Seasonality is known to be historically weak once June arrives. And the S&P hit its top on May 22nd. So should it come as a surprise that price is struggling? Perhaps not. But the big question on most traders and investors minds is whether this bull market can weather negative seasonality without a major correction. To be sure, this market remains vulnerable. And we'll look at some index charts in a moment, but first let's take a look at the weekly autotracker positions.

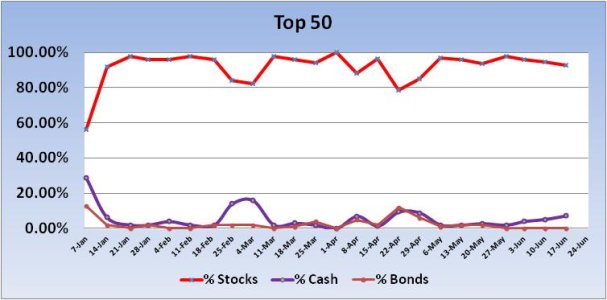

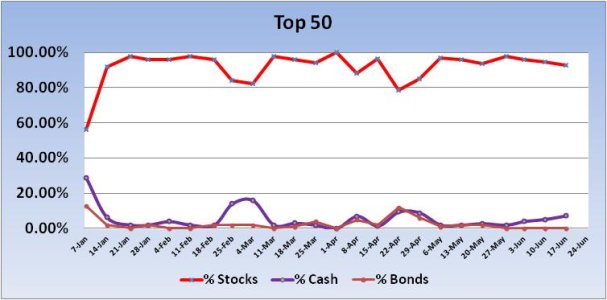

There was little change in the Top 50. Stock allocations dipped by 1.98% from 94.66% last week to 92.68% this week. This group remains firmly on the long side.

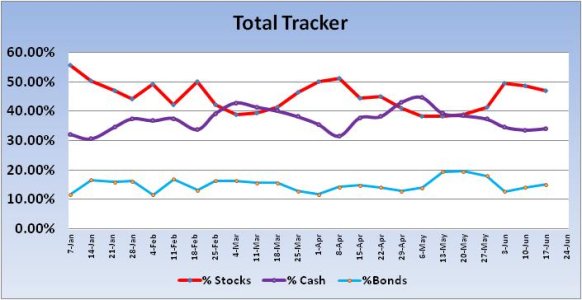

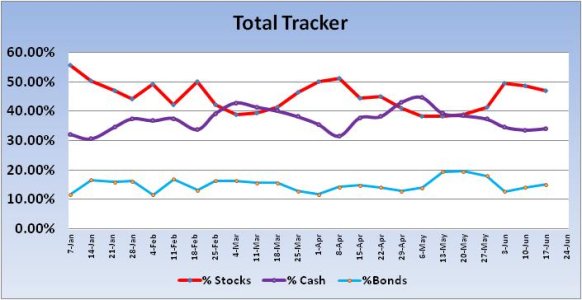

The Total Tracker was also little changed this week as stock allocation dipped by 1.65% to a total allocation of 46.93%. As long as that number remains below 50%, I view it as a positive for the longer term bull.

After peaking on May 22nd, the S&P has largely traded down, but that lower trend line remains unbroken and price remains above the 50 dma. But it's not a lock that price won't close below that line at some point given weak seasonality. RSI is largely neutral, while MACD is modestly weak but appears to be trying to turn higher.

After getting hammered since early May, AGG, one of the largest ETFs around (similar to our F fund), is showing life after that big rally on Thursday, followed by a bit more upside action on Friday. RSI is still negative, but rising, as is MACD. I really think yields need to drop or at least not continue to rise if stocks are to regain their upside footing.

The EFA, which is very similar to our I fund, is the index under the most pressure as far as stocks go. Price has fallen and remained below that lower trend line long enough to be wary of more downside. I suspect that the Asian markets have had the most to do with this indexes struggles; especially Japan's Nikkei average, which has seen some serious sell offs recently. Price has also been below the 50 dma for more than 2 weeks. RSI is negative as is MACD.

Thursday's rally helped turn some technical indicators back up as the action was getting a bit bearish earlier in the week, and then of course Friday gave back a portion of those gains. This market is not out of the woods yet, but I have to continue to give the bull some room as we've seen this market come roaring back many times in the past. Seasonality is negative and that may continue to contribute to the volatility. I am encouraged by the recent action in the bond market as I'd really like to see yields stabilize. This week is also an OPEX quadruple witching week, which I would expect would be supportive of price. And we also have a FOMC meeting this week. No doubt that will be very carefully watched and weighed by market participants when the announcement comes Wednesday. As a side note, liquidity remains in expansion, although its level has fallen off the past couple of weeks. As long as it remains in expansion it will remain a positive for the bulls.

So I'm expecting more volatility, but I'm optimistic price will remain supported to some extent this week. There were no signals triggered by the autotracker this week, but our sentiment survey came in at 36% bulls vs 55% bears and that's another plus for the bulls.

There was little change in the Top 50. Stock allocations dipped by 1.98% from 94.66% last week to 92.68% this week. This group remains firmly on the long side.

The Total Tracker was also little changed this week as stock allocation dipped by 1.65% to a total allocation of 46.93%. As long as that number remains below 50%, I view it as a positive for the longer term bull.

After peaking on May 22nd, the S&P has largely traded down, but that lower trend line remains unbroken and price remains above the 50 dma. But it's not a lock that price won't close below that line at some point given weak seasonality. RSI is largely neutral, while MACD is modestly weak but appears to be trying to turn higher.

After getting hammered since early May, AGG, one of the largest ETFs around (similar to our F fund), is showing life after that big rally on Thursday, followed by a bit more upside action on Friday. RSI is still negative, but rising, as is MACD. I really think yields need to drop or at least not continue to rise if stocks are to regain their upside footing.

The EFA, which is very similar to our I fund, is the index under the most pressure as far as stocks go. Price has fallen and remained below that lower trend line long enough to be wary of more downside. I suspect that the Asian markets have had the most to do with this indexes struggles; especially Japan's Nikkei average, which has seen some serious sell offs recently. Price has also been below the 50 dma for more than 2 weeks. RSI is negative as is MACD.

Thursday's rally helped turn some technical indicators back up as the action was getting a bit bearish earlier in the week, and then of course Friday gave back a portion of those gains. This market is not out of the woods yet, but I have to continue to give the bull some room as we've seen this market come roaring back many times in the past. Seasonality is negative and that may continue to contribute to the volatility. I am encouraged by the recent action in the bond market as I'd really like to see yields stabilize. This week is also an OPEX quadruple witching week, which I would expect would be supportive of price. And we also have a FOMC meeting this week. No doubt that will be very carefully watched and weighed by market participants when the announcement comes Wednesday. As a side note, liquidity remains in expansion, although its level has fallen off the past couple of weeks. As long as it remains in expansion it will remain a positive for the bulls.

So I'm expecting more volatility, but I'm optimistic price will remain supported to some extent this week. There were no signals triggered by the autotracker this week, but our sentiment survey came in at 36% bulls vs 55% bears and that's another plus for the bulls.