At least on a relative basis. Citigroup and Apple dragged down the broader market for most of the trading day, but by the close fresh 2-year highs were posted.

In economic data, The Empire State Manufacturing Survey posted an 11.9, which was an improvement.

EU debt offerings continue to be successful, which helped the euro rally against the dollar, which fell approximately 0.6%.

Here's today's charts:

Both NAMO and NYMO remain on buys, but momentum isn't exactly inspiring. Then it may not have to be given how strong the current trend is.

Internals looked decent as both NAHL and NYHL moved higher. They are also flashing buys.

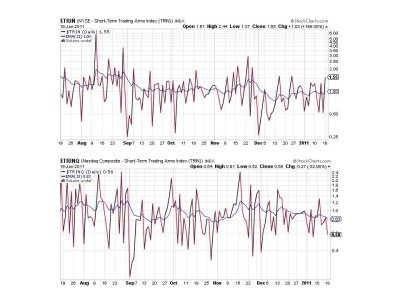

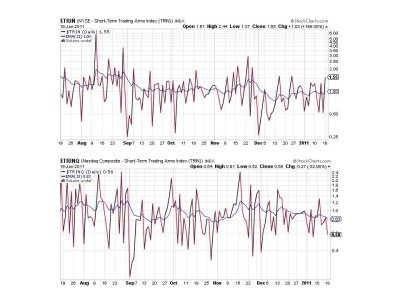

TRIN flipped to a sell today, while TRINQ spiked lower into buy territory.

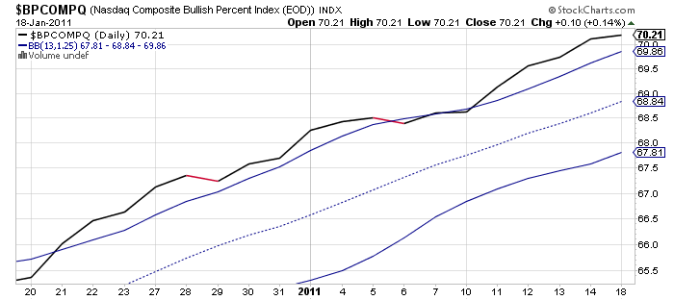

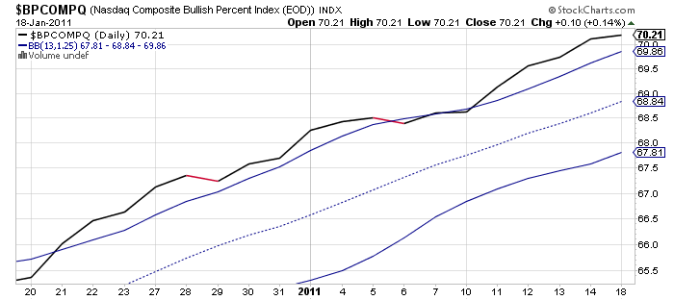

BPCOMPQ ebbed a bit higher today and continues to look bullish. But it is in overbought territory.

So 6 of 7 signals are flashing buys, which keeps the system on a buy. The trend obviously remains up.

In economic data, The Empire State Manufacturing Survey posted an 11.9, which was an improvement.

EU debt offerings continue to be successful, which helped the euro rally against the dollar, which fell approximately 0.6%.

Here's today's charts:

Both NAMO and NYMO remain on buys, but momentum isn't exactly inspiring. Then it may not have to be given how strong the current trend is.

Internals looked decent as both NAHL and NYHL moved higher. They are also flashing buys.

TRIN flipped to a sell today, while TRINQ spiked lower into buy territory.

BPCOMPQ ebbed a bit higher today and continues to look bullish. But it is in overbought territory.

So 6 of 7 signals are flashing buys, which keeps the system on a buy. The trend obviously remains up.