♗ Weekly Recap

● WTD Overview: Risk-on tone: SPX WTD +3.73% with broad gains across tiers and sectors, leadership wide not narrow. Equities, credit, and cyclic assets drew bids while cash built; dollar softened and equity volatility collapsed.

Key Takeaway: Short-term regime is risk-on but stretched; watch long-end yields and equity volatility for any shift toward de-risking.

$↗︎ Net Flows $↘︎ — Wednesday Series

Fund Inflows — Wednesday Series (ici.org)

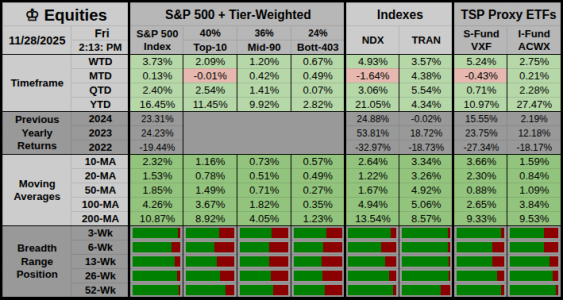

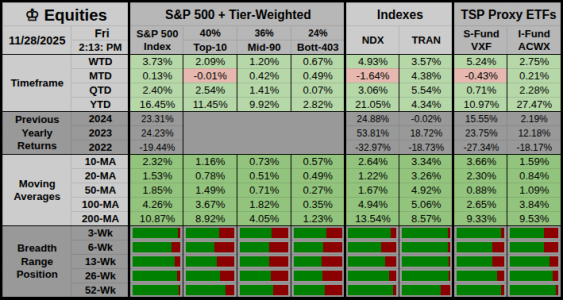

♔ Equities

WTD Overview: Risk-on week: SPX WTD +3.73%, Top-10 outpaced Mid-90 and Bott-403, with strong help from transports and ex-US. Large growth, cyclic groups, and small caps all participated while stress stayed muted as equity volatility fell -30.22%.

Leaders & Relative Holds

● Risk Bias: Risk-on. Mid and lower tiers gained, but Top-10 and transports led, keeping leadership still somewhat top-heavy.

● Breadth: Participation widened; cyclicals and small caps gained strongly while laggards were modest, so pullbacks were shallow and brief.

Key Takeaway: As long as equity volatility holds low and long yields stay capped, dip buyers keep control near term.

Key Takeaway: As long as equity volatility holds low and long yields stay capped, dip buyers keep control near term.

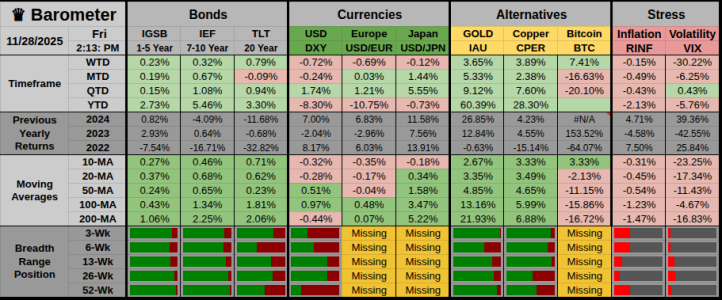

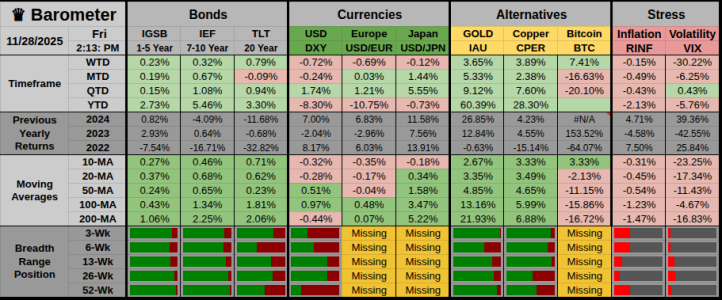

♛ Barometer

WTD Overview: Treasuries inched higher as DXY fell. Gold and copper advanced, VIX sank, and Bitcoin bounced.

Hedges & Risk Bias

● Risk Bias: Risk-on. The curve bull-flattened modestly, gold and copper rose together, inflation expectations were stable, and a softer dollar helped global risk.

● Breadth: Safety trades were mixed rather than dominant; cyclic proxies like copper and crypto were strong, tilting participation toward offense over defense.

Key Takeaway: Rates and dollar moves are supportive; a sharp rebound in equity volatility or a firmer dollar would be the clearest risk-off trigger.

Key Takeaway: Rates and dollar moves are supportive; a sharp rebound in equity volatility or a firmer dollar would be the clearest risk-off trigger.

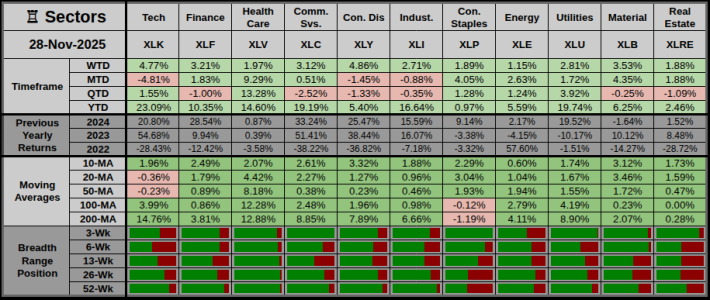

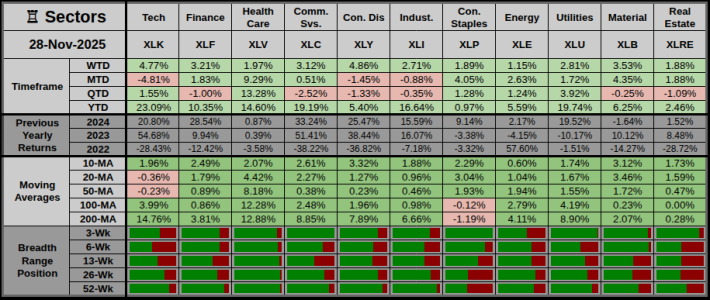

♖ Sectors & Rotation

Weekly Sector Overview: Cyclicals led: XLK +4.77%, XLY +4.86%, and XLB +3.53% outpaced defensives that still finished green.

Offensive Assets

● Top gainers: XLY +4.86% and XLK +4.77% on growth and consumer strength, with XLB +3.53% confirming cyclical tone.

● Cyclicals outperformed; breadth was wide as tech, consumer, and industrial groups beat the S&P 500 and pulled laggards higher.

Defensive Assets

● Defensives like XLV +1.97%, XLP +1.89%, and XLU +2.81% rose but trailed the main leaders.

● Energy (XLE +1.15%) lagged relative, so hedging came more from quiet defensives than from a classic yield grab.

Key Takeaway: With broad green across sectors and high breadth readings, the next test is whether defensives stay quiet on the next rate wobble.

Key Takeaway: With broad green across sectors and high breadth readings, the next test is whether defensives stay quiet on the next rate wobble.

4–6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Late: leadership narrow at the top, trend momentum strong but aging, breadth shows a late tilt despite wide current gains.

● ● Alternate: Contraction: defensives have firmed underneath and prior years point to eventual cooling, even with present cyclical dominance.

● ● ● Confidence: High — Time and Breadth lenses are Neutral together; Trend lens disagrees but does not flip the overall stage.

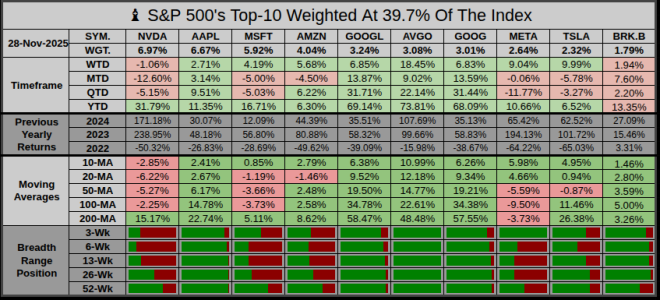

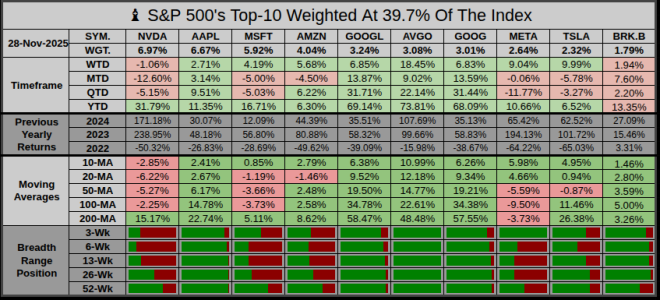

♗ S&P 500’s Weighted Top-10

Overview: Tone was broadly strong across the Top-10, with only NVDA slightly red and dispersion skewed to big upside in semis.

Offensive Leaders

● Standout mover: AVGO +18.45% led on AI and chip enthusiasm, while TSLA +9.99% and META +9.04% added high-beta fuel.

● Search and ad names GOOGL +6.85% and GOOG +6.83% were strong, confirming broad mega-cap growth support rather than a single-stock spike.

Defensive Laggards

● Laggard list was short: NVDA -1.06% and a modest AAPL +2.71% trailed the pack after prior strong runs.

● MSFT +4.19% and BRK.B +1.94% were solid but not extreme, leaving breadth inside the Top-10 robust rather than one-sided.

Key Takeaway: Mega-cap and semi strength drives the tape, but the index stays fragile if they weaken.

Key Takeaway: Mega-cap and semi strength drives the tape, but the index stays fragile if they weaken.

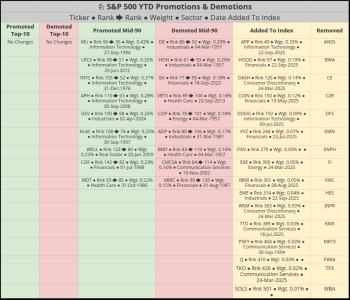

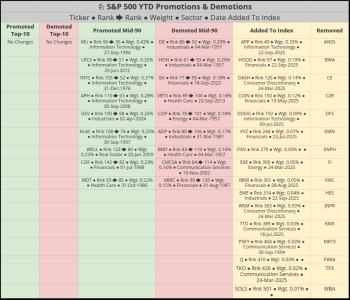

♘ S&P 500’s Tier-Weighted: Rank & Weight Changes

Overview: Shifts leaned into large tech & growth cyclicals moving up from the Mid-90. Some mature industrial and health names slipped into the Bott-403.

● Participation widened as more growth and cyclical names picked up weight, hinting at a more durable advance if macro conditions hold.

Key Takeaway: Upward moves in semiconductors and select financials point to healthier participation beyond the Top-10, even as a few legacy blue chips drift lower.

Key Takeaway: Upward moves in semiconductors and select financials point to healthier participation beyond the Top-10, even as a few legacy blue chips drift lower.

Next Week’s Projection

Next Week’s Projection

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

● WTD Overview: Risk-on tone: SPX WTD +3.73% with broad gains across tiers and sectors, leadership wide not narrow. Equities, credit, and cyclic assets drew bids while cash built; dollar softened and equity volatility collapsed.

Key Takeaway: Short-term regime is risk-on but stretched; watch long-end yields and equity volatility for any shift toward de-risking.

$↗︎ Net Flows $↘︎ — Wednesday Series

| Box | Category | Weekly Flow | 4-wk Median Read | Risk Tone |

|---|---|---|---|---|

| Equity mutual funds | -$21.63B | Near | Risk-off/de-risking | |

| Bond mutual funds | +$4.67B | Above | Risk-on/supportive | |

| ETFs (net issuance) | +$34.25B | Below | Mixed: risk-on but softer vs trend | |

| Combined MF + ETF | +$14.64B | Below | Mixed: bonds offset equity selling | |

| Money market funds | +$45.51B to $7.57T | Above | Risk-off/de-risking (cash build) |

♔ Equities

WTD Overview: Risk-on week: SPX WTD +3.73%, Top-10 outpaced Mid-90 and Bott-403, with strong help from transports and ex-US. Large growth, cyclic groups, and small caps all participated while stress stayed muted as equity volatility fell -30.22%.

Leaders & Relative Holds

● Risk Bias: Risk-on. Mid and lower tiers gained, but Top-10 and transports led, keeping leadership still somewhat top-heavy.

● Breadth: Participation widened; cyclicals and small caps gained strongly while laggards were modest, so pullbacks were shallow and brief.

♛ Barometer

WTD Overview: Treasuries inched higher as DXY fell. Gold and copper advanced, VIX sank, and Bitcoin bounced.

Hedges & Risk Bias

● Risk Bias: Risk-on. The curve bull-flattened modestly, gold and copper rose together, inflation expectations were stable, and a softer dollar helped global risk.

● Breadth: Safety trades were mixed rather than dominant; cyclic proxies like copper and crypto were strong, tilting participation toward offense over defense.

♖ Sectors & Rotation

Weekly Sector Overview: Cyclicals led: XLK +4.77%, XLY +4.86%, and XLB +3.53% outpaced defensives that still finished green.

Offensive Assets

● Top gainers: XLY +4.86% and XLK +4.77% on growth and consumer strength, with XLB +3.53% confirming cyclical tone.

● Cyclicals outperformed; breadth was wide as tech, consumer, and industrial groups beat the S&P 500 and pulled laggards higher.

Defensive Assets

● Defensives like XLV +1.97%, XLP +1.89%, and XLU +2.81% rose but trailed the main leaders.

● Energy (XLE +1.15%) lagged relative, so hedging came more from quiet defensives than from a classic yield grab.

4–6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Late: leadership narrow at the top, trend momentum strong but aging, breadth shows a late tilt despite wide current gains.

● ● Alternate: Contraction: defensives have firmed underneath and prior years point to eventual cooling, even with present cyclical dominance.

● ● ● Confidence: High — Time and Breadth lenses are Neutral together; Trend lens disagrees but does not flip the overall stage.

| Box | Bias | Probability | Narrative (4–6 Week Horizon) |

|---|---|---|---|

| Up | 18% | If rates stay contained, dollar remains soft, and sector breadth stays wide, then indexes can grind higher. | |

| Sideways | 13% | If yields and equity volatility both settle into ranges, then leadership rotation likely keeps indexes in a choppy band. | |

| Down | 69% | If cyclicals tire, dollar firms, and equity volatility rebounds from lows, then de-risking should pressure indexes. |

♗ S&P 500’s Weighted Top-10

Overview: Tone was broadly strong across the Top-10, with only NVDA slightly red and dispersion skewed to big upside in semis.

Offensive Leaders

● Standout mover: AVGO +18.45% led on AI and chip enthusiasm, while TSLA +9.99% and META +9.04% added high-beta fuel.

● Search and ad names GOOGL +6.85% and GOOG +6.83% were strong, confirming broad mega-cap growth support rather than a single-stock spike.

Defensive Laggards

● Laggard list was short: NVDA -1.06% and a modest AAPL +2.71% trailed the pack after prior strong runs.

● MSFT +4.19% and BRK.B +1.94% were solid but not extreme, leaving breadth inside the Top-10 robust rather than one-sided.

♘ S&P 500’s Tier-Weighted: Rank & Weight Changes

Overview: Shifts leaned into large tech & growth cyclicals moving up from the Mid-90. Some mature industrial and health names slipped into the Bott-403.

● Participation widened as more growth and cyclical names picked up weight, hinting at a more durable advance if macro conditions hold.

| Scenario | Probability | Evidence (Weekly-Based, conditional) |

|---|---|---|

| 45% | If long yields stay tame, dollar stays softer, and equity volatility remains low, then SPX can edge higher next week. | |

| 30% | If rates and dollar move little while sector leadership rotates, then SPX likely chops inside a tight range. | |

| 25% | If equity volatility bounces from extremes or long yields jump, then profit-taking could drive a modest pullback. |

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.