Stocks appear to be at another crossroad. Can the broader market slice through resistance directly overhead or is it ready to reverse back to the downside? It's been a big run in just three days and that jobs report could be the catalyst that sends the averages in one direction or the other.

Treasuries have been moving lower in recent days as stocks have rallied. And while the moves in the bond market haven't been nearly as dramatic, it's been volatile all the same. But in the bigger picture, the bond market is still quite healthy and is giving absolutely no indication that it believes good times are ahead.

The only economic data point of note was the latest weekly initial jobless claims count, which was up by 6,000 to 401,000. That was pretty much in-line with estimates.

Now the spotlight is on the official non-farm payrolls report, which will be released early this morning. A sell the news event? I note that our sentiment survey came in on the bullish side and flip to a sell for next week. Given the large upside swing we've just had, I'd not be surprised we head lower very soon.

Here's Thursday's charts:

Both NAMO and NYMO moved higher yesterday and remain on buys. However, note the lower highs at the peaks over the past couple of months. Thursday's action left both charts at lower highs again, which suggests to me that some selling pressure could be imminent.

NAHL and NYHL didn't move much yesterday, but remain on buys. Both are just below the neutral line, which isn't a positive in this bear market. They too suggest this upside move could be almost finished.

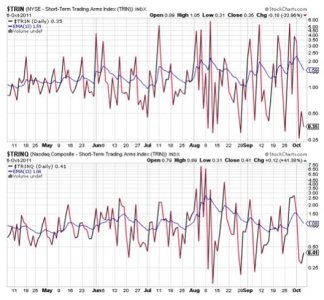

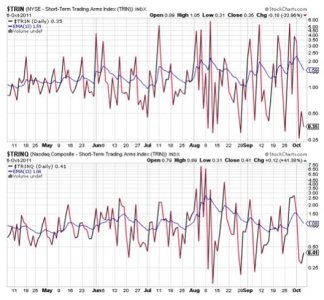

TRIN and TRINQ remain on buys as well, but suggest a moderately overbought market. As with the previous charts, they are also suggesting that selling pressure could be near.

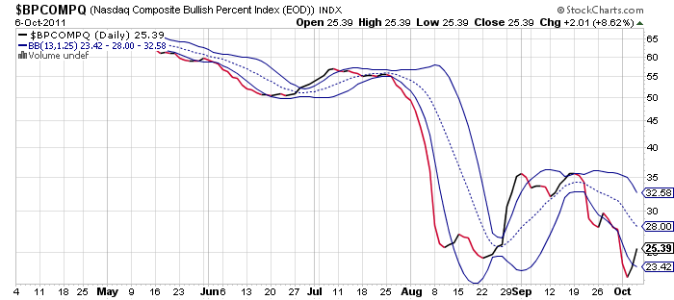

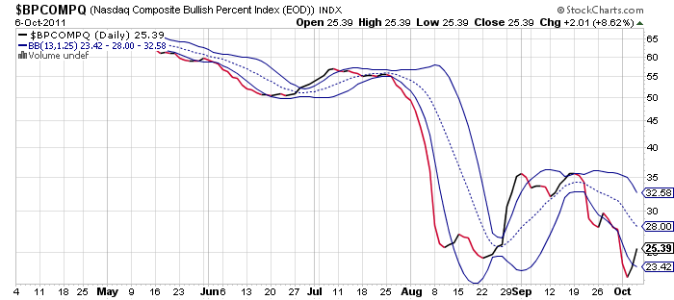

BPCOMPQ remains on a buy, but should this market reverse hard over the coming days it would not take much to flip this signal back to a sell.

While I've pointed out that the charts highly suggest a move lower is near, we could breakout to the upside too. And if we do, that could bring capitulation from the bears who've been doing a lot of shorting of late. Just like the poke to a fresh low got reversed quickly, the same could hold true if we break through resistance. The market may just want to do that first before any reversal.

I've been stuck in the F fund for about a month and half and yesterday's closing price puts me almost at my buy-in price, which means I've gotten nowhere in that time. But I haven't been whipsawed either, and that means a lot. I'm tempted to buy this market near support should we move back down to previous lows since my charts won't predict the turns fast enough to act on them. That's not the way I want to trade my account, but Tuesday's turn came in the final 40 minutes of trade, which meant I couldn't buy this market until close of business Wednesday. And by that time we'd covered a lot of ground. Monday was the ideal day to buy, but it would have taken a lot of faith to buy at that point given we'd just broken support. And that's called gambling in my book, but it sure has been profitable for those who've had the guts to do it. However, one still has to extract themselves with the gain intact, and that's not so simple either given moves in both directions have tended to be fast and deep. You have to the sell the rallies and not wait for the turn, otherwise it could be too late to lock in profits.

Treasuries have been moving lower in recent days as stocks have rallied. And while the moves in the bond market haven't been nearly as dramatic, it's been volatile all the same. But in the bigger picture, the bond market is still quite healthy and is giving absolutely no indication that it believes good times are ahead.

The only economic data point of note was the latest weekly initial jobless claims count, which was up by 6,000 to 401,000. That was pretty much in-line with estimates.

Now the spotlight is on the official non-farm payrolls report, which will be released early this morning. A sell the news event? I note that our sentiment survey came in on the bullish side and flip to a sell for next week. Given the large upside swing we've just had, I'd not be surprised we head lower very soon.

Here's Thursday's charts:

Both NAMO and NYMO moved higher yesterday and remain on buys. However, note the lower highs at the peaks over the past couple of months. Thursday's action left both charts at lower highs again, which suggests to me that some selling pressure could be imminent.

NAHL and NYHL didn't move much yesterday, but remain on buys. Both are just below the neutral line, which isn't a positive in this bear market. They too suggest this upside move could be almost finished.

TRIN and TRINQ remain on buys as well, but suggest a moderately overbought market. As with the previous charts, they are also suggesting that selling pressure could be near.

BPCOMPQ remains on a buy, but should this market reverse hard over the coming days it would not take much to flip this signal back to a sell.

While I've pointed out that the charts highly suggest a move lower is near, we could breakout to the upside too. And if we do, that could bring capitulation from the bears who've been doing a lot of shorting of late. Just like the poke to a fresh low got reversed quickly, the same could hold true if we break through resistance. The market may just want to do that first before any reversal.

I've been stuck in the F fund for about a month and half and yesterday's closing price puts me almost at my buy-in price, which means I've gotten nowhere in that time. But I haven't been whipsawed either, and that means a lot. I'm tempted to buy this market near support should we move back down to previous lows since my charts won't predict the turns fast enough to act on them. That's not the way I want to trade my account, but Tuesday's turn came in the final 40 minutes of trade, which meant I couldn't buy this market until close of business Wednesday. And by that time we'd covered a lot of ground. Monday was the ideal day to buy, but it would have taken a lot of faith to buy at that point given we'd just broken support. And that's called gambling in my book, but it sure has been profitable for those who've had the guts to do it. However, one still has to extract themselves with the gain intact, and that's not so simple either given moves in both directions have tended to be fast and deep. You have to the sell the rallies and not wait for the turn, otherwise it could be too late to lock in profits.