Yes, the market made yet another comeback from some hard selling pressure the previous trading session, but what can we make of it?

There were no major surprises on the economic data front today, but one has to wonder if the market took its cues from that data, or the fact that it was a Monday following a Friday sell-off. In any event, the Seven Sentinels improved in some ways, but weakened in others.

Here's the charts:

NAMO and NYMO managed to get back above their respective 6 day EMAs, which flipped them to a buy.

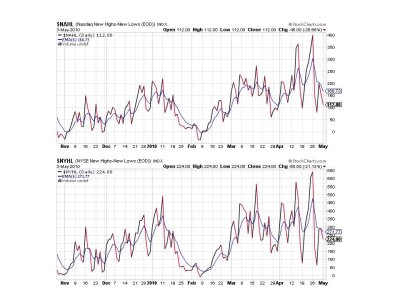

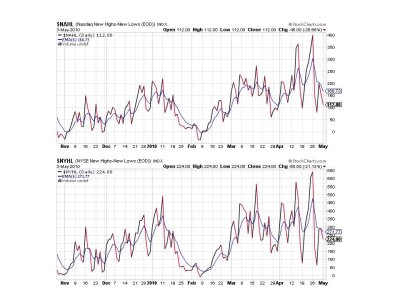

NAHL and NYHL dropped in spite of the rally. Is this a warning that internals are weakening?

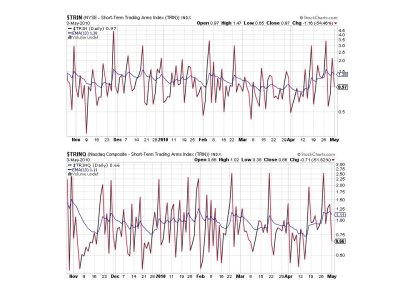

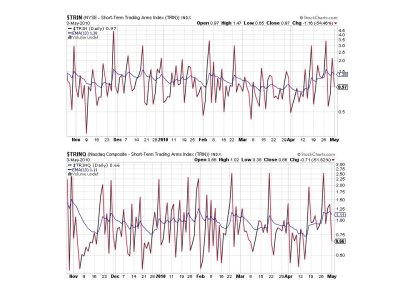

TRIN and TRINQ flipped back to a buy.

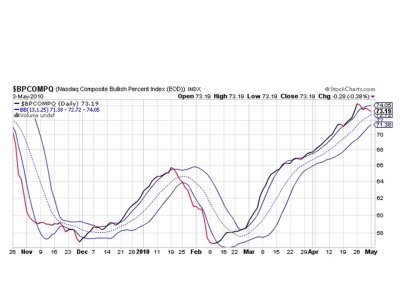

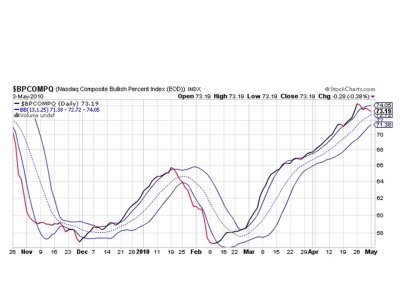

BPCOMPQ crept a bit lower and that has my attention.

So we have 4 of 7 signals on a buy, but the system triggered a sell Friday and we need all seven signals to realign to a buy simultaneously to flip it back to a buy. So we remain on a sell.

The increased volatility of this market can make interpretation of these signals a bit difficult, but it's possible that today's rally may have been a dead cat bounce based on NAHL/NYHL and BPCOMPQ weakening. As you know BPCOMPQ is the most robust of the seven signals, and just like I had to respect that signal's rise in the face of weakness of the other signals, I also have to respect its drop in the face of this rally. It is a trend indicator and anything over 70 on its chart is considered overbought. I had thought until recently that we would see new highs, and we may still do that, but it may not happen until this market corrects, so we have to keep that scenario in mind.

I went to cash today and will remain in cash until the next buy signal is given. That's it for this evening. See you tomorrow.

There were no major surprises on the economic data front today, but one has to wonder if the market took its cues from that data, or the fact that it was a Monday following a Friday sell-off. In any event, the Seven Sentinels improved in some ways, but weakened in others.

Here's the charts:

NAMO and NYMO managed to get back above their respective 6 day EMAs, which flipped them to a buy.

NAHL and NYHL dropped in spite of the rally. Is this a warning that internals are weakening?

TRIN and TRINQ flipped back to a buy.

BPCOMPQ crept a bit lower and that has my attention.

So we have 4 of 7 signals on a buy, but the system triggered a sell Friday and we need all seven signals to realign to a buy simultaneously to flip it back to a buy. So we remain on a sell.

The increased volatility of this market can make interpretation of these signals a bit difficult, but it's possible that today's rally may have been a dead cat bounce based on NAHL/NYHL and BPCOMPQ weakening. As you know BPCOMPQ is the most robust of the seven signals, and just like I had to respect that signal's rise in the face of weakness of the other signals, I also have to respect its drop in the face of this rally. It is a trend indicator and anything over 70 on its chart is considered overbought. I had thought until recently that we would see new highs, and we may still do that, but it may not happen until this market corrects, so we have to keep that scenario in mind.

I went to cash today and will remain in cash until the next buy signal is given. That's it for this evening. See you tomorrow.