OPEX week ended with the major averages posting significant gains. It's been up, up, up since the beginning of the year with few opportunities to buy a dip. Here's this week's charts:

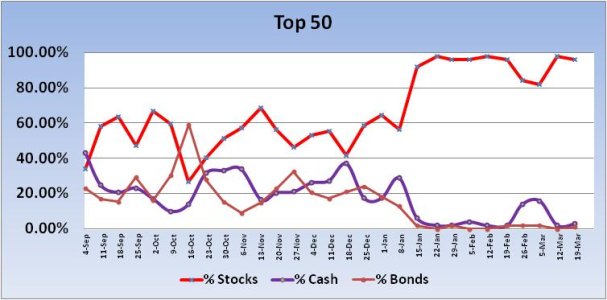

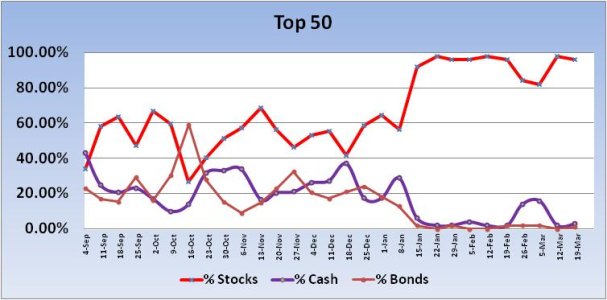

The Top 50 saw a very modest dip in stock allocations, going from 98% last week to 96% this week. The trend has been up and those folks who've been sticking with the S fund this year make up the majority of the TSPers in this group.

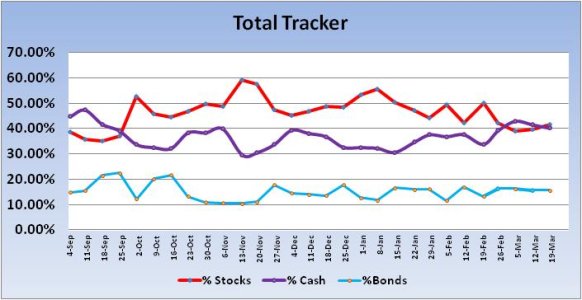

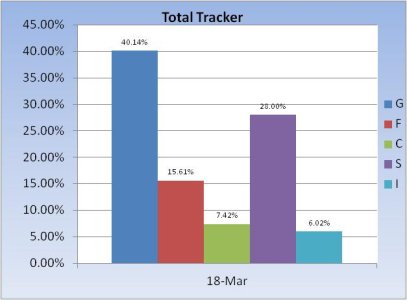

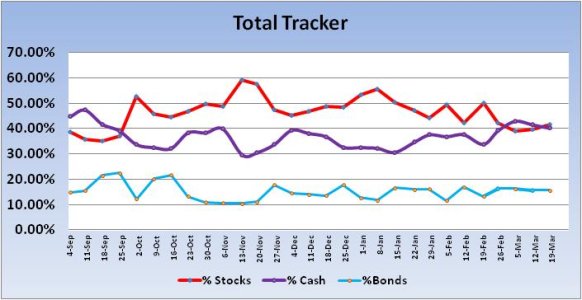

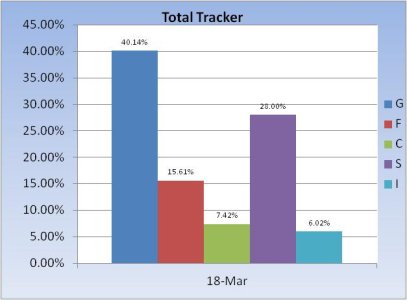

The Total Tracker saw a modest increase in stock allocations of just 1.89%, going from a total allocation of 39.55% last week to 41.44% this week. That's still pretty conservative in a relentless bull market. Can't accuse us of being greedy.

Looking at the S&P, price remains within that upper, advancing trend line. And while price has been trading in a relatively tight range of late, I note the increase in volume from Friday's action. RSI, while still quite high, took a modest dip, as did the MACD. I'm not going to read too much into these indications, but sooner or later this market is going to correct and it may very well have modest beginnings.

The dollar dipped under it's recent trending channel on Friday, which also has me wondering if market character is about to change.

Our sentiment survey remained on a buy with the bulls coming in at 49% and the bears at 40%. I view this as a bit neutral, but other surveys are overly bullish (bearish). Still, as long as the source of the underlying strength remains, sentiment and technical indicators may not be as meaningful. We'll see how it plays out this week. Friday's action has me a bit more attentive than usual. The intermediate term remains up, but for how much longer?

The Top 50 saw a very modest dip in stock allocations, going from 98% last week to 96% this week. The trend has been up and those folks who've been sticking with the S fund this year make up the majority of the TSPers in this group.

The Total Tracker saw a modest increase in stock allocations of just 1.89%, going from a total allocation of 39.55% last week to 41.44% this week. That's still pretty conservative in a relentless bull market. Can't accuse us of being greedy.

Looking at the S&P, price remains within that upper, advancing trend line. And while price has been trading in a relatively tight range of late, I note the increase in volume from Friday's action. RSI, while still quite high, took a modest dip, as did the MACD. I'm not going to read too much into these indications, but sooner or later this market is going to correct and it may very well have modest beginnings.

The dollar dipped under it's recent trending channel on Friday, which also has me wondering if market character is about to change.

Our sentiment survey remained on a buy with the bulls coming in at 49% and the bears at 40%. I view this as a bit neutral, but other surveys are overly bullish (bearish). Still, as long as the source of the underlying strength remains, sentiment and technical indicators may not be as meaningful. We'll see how it plays out this week. Friday's action has me a bit more attentive than usual. The intermediate term remains up, but for how much longer?