♗ Weekly Recap

● WTD Overview: Risk-off: SPX slipped −1.95% as growth, small caps, and global stocks trailed and leadership narrowed. Flows favored bonds and cash left crypto while defensives led, the dollar firmed, and volatility jumped.

Key Takeaway: Risk-off holds unless long-end yields stay calm, the dollar cools, and volatility retreats to a quieter range.

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series (ici.org)

● Week ended Nov 12, 2025: equity mutual funds shed −$23.06B while bond funds drew +$1.65B, both close to trend. ICI

● Equity and bond ETFs added +$41.47B; combined mutual fund and ETF flows were +$19.06B as money funds slipped −$15.74B. ICI

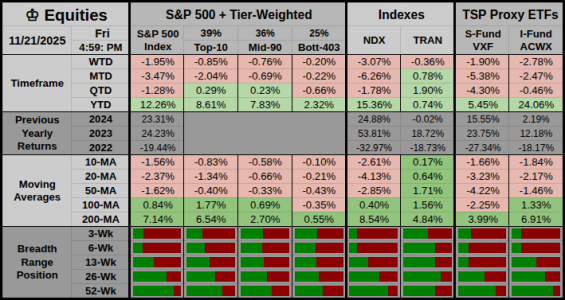

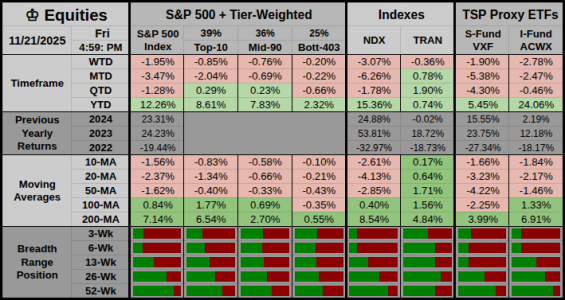

♔ Equities

WTD Overview: Risk-off: SPX fell −1.95% as NDX dropped −3.07% and ACWX slid −2.78% while Mid-90 and Bott-403 cushioned the drop.

● Key Takeaway: With mega-cap growth soft and global stocks heavy, bulls need calmer volatility and steadier rates before dip-buying regains control.

Leaders & Relative Holds

● Risk Bias: Risk-off. Top-10 underperformed SPX mildly while mid- and lower-tier names cushioned some of the downside.

● Breadth: Participation narrowed; tech and high-duration growth led the slide while small caps and global ex-US took a clear hit.

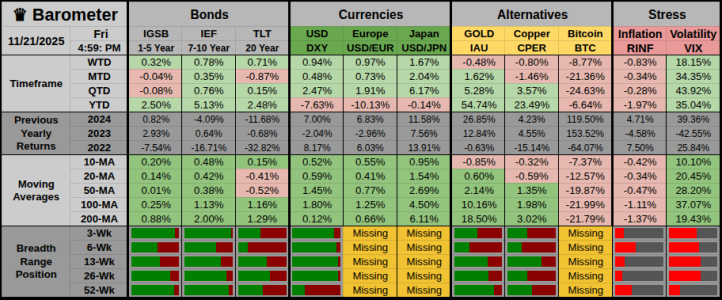

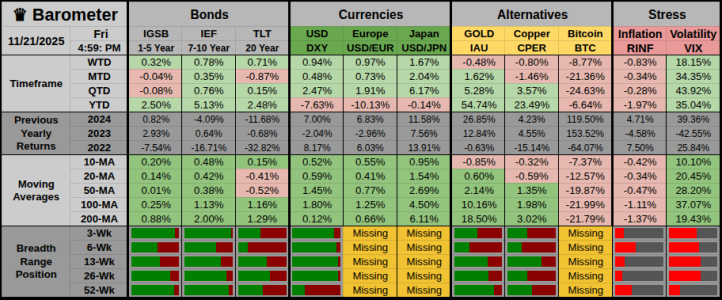

♛ Barometer

WTD Overview: IGSB, IEF, and TLT rose on lower yields as DXY gained +0.94%. Gold and copper eased, BTC sank −8.74%, and VIX spiked +18.15%.

Key Takeaway: Rates and the dollar flashed risk-off while volatility jumped; conviction improves only if yields stay tame and vol backs off.

Key Takeaway: Rates and the dollar flashed risk-off while volatility jumped; conviction improves only if yields stay tame and vol backs off.

Hedges & Risk Bias

● Risk Bias: Risk-off. The curve rallied across tenors, gold lagged industrial metals, and inflation expectations slipped with RINF down −0.83%.

● Breadth: Safety trades were broad, cyclic proxies were weak, and participation tilted toward defense over offense.

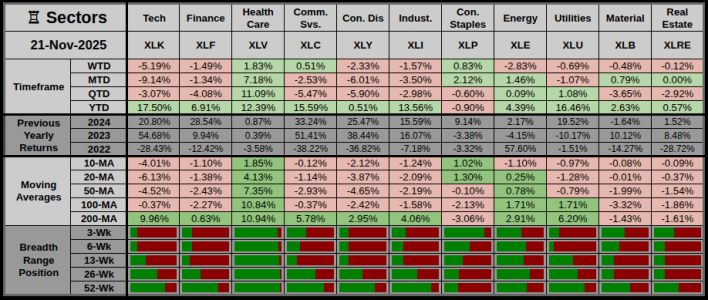

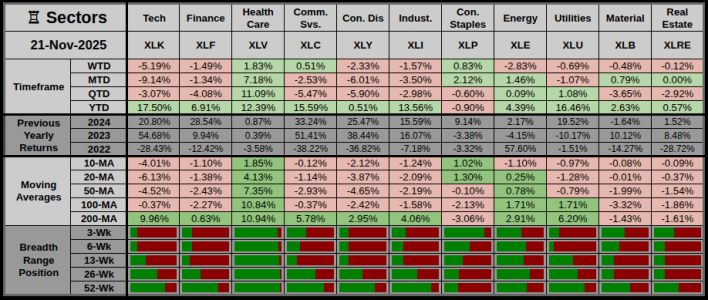

♖ Sectors & Rotation

Weekly Sector Overview: Defensives led: XLV gained +1.83% and XLP rose +0.83% while XLK sank −5.19% and XLE fell −2.83%.

• Key Takeaway: Defensives over cyclicals and a weak tech tape keep the bias cautious unless growth sectors can stabilize and reengage.

Offensive Assets

● Top WTD gainers: XLV +1.83%, XLP +0.83% as health care and staples drew steady demand.

● Breadth/outperformance: Cyclicals lagged SPX; participation favored stable earners over high-duration growth and energy.

Defensive Assets

● Standout defense: XLU slipped only −0.69% and XLRE eased −0.12% as yield-sensitive groups held better than tech.

● Safety tone or drag: Defensives led; leadership was narrow, and energy plus tech weakness capped overall risk appetite.

4-6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Contraction — Why: defensives led; trend mixed; breadth shows a late tilt.

● ● Alternate: Late — Why: leadership narrow; trend weakening; breadth late tilt.

● ● ● Confidence: High, as Time, Trend, and Breadth lenses all cluster near the same Late/Contraction mix.

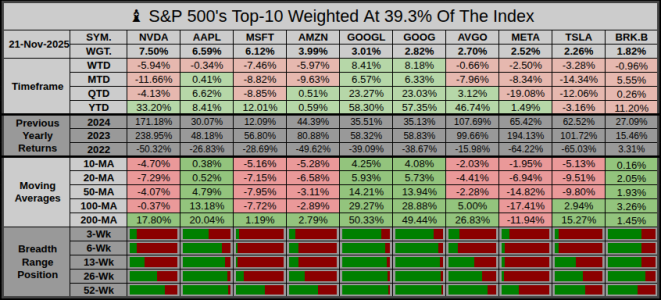

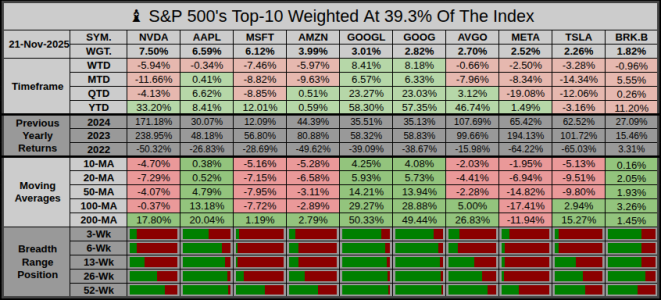

♗ S&P 500’s Weighted Top-10

Overview: Mixed: only Alphabet stood out as GOOGL jumped +8.41% and GOOG rose +8.18% while most peers finished red.

● Key Takeaway: Leadership stayed highly concentrated in search; weakness in semis and cloud keeps index gains fragile.

Offensive Leaders

● Winners: GOOGL +8.41%, GOOG +8.18% on resilient ad and AI narratives despite a softer tape.

● Secondary: BRK.B slipped only −0.96%, offering a modest ballast inside the Top-10.

Defensive Laggards

● Biggest decliners: MSFT −7.46%, NVDA −5.94%, AMZN −5.97%.

● Search strength versus broad mega-cap weakness signals narrow leadership and raises the risk of further de-risking in growth.

Next Week’s Projection

Next Week’s Projection

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

● WTD Overview: Risk-off: SPX slipped −1.95% as growth, small caps, and global stocks trailed and leadership narrowed. Flows favored bonds and cash left crypto while defensives led, the dollar firmed, and volatility jumped.

Key Takeaway: Risk-off holds unless long-end yields stay calm, the dollar cools, and volatility retreats to a quieter range.

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series (ici.org)

| Box | Category | Weekly Flow | 4-wk Median Read | Risk Tone |

|---|---|---|---|---|

| Equity mutual funds | −$23.06B | Near | Risk-off/de-risking | |

| Bond mutual funds | +$1.65B | Below | Mixed/neutral | |

| ETFs (net issuance) | +$41.47B | Near | Risk-on/supportive | |

| Combined MF + ETF | +$19.06B | Near | Mixed with ETF tilt | |

| Money market funds | −$15.74B to $7.52T | Near | Risk-on/supportive (cash deploy) |

● Week ended Nov 12, 2025: equity mutual funds shed −$23.06B while bond funds drew +$1.65B, both close to trend. ICI

● Equity and bond ETFs added +$41.47B; combined mutual fund and ETF flows were +$19.06B as money funds slipped −$15.74B. ICI

♔ Equities

WTD Overview: Risk-off: SPX fell −1.95% as NDX dropped −3.07% and ACWX slid −2.78% while Mid-90 and Bott-403 cushioned the drop.

● Key Takeaway: With mega-cap growth soft and global stocks heavy, bulls need calmer volatility and steadier rates before dip-buying regains control.

Leaders & Relative Holds

● Risk Bias: Risk-off. Top-10 underperformed SPX mildly while mid- and lower-tier names cushioned some of the downside.

● Breadth: Participation narrowed; tech and high-duration growth led the slide while small caps and global ex-US took a clear hit.

♛ Barometer

WTD Overview: IGSB, IEF, and TLT rose on lower yields as DXY gained +0.94%. Gold and copper eased, BTC sank −8.74%, and VIX spiked +18.15%.

Hedges & Risk Bias

● Risk Bias: Risk-off. The curve rallied across tenors, gold lagged industrial metals, and inflation expectations slipped with RINF down −0.83%.

● Breadth: Safety trades were broad, cyclic proxies were weak, and participation tilted toward defense over offense.

♖ Sectors & Rotation

Weekly Sector Overview: Defensives led: XLV gained +1.83% and XLP rose +0.83% while XLK sank −5.19% and XLE fell −2.83%.

• Key Takeaway: Defensives over cyclicals and a weak tech tape keep the bias cautious unless growth sectors can stabilize and reengage.

Offensive Assets

● Top WTD gainers: XLV +1.83%, XLP +0.83% as health care and staples drew steady demand.

● Breadth/outperformance: Cyclicals lagged SPX; participation favored stable earners over high-duration growth and energy.

Defensive Assets

● Standout defense: XLU slipped only −0.69% and XLRE eased −0.12% as yield-sensitive groups held better than tech.

● Safety tone or drag: Defensives led; leadership was narrow, and energy plus tech weakness capped overall risk appetite.

4-6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Contraction — Why: defensives led; trend mixed; breadth shows a late tilt.

● ● Alternate: Late — Why: leadership narrow; trend weakening; breadth late tilt.

● ● ● Confidence: High, as Time, Trend, and Breadth lenses all cluster near the same Late/Contraction mix.

| Box | Bias | Probability | Narrative (4–6 Week Horizon) |

|---|---|---|---|

| Up | 7% | If cyclicals reassert and tech steadies, upside follow-through can reopen. | |

| Sideways | 7% | If defensives lead but rates and the dollar just chop, range trading dominates. | |

| Down | 86% | If tech stays weak and volatility stays firm, de-risking and faded rallies stay likely. |

♗ S&P 500’s Weighted Top-10

Overview: Mixed: only Alphabet stood out as GOOGL jumped +8.41% and GOOG rose +8.18% while most peers finished red.

● Key Takeaway: Leadership stayed highly concentrated in search; weakness in semis and cloud keeps index gains fragile.

Offensive Leaders

● Winners: GOOGL +8.41%, GOOG +8.18% on resilient ad and AI narratives despite a softer tape.

● Secondary: BRK.B slipped only −0.96%, offering a modest ballast inside the Top-10.

Defensive Laggards

● Biggest decliners: MSFT −7.46%, NVDA −5.94%, AMZN −5.97%.

● Search strength versus broad mega-cap weakness signals narrow leadership and raises the risk of further de-risking in growth.

| Scenario | Probability | Evidence (Weekly-Based, conditional) |

|---|---|---|

| 25% | If long-end yields stay calm and the dollar eases, then dip-buyers retain control. | |

| 35% | If the dollar stays firm and leadership remains mixed, then the index chops in a range. | |

| 40% | If yields rebound and volatility rises, then a short-term fade becomes likely. |

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

Last edited: