It's tough to pin fundamental reasons for the volatility in this market, but media pundits always have ready answers for any given trading day and today was no exception.

A drop in November exports from China was one reason cited for Monday's sell-off. After all, slowing exports in China means possible economic contraction in other countries. Another was "concern" over EU officials being able to build on last week's summit. Funny how that concern shifts from day to day in spite of the plethora of articles and opinion pieces that continually cast doubt over viability of the current euro-based monetary system.

But all those "worries" dragged the market down for sizable losses today, although a late buying spree did take the major averages off their lows of the day.

Volume was quite low in today's trading, which always cast doubt over the conviction of market participants. Along with the low volume trading the dollar spiked higher, which is considered a safety play. As a result, our I fund was hammered much harder than either the C or S funds.

Let's see what the charts show:

NAMO and NYMO moved lower and both flipped back to sells.

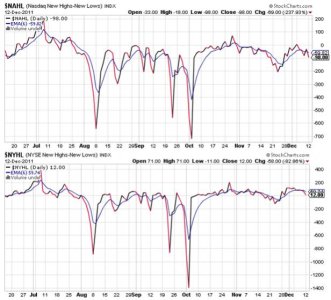

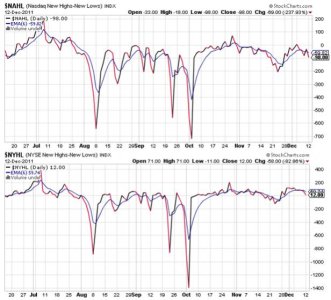

NAHL and NYHL are also on sells.

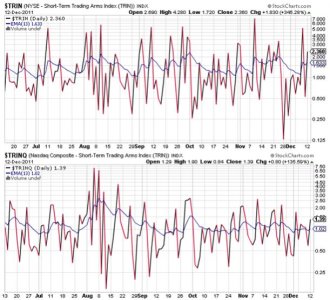

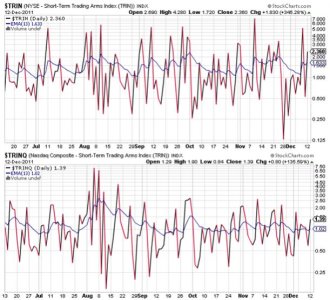

TRIN and TRINQ both moved back to sells as well. Neither indicate an oversold market.

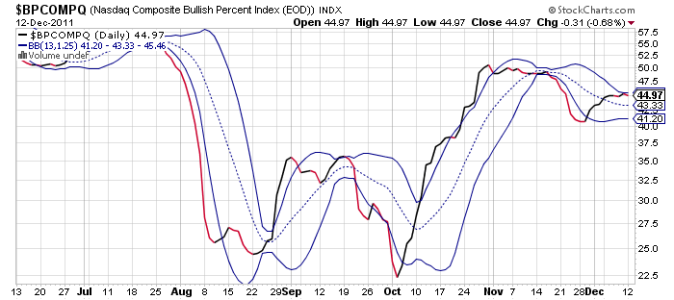

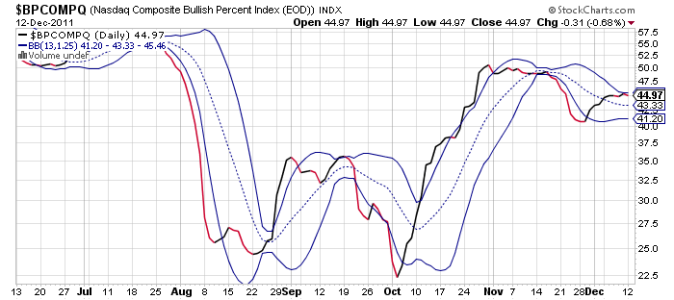

BPCOMPQ dipped back down, but remains firmly in a buy condition.

So the signals are mixed again and that keeps the system in an official sell condition.

I don't see anything particularly telling about the charts. Given this week is OPEX I knew volatility would probably be part the game again, and we're certainly getting that. I also anticipate that the market will continue to have some measure of support going into OPEX, which is why I chose to take a moderate position in the S fund today. The selling pressure may not be over, but I'm not looking for anything dramatic so it seems like a reasonable risk as we make our way to the mid-point of the month. And those three unconfirmed buy signals should still be in play.

A drop in November exports from China was one reason cited for Monday's sell-off. After all, slowing exports in China means possible economic contraction in other countries. Another was "concern" over EU officials being able to build on last week's summit. Funny how that concern shifts from day to day in spite of the plethora of articles and opinion pieces that continually cast doubt over viability of the current euro-based monetary system.

But all those "worries" dragged the market down for sizable losses today, although a late buying spree did take the major averages off their lows of the day.

Volume was quite low in today's trading, which always cast doubt over the conviction of market participants. Along with the low volume trading the dollar spiked higher, which is considered a safety play. As a result, our I fund was hammered much harder than either the C or S funds.

Let's see what the charts show:

NAMO and NYMO moved lower and both flipped back to sells.

NAHL and NYHL are also on sells.

TRIN and TRINQ both moved back to sells as well. Neither indicate an oversold market.

BPCOMPQ dipped back down, but remains firmly in a buy condition.

So the signals are mixed again and that keeps the system in an official sell condition.

I don't see anything particularly telling about the charts. Given this week is OPEX I knew volatility would probably be part the game again, and we're certainly getting that. I also anticipate that the market will continue to have some measure of support going into OPEX, which is why I chose to take a moderate position in the S fund today. The selling pressure may not be over, but I'm not looking for anything dramatic so it seems like a reasonable risk as we make our way to the mid-point of the month. And those three unconfirmed buy signals should still be in play.