It wasn't exactly a gap and go day like the last two trading days, but the major averages managed to end the day in positive territory for a third straight day. That's actually not surprising because when the smart money piles in many traders don't ask questions and jump simply based on who's doing the buying and in what amounts. POMO doesn't hurt either.

And it's quite obvious what matters most to the bulls because today's data points certainly weren't the reason for another follow-through day to the upside.

Nonfarm payrolls were up a mere 39,000, which was well below estimates. Private payrolls were up 50,000; again well below estimates. And the unemployment rate moved higher to 9.8%.

As if that wasn't enough depressing news, the percentage of people unemployed 27 weeks or longer moved up to 41.9% from 41.8%, while the "real" unemployment rate," remained at 17.0%.

Finally, the November Consumer Confidence Index managed to jump to 54.1 from 49.9.

But most traders care not about fundamentals. It's really all about price and right now price is moving back up.

The Sentinels have all been flashing buys as of yesterday, and if you're so inclined and more of a risk taker, you may want to act on that. But NYMO has still not confirmed this rally. Let's take a look.

Still on buys here for both signals and we can see that NYMO is now at 14.59, but it needs to go above 36.6 before I can technically call this buy signal valid.

NAHL and NYHL also remain on buys.

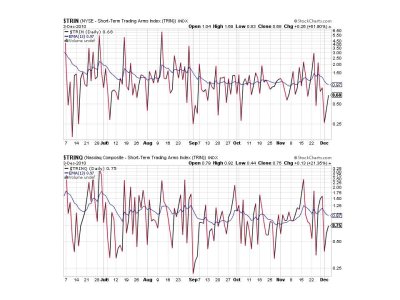

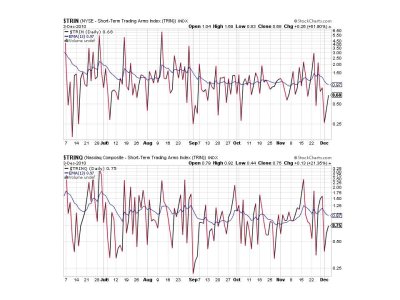

Same with TRIN and TRINQ, which are working off their overbought levels.

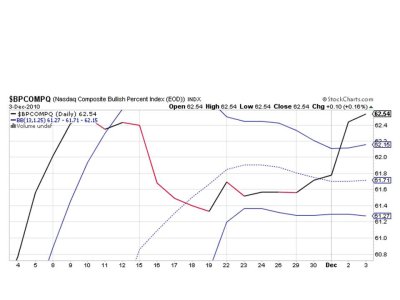

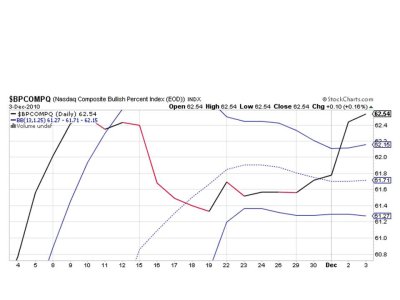

BPCOMPQ ticked a bit higher today.

So all signals remain on buys and as I said you may want to act on that, especially given our sentiment survey remained on a buy for next week. But technically I need NYMO to confirm the signal by driving past its 28 day trading high, and that has not yet occurred. So if you're risk averse like me, you may want to hold off buying this market.

Sentiment in general is bullish across numerous surveys and that troubles me. It is also one of the reasons I'm not in a hurry to jump in.

See you later weekend when I post the tracker charts. I've got a birthday cake to eat. :nuts:

And it's quite obvious what matters most to the bulls because today's data points certainly weren't the reason for another follow-through day to the upside.

Nonfarm payrolls were up a mere 39,000, which was well below estimates. Private payrolls were up 50,000; again well below estimates. And the unemployment rate moved higher to 9.8%.

As if that wasn't enough depressing news, the percentage of people unemployed 27 weeks or longer moved up to 41.9% from 41.8%, while the "real" unemployment rate," remained at 17.0%.

Finally, the November Consumer Confidence Index managed to jump to 54.1 from 49.9.

But most traders care not about fundamentals. It's really all about price and right now price is moving back up.

The Sentinels have all been flashing buys as of yesterday, and if you're so inclined and more of a risk taker, you may want to act on that. But NYMO has still not confirmed this rally. Let's take a look.

Still on buys here for both signals and we can see that NYMO is now at 14.59, but it needs to go above 36.6 before I can technically call this buy signal valid.

NAHL and NYHL also remain on buys.

Same with TRIN and TRINQ, which are working off their overbought levels.

BPCOMPQ ticked a bit higher today.

So all signals remain on buys and as I said you may want to act on that, especially given our sentiment survey remained on a buy for next week. But technically I need NYMO to confirm the signal by driving past its 28 day trading high, and that has not yet occurred. So if you're risk averse like me, you may want to hold off buying this market.

Sentiment in general is bullish across numerous surveys and that troubles me. It is also one of the reasons I'm not in a hurry to jump in.

See you later weekend when I post the tracker charts. I've got a birthday cake to eat. :nuts: