RealMoneyIssues

TSP Legend

- Reaction score

- 101

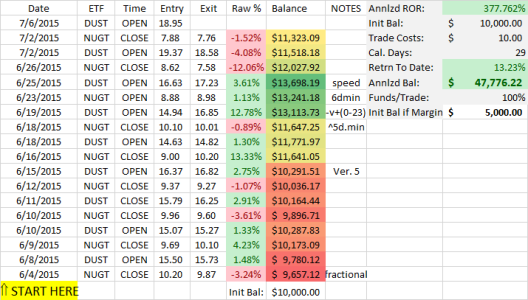

After the OPEN. The opening price gets calculated into the new sheet. Prior to today's open, the system stayed with the previous trade from the last sheet--thus, no updates until today.

Ah, gotcha, ok...

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

After the OPEN. The opening price gets calculated into the new sheet. Prior to today's open, the system stayed with the previous trade from the last sheet--thus, no updates until today.

07-02-15 DUST AT OPEN

07-02-15 NUGT AT CLOSE (subject to change)

I assume this means buy Dust at open sell Nugt at close?

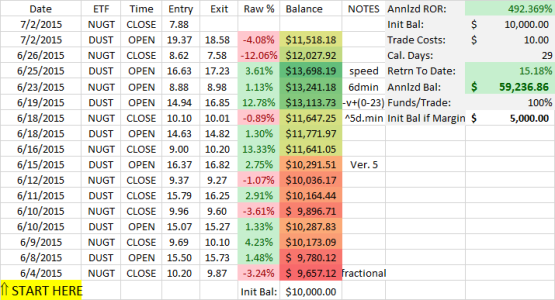

SPREADSHEET UPDATE (Kathy, let me know if you can't view these):

View attachment 34312

07-02-15 DUST AT OPEN

07-02-15 NUGT AT CLOSE (subject to change)

Here, this will fix it...

I, RMI, do solemnly swear to no longer follow this system.

There, all fixed.

Have a great week!!

Sent from my (Daughter forcing me to use an) iPhone using Tapatalk...

I'm still in NUGT. As they say in Street Fighter... FIGHT!