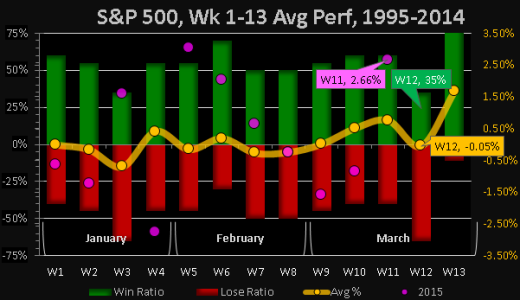

It was an excellent week. For the S&P 500, the third week of March (week 11 of 52) closed up 2.66% this is above the .76% average week 11 returns, is the 5th best week over the past 21 years, and the 8th best over the past 66 years.

___

Contrasting upcoming week 12 against the 52 weeks of the year, from 1995-2014

- We show a 35% winning ratio, which is below average, ranking in a 3-way tie for 49th

- We show -.05% average returns, which is below average, ranking 33rd

- We show 1.67% average positive returns, which is above average, ranking 23rd

- We show -.98% average negative returns, which is above average, ranking 4th

- There is a historical negative bias for week 12, but because the losses aren't too bad, it ranks 25th, of the 52 weeks of the year

___

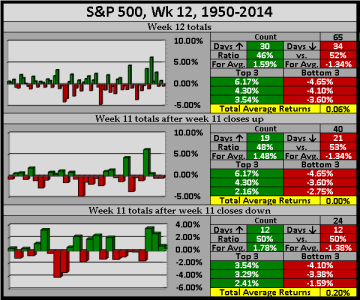

Contrasting upcoming week 12 against an up/down week 11 from 1950-2014

- We show the last 65 week 12s have an average 46% winning ratio with .06% average returns

- For the 40 years when week 11 closed up, week 12 shows a 48% winning ratio with .00% average returns

- For the 24 years when week 11 closed down, week 12 shows a 50% winning ratio with .20% average returns

- Under current conditions, week 12 has a very slight negative bias, but the average gains aren't as bad as the winning ratios

___

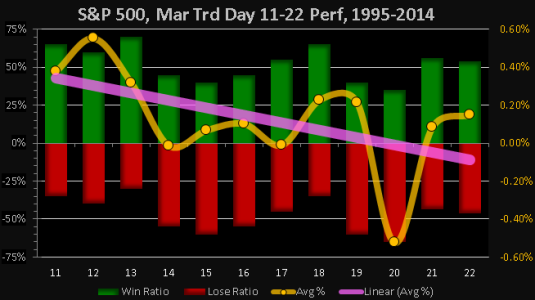

For week 12, we have trading days 16-20

- The average 5-day winning ratio is 48%

- The cumulative 5-day average return is .01%

___

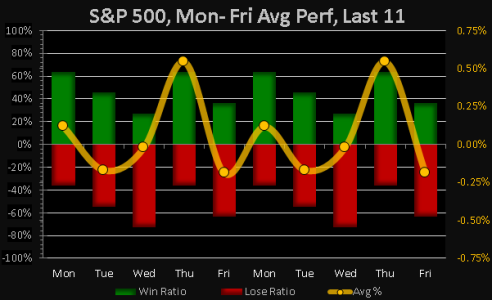

For the last 11 Monday through Fridays

- Last 3 Mondays closed up (2nd best day)

- Last 3 Tuesdays closed down (3rd best day)

- Last 3 of 8 Wednesdays closed up (worst day)

- Last 7 of 11 Thursdays closed up, (best average returns)

- Last 4 of 11 Fridays closed up (2nd worst day)

___

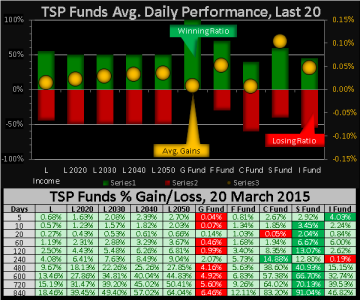

TSP Fund Price Performance over the past 20 days (only discussing the F/C/S/I funds)

- S-Fund ranks 1st with a 60% winning ratio and .10% average returns

- F-Fund ranks 2nd with a 70% winning ratio and .05% average returns

- I -Fund ranks 3rd with a 45% winning ratio and .05% average returns

- C-Fund ranks 4th with a 40% winning ratio and .01% average returns

The I-Fund leads YTD

___

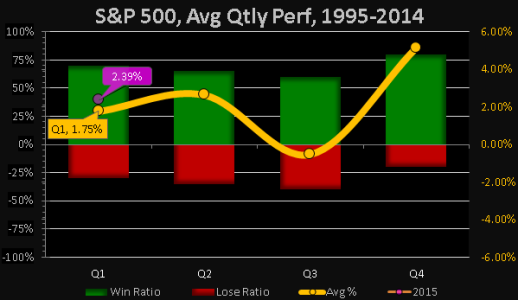

In case you're interested, for 2015's 1st Quarter, we are currently at 2.39% which is just above the 1.75% average returns (over the past 20 years). My expectations for week 12 are for a flat close, so if you have an extra IFT to jump out and back in, then this may be a good time to carve out an edge over the markets. Otherwise, I'll be riding out this wave until I see a valid reason to step aside

Take care…Jason