Up until late afternoon it looked as though the market was going to sell-off into close, with the S&P tagging 1044.5 as the low of the day, but some late day buying interest came into the market and pushed the S&P back up to a closing price of 1066.19, and on higher than average volume too. That's a pretty sizeable intraday reversal, but it comes on a very obvious end of week timeframe with bullish Monday looming. I can easily see this as a bull trap.

Early and intraday selling interest was attributed to the non-farm payrolls declining 20,000 in January, which was more than estimated. The December nonfarm payrolls was revised lower to show a drop of 150,000 jobs versus the 85,000 previously reported. But I think a lot of folks were scratching their heads when the unemployment rate was revised .3% lower to 9.7%.

Huh? :blink:

All the other fear factors from earlier in the week were still in play as well. So where does that leave the Seven Sentinels? Here's the charts:

The 6 day EMA has dropped considerably, so NAMO came close to crossing it today, but not quite. Still a sell. NYMO on the other hand didn't make much of a move higher, but the 6 day EMA is not far off here either. That one remains on a sell too.

Take particular note of how quickly previous lows at this level reversed last year. Most were "V" shaped. Now were seeing some volatile action which could be interpreted as bottoming action, but I'm not ready to make that call as you shall see below.

NAHL and NYHL showed little improvement today, but at least it held steady.

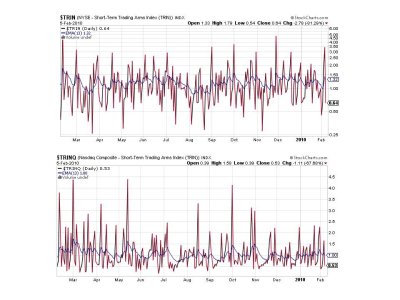

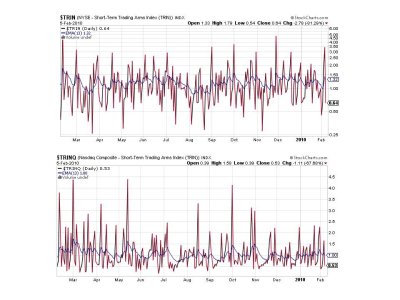

TRIN and TRINQ suggest we see some follow through buying interest on Monday as they flipped to a buy. But these are short term signals.

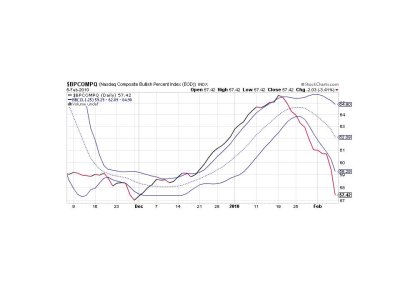

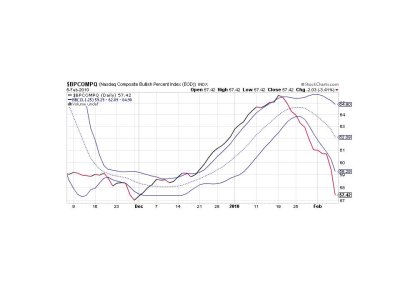

Here's where things get dicey for the bullish case. BPCOMPQ dropped 2 points today. That suggests the "trend" is still down, bounces notwithstanding.

So we have a market that's not bouncing back as quickly as it did in most other declines last year (after the March lows). We see TRIN and TRINQ suggesting more buying interest at least for Monday (whether it holds the day is another matter assuming it happens), and then we have BPCOMPQ showing more weakness. That signal in particular is probably not going to flip over easily at this point and is one of the reasons I think we test the 200 day moving average again. We have to allow for bounces in a downtrend, but bottom-calling is tough. I'm expecting lower prices based on my interpretation of the sentinels however, so I don't think the low is in yet on this correction. But it could come next week.

I'll post my tracker charts later this weekend. See you then.

Early and intraday selling interest was attributed to the non-farm payrolls declining 20,000 in January, which was more than estimated. The December nonfarm payrolls was revised lower to show a drop of 150,000 jobs versus the 85,000 previously reported. But I think a lot of folks were scratching their heads when the unemployment rate was revised .3% lower to 9.7%.

Huh? :blink:

All the other fear factors from earlier in the week were still in play as well. So where does that leave the Seven Sentinels? Here's the charts:

The 6 day EMA has dropped considerably, so NAMO came close to crossing it today, but not quite. Still a sell. NYMO on the other hand didn't make much of a move higher, but the 6 day EMA is not far off here either. That one remains on a sell too.

Take particular note of how quickly previous lows at this level reversed last year. Most were "V" shaped. Now were seeing some volatile action which could be interpreted as bottoming action, but I'm not ready to make that call as you shall see below.

NAHL and NYHL showed little improvement today, but at least it held steady.

TRIN and TRINQ suggest we see some follow through buying interest on Monday as they flipped to a buy. But these are short term signals.

Here's where things get dicey for the bullish case. BPCOMPQ dropped 2 points today. That suggests the "trend" is still down, bounces notwithstanding.

So we have a market that's not bouncing back as quickly as it did in most other declines last year (after the March lows). We see TRIN and TRINQ suggesting more buying interest at least for Monday (whether it holds the day is another matter assuming it happens), and then we have BPCOMPQ showing more weakness. That signal in particular is probably not going to flip over easily at this point and is one of the reasons I think we test the 200 day moving average again. We have to allow for bounces in a downtrend, but bottom-calling is tough. I'm expecting lower prices based on my interpretation of the sentinels however, so I don't think the low is in yet on this correction. But it could come next week.

I'll post my tracker charts later this weekend. See you then.