Good to hear ripper. Very smart of you! Years ago I pondered how one could trade multiple systems. I concluded that you can simply trade the majority signals (trade the signal that the majority of the systems call for), or unanimous 'decision' (only trade when all systems agree), etc. Your 'other' system would be: only trade with the trend. Nicely done.

Position sizing is extremely important, especially with an unproven system.

It'll be a while before I run tests on using 'stops.' I first want to achieve the best possible underlying system first. Then I would probably want to code a full fledged backtesting program to test stop usage/placement. Misplaced stops, or any stops, can also possibly harm performance. It ALL depends on the accuracy of the underlying system.

Also, using stops while only trading in one direction is easier than using stops while trading both ways. For example, what to do if you are stopped out one day while long--and the system calls to go long at the end of the day? at a worse price than which you were stopped out? When/How do you determine when to get back in if the system keeps calling for long? It's not as simple when trading both ways.

EDIT: On second thought, stops probably aren't easier in one direction.

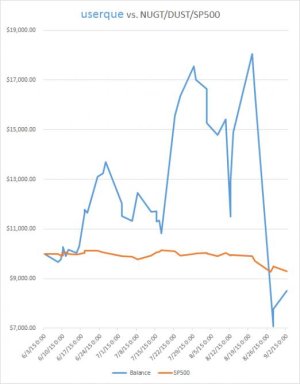

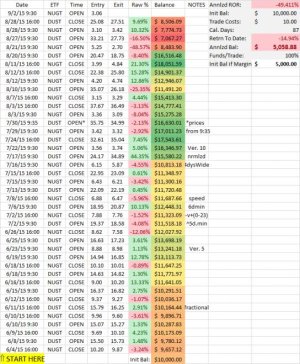

I'm still here. When I haven't posted in a while, it usually means 'I'm working on something...' I'm not the 'give up easily' type. I have a big hole to trade out of. I admit, I wasn't going to post the latest details until I say your post. I was simply going to "just do it:"

SYSTEM PROGRESS UPDATE:

I finally broke down and spent several hours this weekend coding a brute-force program to try every and all possible combinations of all of the indicators I've developed or use(d). It starts with 'yesterday's' indicators/metrics and crunches it way back in time. This way, it'll find the more relevant solutions first, as it computes on into infinity looking for something better. It has been running for 19 hours now.

Within the first hour, it had already found a solution better than what I've ever used and tested so far. (I've previously tested my systems manually [but with simple macros] going back several months). These aren't backtests to see how much money it would have made. These tests test how well the systems can forecast future price action. They do use percentage gained/lost to keep score. The first solution the brute-force code (let's call him "brutus") found did more than twice as well as my previous best. It has since improved that solution twice. It tests back 11 months and is into the third day of recent history signal-wise.

(Signal-wise explained: For example, if I wanted to find the best system to trade GDX using a moving average, I would code a program to start with the 2 day moving average, going back 11 months. Log the results. Then test the combination of the 2 day AND the 3 day MA's ALL going back 11 months, then the combination of 2, 3, and 4; and so on, up until an "obvious" stopping point: 400 day MA? Until no further improvements in a certain amount of time? Why stop it at all?).

My indicators are more complex than MA's. They are more computationally involved. The time it takes to test, signal-wise, increases exponentially. IOW, it'll be several days before I can completely brute-force 4 days of metrics 'back,' whereas I did the first three in one day. (I'll be splitting computer resource with the TSP model as well.)

BTW, so far, the best solution likes entering dust at Tuesday's open.

I'll run it for several more hours, then I'll port it over to the TSP model and let that model run into Tuesday morning.

Then I'll run them both continually--for at least several weeks, most likely. (I coded brutus to periodically save the results as it crunches and to be stoppable and resumable without having to start again from the beginning.)

So far, 3,368 indicator combinations tested going back 11 months...and counting. (at a rate of about 19 seconds per combination per 11 months)

EDIT: The rate decays exponentially as the combinations get longer--as it goes further back in history gathering metrics/indicators to test.

EDIT3: The rate of combinations doesn't change. The rate of going back in history decreases....as there are MORE combinations to test as it goes further back.

EDIT2: To help put things in perspective, there are about half-a-million combinations to test within only 5 days of indicators/metrics.

__________________________________________________________________________________________________________________________________________________________________________

DISCLAIMER: Userque's trading signals are not affiliated with TSP Talk or Buy Low Sell High, Inc. The information is for educational purposes only! The information is not advice or recommendations. The information may be revised at anytime. Userque does not give investment advice. Do not act on this data. Do not buy, sell or trade any stocks, ETF's, indices, funds, or any other instruments/vehicles based on this information. Userque may trade differently than discussed or posted in this forum.

Thanks for sharing your signals, userque.

I've been trading some of them, albeit with a very small (<1%) portion of my retirement funds. Just more or less for fun and to keep me interested for tracking purposes.

I don't like trading against the long-term trend. Since the gold miners have been in a downtrend, I've only been trading the DUST signals. Just trading those signals has shown a profit of about 28% since they were first tracked on here. That performance can be improved to about 85% with the use of stops. I think it's usually a good idea to use stops, especially when trading something as volatile as this sector.

I expect GDX to move lower. I think gold will eventually dip below $1,000, so I'll probably continue to just play the DUST trades at least until then, as long as they're still posted.

I won't increase my position since it's way too early to determine the long-term performance of this system. It may even flip-flop and make the NUGT trades more profitable than the DUST trades.