Volatility is back. After starting the day lower the indicies fought back to positive territory only to begin a decent of moderate to significant losses (depending on the sector) by mid-afternoon. By 2 p.m. an intraday reversal began that helped the S&P close with a nice 0.45% gain, while the broader market (Wilshire 4500) had a moderate loss of -0.47%. The Nasdaq closed just under flat for the day at -0.05%, while the DOW saw the best returns posting a 0.67% gain. So large caps were the favored sectored today with even the financials posting a 1.1% gain, and that was the sector that caused all the angst on Friday.

So is the uptrend about to resume? I'm not so sure just yet, but admittedly this is a strong bull market. I think sentiment may swing too quickly after today's seemingly successful "buy the dip" trading today and that could easily contribute to more volatility. I would not be surprised by another shot lower here some time this week just to keep the bulls honest and keep as many traders on the sidelines as possible.

And what about the Seven Sentinels? Here they are:

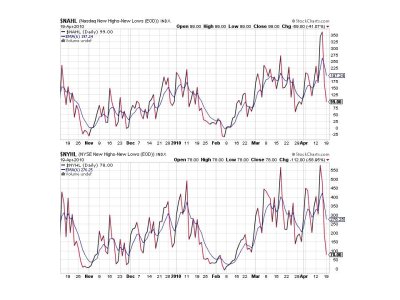

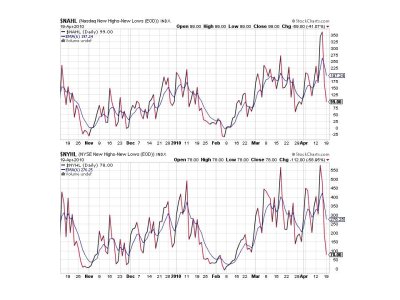

NAMO and NYMO moved a bit lower today and are in negative territory. They weren't that high to begin with last week, so I'm not sure how much downside action we could see with these two signals.

With large caps getting the lion's share of the gains today, it's not surprising to see these two signals drop lower today.

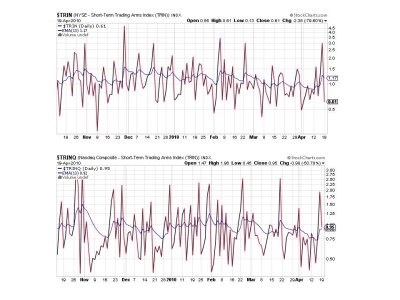

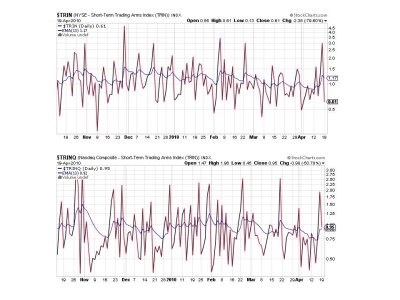

TRIN flipped to a buy, while TRINQ remained on a sell, but close to crossing back over the 6 day EMA and triggering a buy.

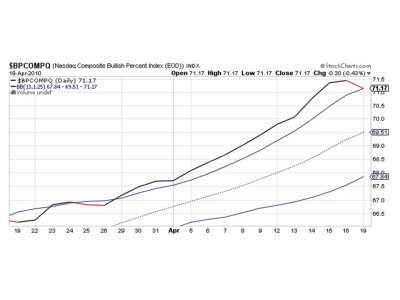

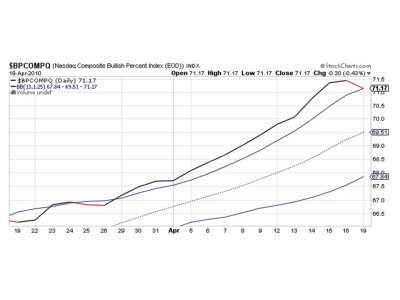

BPCOMPQ is sitting right on the upper bollinger band. I'll consider this a buy until it decisively breaks through that bollinger band.

So we have 5 of 7 signals on a sell, but BPCOMPQ can roll over with any further weakness now and TRIN could flip back to a sell with it. We are walking a fine line here and this market could go either way. I'm still 50/50 GS and looking for an entry with two weeks to go until May. I don't want to be on the sidelines with no IFTs for that long so I'm willing to ride some volatility should we move lower. I'm not of the opinion that further weakness will be severe so I don't want to overreact given our very limited trading restrictions.

That's it this evening, see you tomorrow.

So is the uptrend about to resume? I'm not so sure just yet, but admittedly this is a strong bull market. I think sentiment may swing too quickly after today's seemingly successful "buy the dip" trading today and that could easily contribute to more volatility. I would not be surprised by another shot lower here some time this week just to keep the bulls honest and keep as many traders on the sidelines as possible.

And what about the Seven Sentinels? Here they are:

NAMO and NYMO moved a bit lower today and are in negative territory. They weren't that high to begin with last week, so I'm not sure how much downside action we could see with these two signals.

With large caps getting the lion's share of the gains today, it's not surprising to see these two signals drop lower today.

TRIN flipped to a buy, while TRINQ remained on a sell, but close to crossing back over the 6 day EMA and triggering a buy.

BPCOMPQ is sitting right on the upper bollinger band. I'll consider this a buy until it decisively breaks through that bollinger band.

So we have 5 of 7 signals on a sell, but BPCOMPQ can roll over with any further weakness now and TRIN could flip back to a sell with it. We are walking a fine line here and this market could go either way. I'm still 50/50 GS and looking for an entry with two weeks to go until May. I don't want to be on the sidelines with no IFTs for that long so I'm willing to ride some volatility should we move lower. I'm not of the opinion that further weakness will be severe so I don't want to overreact given our very limited trading restrictions.

That's it this evening, see you tomorrow.