Watch these levels...

I've lost track of how many CNBC types have said "I don't think we'll see a double dip." Back in 2007 I'm sure if you asked those same folks if we'd see 666 on the S&P 500 they'd dismiss you as a fool. Truth is nobody can predict the markets consistently and I'll lay money down on that!

I was deployed back in the peak of 2007 so I didn't get to feel the euphoria everyone was going through, but I did join in on the denial as we proceeded to crash though every technical level known to exist. For some of our newer folks not on the forum back then, I can only tell you it's easy to to stand on the tracks as the train runs you over. Case in point, take a look at the 2008 tracker returns where only 8 out of 117 (complete YTD) folks managed to beat the G-fund. I'm not telling you the markets are going to fall apart, I'm just saying they can and you may have no idea it's happening, while it's happening.

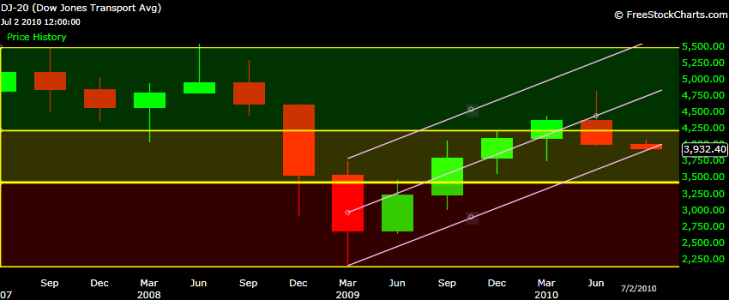

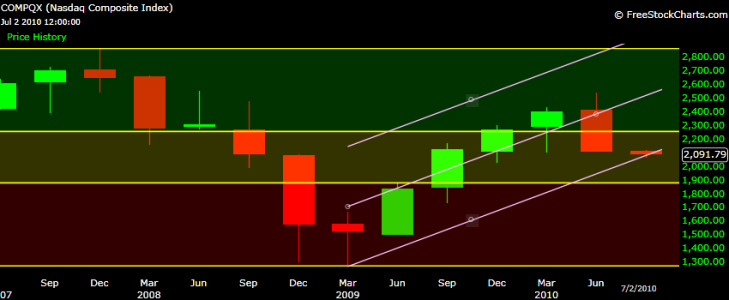

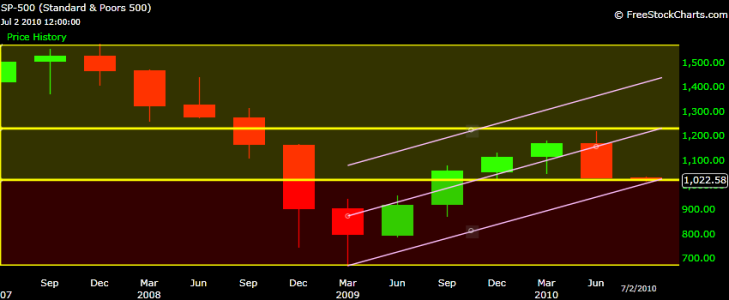

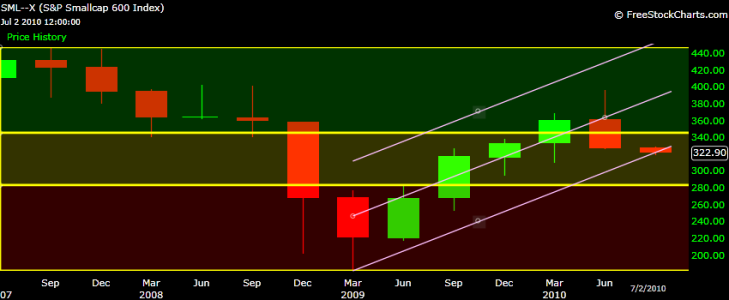

Moving on, using Quarterly charts I've drawn in some Fibonacci color coded boxes, from the Bull 2007 Peak to the Bear 2009 Bottom. The American Indexes are showing us we are in a Neutral condition with a Bearish Bias. Further more I've drawn in Ascending Regression Price Channels, deviating the bottom line to the March 2009 Bottom. These price channels are showing we are oversold and testing critical support. If those channels break, then we may test those red Fibonacci levels below 38.2%. If that happens, then I see no reason why we couldn't entertain a double dip...

I don't like to be the guy whose all doom & gloom, but I do feel it's my duty to pull the fire alarm if I think the markets on fire, so take my warning as you see fit.

Happy Birthday America!!!