I've been traveling most of the day today so I didn't have an opportunity to watch the markets much. But after reviewing the trading session I don't think I missed anything. There was little to drive trading today aside from more earnings reports, but the big story (or perhaps lack thereof) is the continuing debt ceiling talks, which aren't looking too promising. And that is keeping a lid of sorts on this market. So let's look at the charts:

NAMO and NYMO fell back below the neutral line today and flipped to sells in the process.

Same for NAHL and NYHL. Two more sells.

TRIN and TRINQ both remain on buys, but we can see TRINQ worked off that extremely bullish reading after today's moderate sell-off. Both are fairly neutral now.

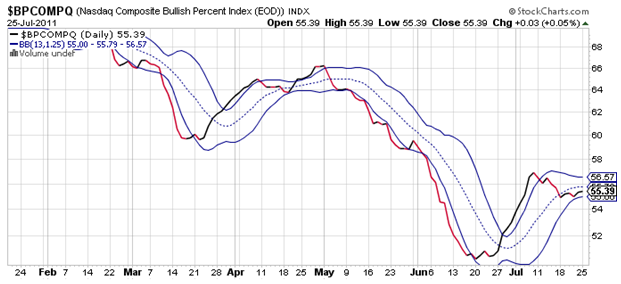

BPCOMPQ ticked a bit sideways and remains in a sell condition.

So 5 of 7 signals are back to sells, but the system still remains in a buy condition. Remember, we did have an unconfirmed sell signal last Monday. It doesn't mean a whole lot, but it could turn out to be a warning.

But this market environment is not typical, so I'm not sure how much analysis I can really do given this is a news driven market. So I'll just take the signals at face value and do my best to use sentiment as a backup indicator.

That's it for this evening as there's only so much that can be gleaned from this market while we wait on our elected officials to come to some sort of resolution on that debt ceiling.