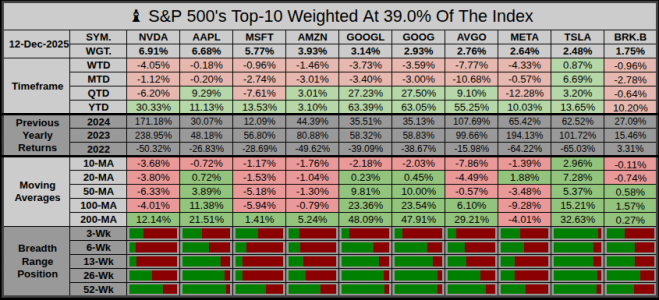

♗ S&P 500’s Weighted Top-10

Overview: Broadly weak: most names were red, and dispersion was high with one green outlier and several sharp decliners.

Offensive Leaders

● Top movers (gains or least-negative): TSLA +0.87%, AAPL −0.18% — autos held up, Apple was a relative shelter.

● Secondary: mega-cap tech faded together, leaving the Top-10 as a net drag on index breadth.

Defensive Laggards

● Biggest decliners: AVGO −7.77%, META −4.33%.

● Semis and search slipped while the rest of the market held up, a classic “narrow leadership” warning.

Key Takeaway: If Top-10 weakness persists, the market needs small caps and cyclicals to keep offsetting the drag.

Key Takeaway: If Top-10 weakness persists, the market needs small caps and cyclicals to keep offsetting the drag.

Next Week’s Projection

Next Week’s Projection

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

● WTD Overview: Risk-off: SPX −0.63%, but breadth was mixed as Mid-90 +0.16% and Bott-403 +0.23% stayed green.

Key Takeaway: If long bonds stabilize and volatility cools, risk can broaden beyond the Top-10.

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series (ici.org)

| Box | Category | Weekly Flow | 4-wk Median Read | Risk Tone |

|---|---|---|---|---|

| Equity mutual funds | −$17.47B | Above | Risk-off/de-risking | |

| Bond mutual funds | +$0.32B | Below | Mixed/neutral | |

| ETFs (net issuance) | +$30.27B | Near | Risk-on/supportive | |

| Combined MF + ETF | +$10.57B | Below | Mixed (ETF-led) | |

| Money market funds | +$1.19B to $7.66T | Near (3-wk proxy) | Mixed/neutral (cash steady) |

♔ Equities

WTD Overview: Risk-off index tape: SPX −0.63%, with mega-caps lagging while the broader list held up.

Leaders & Relative Holds

● Risk Bias: Risk-off. Bott-403 +0.23% and Mid-90 +0.16% cushioned while Top-10 slipped −0.95%.

● Breadth: Participation widened. VXF +0.31% held up while NDX fell −1.93%.

♛ Barometer

WTD Overview: Duration sold off (long bonds down) while the dollar eased and gold caught a bid; volatility rose and copper slipped.

Hedges & Risk Bias

● Risk Bias: Risk-off. TLT −0.94% with DXY −0.61%, IAU +2.34%, and VIX +2.14%.

● Breadth: Mixed. Safety bid showed in gold, but CPER −1.56% flagged slower growth while BTC +0.76% stayed resilient.

♖ Sectors & Rotation

Weekly Sector Overview: Cyclicals outperformed; breadth wide, but tech was the main drag.

Offensive Assets

● Top WTD gainers: XLB +2.40%, XLF +2.37% — materials and banks led the tape.

● Breadth/outperformance: Cyclicals > SPX; participation widened as XLI +1.40% and XLY +0.81% stayed green.

Defensive Assets

● Standout hedge/defense: XLP +1.22% — staples held up despite long-rate pressure.

● Safety tone or drag: Utilities lagged at XLU −1.09%, a headwind from higher yields.

4–6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Mid: mixed spread; trend mixed; breadth neutral.

● ● Alternate: Early: cyclicals led; trend firm; breadth early tilt.

● ● ● Confidence: High: Timeframe, Trend, and Breadth lenses all read Mid.

| Box | Bias | Probability | Narrative (4–6 Week Horizon) |

|---|---|---|---|

| Up | 56% | If dollar stays soft and cyclicals lead, then breadth improves and pullbacks stay buyable. | |

| Sideways | 33% | If yields stay jumpy and tech lags, then chop persists with rotation and limited index progress. | |

| Down | 11% | If volatility rises and long bonds keep sliding, then defensives lead and indexes retest recent lows. |

♗ S&P 500’s Weighted Top-10

Overview: Broadly weak: most names were red, and dispersion was high with one green outlier and several sharp decliners.

Offensive Leaders

● Top movers (gains or least-negative): TSLA +0.87%, AAPL −0.18% — autos held up, Apple was a relative shelter.

● Secondary: mega-cap tech faded together, leaving the Top-10 as a net drag on index breadth.

Defensive Laggards

● Biggest decliners: AVGO −7.77%, META −4.33%.

● Semis and search slipped while the rest of the market held up, a classic “narrow leadership” warning.

| Scenario | Probability | Evidence (Weekly-Based, conditional) |

|---|---|---|

| 45% | If DXY stays lower and XLF/XLB keep leading, then SPX grinds higher with improving breadth. | |

| 35% | If yields stay volatile and VIX stays elevated, then SPX chops in a tight range with rotation. | |

| 20% | If TLT keeps falling and tech stays heavy, then SPX slips and defensives take the lead again. |

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.