-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

userque's Account talk

- Thread starter userque

- Start date

burrocrat

TSP Talk Royalty

- Reaction score

- 162

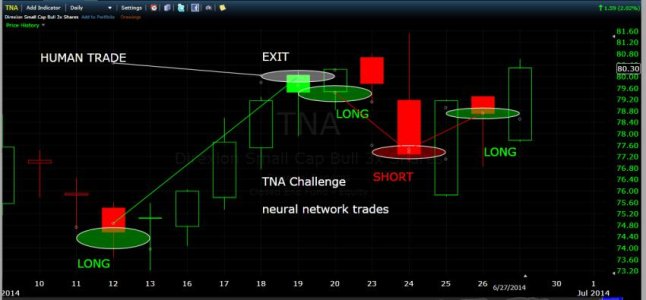

TNA Challenge Results for 27 JUN 2014!

View attachment 29283

burrocrat and his recent trades will appear on the tally next week!

oh goody, i can't hardly wait until monday to see how hard i got kicked on today.

probably pee'd away about $200, plus the $5 for user's paypal account.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

user and ebb may not realize it yet, but i am actually providing a valuable prooftesting control group service here. of course they can compare their well thought-out and complex trading strategeries against each other and the market, but with me in the game now they can also compare their performance versus how well a monkey flinging poo at a wall randomly painted with the words 'long' 'cash' and 'short' on it can do.

userque

TSP Legend

- Reaction score

- 36

user and ebb may not realize it yet, but i am actually providing a valuable prooftesting control group service here. of course they can compare their well thought-out and complex trading strategeries against each other and the market, but with me in the game now they can also compare their performance versus how well a monkey flinging poo at a wall randomly painted with the words 'long' 'cash' and 'short' on it can do.

Hey, you never know. The Random Walker, Sr. trader trades based on the NY Numbers Lottery game: >500, midday drawing=LONG, else SHORT. Look how well it's doing. Those Random traders were the original control group.

userque

TSP Legend

- Reaction score

- 36

Somehow went LONG when system said SHORT for next week. Was hurrying yesterday.

Anyway, I'll let the mis-trade stand even though the market doesn't open for a couple of days.

However, I'll let the freestockcharts I post reflect the true intent of the system.

Also, I went to G in real TSP (from a recent move to F-fund), forgot to update tracker. I'll see how that mistake plays out next trading morning before I act on that one.

Anyway, I'll let the mis-trade stand even though the market doesn't open for a couple of days.

However, I'll let the freestockcharts I post reflect the true intent of the system.

Also, I went to G in real TSP (from a recent move to F-fund), forgot to update tracker. I'll see how that mistake plays out next trading morning before I act on that one.

Last edited:

userque

TSP Legend

- Reaction score

- 36

Dear Diary,

Been a busy weekend.

Made NN much more efficient (faster) by many factors. Ran it to the point of extremely diminishing returns: this 'smarter' NN likes my current, LONG position. I also added more optimization data to the NN. It now back-tests itself to May 2013.

Even though the new NN likes the LONG position right now, the stock charts I post will continue to reflect the conclusion reached by the now retired, less smart NN. Who knows? The market does what it wants to.

While I continue to (slowly) develop a VBA solution, I'll continue to manually add back-testing data to the NN's at a rate of about two months per day or so until I run out of historical data for the W4500 (about 2004 or so), or finish the automated solution. This means that I must suspend adding back-testing data to the NUGT/DUST NN and make educating the W4500 NN the priority.

Built some NN's and ran some tests regarding trading the open. Learned some things, but for a few reasons, systemically trading the open is not feasible for me to do right now, but that option is available in the TNA Challenge.

Been a busy weekend.

Made NN much more efficient (faster) by many factors. Ran it to the point of extremely diminishing returns: this 'smarter' NN likes my current, LONG position. I also added more optimization data to the NN. It now back-tests itself to May 2013.

Even though the new NN likes the LONG position right now, the stock charts I post will continue to reflect the conclusion reached by the now retired, less smart NN. Who knows? The market does what it wants to.

While I continue to (slowly) develop a VBA solution, I'll continue to manually add back-testing data to the NN's at a rate of about two months per day or so until I run out of historical data for the W4500 (about 2004 or so), or finish the automated solution. This means that I must suspend adding back-testing data to the NUGT/DUST NN and make educating the W4500 NN the priority.

Built some NN's and ran some tests regarding trading the open. Learned some things, but for a few reasons, systemically trading the open is not feasible for me to do right now, but that option is available in the TNA Challenge.

userque

TSP Legend

- Reaction score

- 36

Not to be negative, but I would bet you'll give it up before Kwanzaa arrives.

lol kwanzaa...

give what up, exactly

userque

TSP Legend

- Reaction score

- 36

TNA Trading Challenge has moved to The Lounge:

http://www.tsptalk.com/mb/lounge/20697-tna-trading-challenge.html

http://www.tsptalk.com/mb/lounge/20697-tna-trading-challenge.html

userque

TSP Legend

- Reaction score

- 36

Overfitting

Several days ago, I discovered evidence that my NN's may be overfitting (Overfitting - Wikipedia, the free encyclopedia). Simply, that is when a machine learning system resorts to 'memorizing' it's training data rather than 'figuring out' general 'rules' whereby it can predict future, unknown values.

After the discovery, I decommissioned the TSP NN and overhauled the S-Fund NN. I tested various new iterations of the S-Fund model and happily settled on a 'dumbed down' model that actually utilizes the full capacity of the Excel Solver (200 variables). The previous versions used around 60 variables but applied complex algorithms to achieve a trading solution. The new version uses many more variables, but they are extremely constrained. My tests show that this latest model will not over-fit to the historical trading data.

It took a few days of thought experiments (Thought experiment - Wikipedia, the free encyclopedia) to figure out how to apply the same technique to the TSP model. I solved that problem only yesterday. (Too late, unfortunately. I would've been in the F-fund had I sorted things before July and before IFT'ing to the S-fund based on an old TSP model.) The new and improved TSP NN has been recommissioned.

The newer models forecast one day ahead. (I could make a new NN for each day ahead (one for 2 days, another for 3 days, etc.), but I would only need them when I've traded without using the original NN, and then would need to know whether to stay in the bad trade or bail. Plus, I would have to keep them updated and maintained. Work.

Instead, I enhance that older TSP model I mentioned because it forecasts local highs and lows several days into the future.

We'll see how it goes.

UPDATE: I also wanted to mention that I found more ways to increase the speed of the Solver. In addition to those new 'ways,' and even though more variables are now utilized, the variables are SO constrained, that the Solver runs faster than before even without the previously mentioned speed increases. An exponential whammy.

Last edited:

userque

TSP Legend

- Reaction score

- 36

Trading the Open

When I previously looked into trading the Open, it was with the understanding that I would be trading the Open as well as the Close. I had an epiphany: what about trading the Open instead of the Close. This will only require a simple modification to the NN to test this out. Should know the effectiveness of such a change by next week.

Regarding everything else, nothing new to report (that I can remember right now). It's all good.

userque

TSP Legend

- Reaction score

- 36

Forgot to Mention

The NN is based upon the W4500. I use it to trade the TNA. It works because there is a "good" correlation between the two. However, once I automate the pre-processing of the data the NN needs, I would actually build the NN based on the instrument it will be used to trade! In other words, The TNA trades will become even more accurate as they will be based upon the Russell 2000 itself and not the W4500, and I will be able to build a similar NN to trade anything else, in short order.

userque

TSP Legend

- Reaction score

- 36

Trading the Open

When I previously looked into trading the Open, it was with the understanding that I would be trading the Open as well as the Close. I had an epiphany: what about trading the Open instead of the Close. This will only require a simple modification to the NN to test this out. Should know the effectiveness of such a change by next week.

Regarding everything else, nothing new to report (that I can remember right now). It's all good.

Trading the Open wouldn't work as well. The NN was able to predict the Open as well as it does the Close, but the volatility of the open makes trading it more risky as I would be less likely to actually fill the trade at the price the NN expects. I guess I could do a market-at-open order, and use the futures to give the NN a good guess as to what the Opening price will be, but that's more work than simply trading the close.

userque

TSP Legend

- Reaction score

- 36

Neural Network - Fluctuating Output

When I am testing or otherwise working on the NN, it can't be used to find a trading solution. Today I ran it for only about an hour before the close I was to trade.

It stores it's previous "best" solution and will use that until it finds a "better" one. Under normal circumstances, when I wouldn't be adding two months or so of historical data to it daily, there would likely be little change in its solutions on a day to day basis. But now, during this development stage, waffling is more likely, but not really probable, in my current opinion.

(Also, each time the NN starts working to find a solution, it starts from scratch. I run it for many hours over the weekend to "lock in" a good solution. Running it daily for a several hours or more helps to account for the new history I've added to it [daily] and, of course, for the current trading day's data.)

Waffling is what I call the act of the NN forecasting the next day as: Long, then shortly finding a better solution and calling the next day Short. The NN actually predicts all the days it has history for, not just the next trading day. I am able to notice by looking at the NN internally, that most of the days are stable.

My theory is that waffling days are days that will likely be "small movement" days, OR, days that have a "pattern" that the NN hasn't seen much of, in the history it has; and is exacerbated by my adding additional historical data to the initial network. But, if the cause is an unfamiliar pattern, then the forecasted day may not be "restricted" to being a small movement day!

All that to say: as I continue running the NN right now, tomorrow has been waffling. I am considering indicating the "waffleness" associated with forecasts, as well as the frequency (NN's familiarity) of the pattern associated with forecast.

userque

TSP Legend

- Reaction score

- 36

Neural Network - Fluctuating Output II

Well, after the NN has been improving the network slightly at least about every half hour or so, it went for over an hour without improvement. I stopped it. I looked at the pattern data I discussed earlier and realized that it had no record of yesterday's pattern in it's historical database (rare). So that explains the fluctuations. It's guess for today's cCose being higher or lower was really (in this type of custom NN) just a pure guess.

In the future, I'll have to check for this sort of thing. When it occurs, I'll likely just hold the current position I'm in. In this particular case for example, I would have remained Long. But, I may go Long at the open, especially if there is a gap-down.

If I go long at the open and the market goes down after the open. I don't mind. I don't mind losing a hand, as long as I played the hand properly.

Neural Network - Fluctuating Output II

Well, after the NN has been improving the network slightly at least about every half hour or so, it went for over an hour without improvement. I stopped it. I looked at the pattern data I discussed earlier and realized that it had no record of yesterday's pattern in it's historical database (rare). So that explains the fluctuations. It's guess for today's cCose being higher or lower was really (in this type of custom NN) just a pure guess.

In the future, I'll have to check for this sort of thing. When it occurs, I'll likely just hold the current position I'm in. In this particular case for example, I would have remained Long. But, I may go Long at the open, especially if there is a gap-down.

If I go long at the open and the market goes down after the open. I don't mind. I don't mind losing a hand, as long as I played the hand properly.

Userque,

After my university training in analysis, logic, and problem solving, for me this is a very interesting intellectual exercise. (Mind you, computer training was not readily available at the time). I find this a new subject which for me is foreign but very interesting. I was not familiar with the concept of neural network and I started to learn a bit from your posts. I surmise that you are using computers and back data to be able to gain as much future predictability in the markets, as possible. I also suppose that your systems are sort of challenging the existing high frequency programs and thus the "professionals" out there would "feel" or "sense" all attempts by competitive programs to penetrate their turf.

In any event, whatever information you are able to share, will help further my understanding of the positive aspects of the applications to stocks and ETFs. More to the point, I see that you have different tests with different names (userque, conservative NN, swing NN, etc; which have different users, such as TSP members with limitations of 2 IFTs per month, as well as ETFs for IRA trading or brokerage accounts). Please clarify which of the systems is the one more suited for TSP members that also have private brokerage accounts or IRAs earned in TSP, but have rolled over to private brokerage account outside the Thrift Savings Plan. Thank you.

BTW, in this post you stated, "I would have remained Long. But, I may go Long at the open, especially if there is a gap-down." What trading vehicle are you referring to, is it TNA and/or TZA? Tia.

userque

TSP Legend

- Reaction score

- 36

Userque,

After my university training in analysis, logic, and problem solving, for me this is a very interesting intellectual exercise. (Mind you, computer training was not readily available at the time). I find this a new subject which for me is foreign but very interesting. I was not familiar with the concept of neural network and I started to learn a bit from your posts. I surmise that you are using computers and back data to be able to gain as much future predictability in the markets, as possible. I also suppose that your systems are sort of challenging the existing high frequency programs and thus the "professionals" out there would "feel" or "sense" all attempts by competitive programs to penetrate their turf.

Thanks airlift. You are correct. But I'm not really ready to go after the real high frequency programs; at least not the ones that trade several time per minute.

In any event, whatever information you are able to share, will help further my understanding of the positive aspects of the applications to stocks and ETFs.

I started via Google searches, of course. Then specialized searches, included limiting results to .edu domains. Etc. One site I hold in high regard concerning Artificial Neural Networks is:

comp.ai.neural-nets FAQ, Part 1 of 7: Introduction

More to the point, I see that you have different tests with different names (userque, conservative NN, swing NN, etc; which have different users, such as TSP members with limitations of 2 IFTs per month, as well as ETFs for IRA trading or brokerage accounts). Please clarify which of the systems is the one more suited for TSP members that also have private brokerage accounts or IRAs earned in TSP, but have rolled over to private brokerage account outside the Thrift Savings Plan. Thank you.

I started out trading and testing under the "userque" trader. (Which is why the number are so poor for me right now.) I then narrowed my testing range, and made separate individual NN's for each strategy, and named them accordingly. I wanted to use them to forward test my different strategies. I then developed what I called my Unified Theory of Trading (or something like that

This made the forward tests obsolete (except for verification), so I discontinued some of my "trader" bots, and the others that are left all trade in lock-step based on the same signals.

I spent most of my time thus far perfecting the base NN...the day/swing trading one. It's the one from which all others are derived. I've recently "finished" the TSP NN. Starting in August, my TSP trades will be fully based upon NN technologies. I'll mirror my trades on the AutoTracker.

I currently don't post its trades, but I've also recently finished a NN optimized to trade within IRA restrictions.

BTW, in this post you stated, "I would have remained Long. But, I may go Long at the open, especially if there is a gap-down." What trading vehicle are you referring to, is it TNA and/or TZA? Tia.

Oops, TNA.

Similar threads

- Replies

- 0

- Views

- 102

- Replies

- 0

- Views

- 97