In yesterday's blog I had mentioned early on that the Seven Sentinels had seen several unconfirmed buy and sell signals in the previous weeks. Its last sell signal was not productive, in fact the market continued higher while I waited for the next signal to develop. I anticipated that it would be a buy signal, and it was. That was issued last week. And two trading days later (yesterday) the system issued another unconfirmed sell signal. Today it is about as close to a confirmed sell as it can get while remaining on a buy.

I attributed yesterday's decline to fears centering in the Middle East and North Africa. Libya is at the center of the current storm, but what is happening in Libya is not isolated. Several other countries are experiencing some degree of unrest, which could escalate and perhaps even spread to other counties not currently affected.

These unpredictable events can make it very challenging to chart what the market may do through technical analysis, and our very restricted ability to respond to them in TSP complicates our decisions. No one can say for certainty whether the current weakness will be short lived or not, and the volatility we are seeing in the markets suggests fear is rising.

In the short term, I don't think market data means a hill of beans, but longer term it will. For now the market is focused on oil and fear is probably being used as a tool to clear out some weak hands. And with the increased volatility we are now seeing we also have an increased possibility of whipsaw action. This would allow the big money to reload and take the market higher, but from what level? Understand this is speculation on my part, but I am very concerned about whipsaws here.

Yes, risk is now elevated, but while the short and intermediate term is under attack, the longer term trend is still up. But I look at the intermediate term with the seven sentinels and because I am seeing so many signals, both unconfirmed and confirmed, I cannot be sure what this market is planning on doing next. It now looks ready to roll over, and after the long, sustained move we saw over the past 6 months, that would seem to make sense. But liquidity hasn't yet stopped, and that's another factor that suggests the powers that be want to take this market higher. So it appears to be a battle between liquidity and fear at the moment.

So we have hit a rough patch and it doesn't look good, but as I've tried to point out the big picture is quite complicated and nothing can be assumed.

Let's look at the charts:

Still on a sell here, and NYMO is within about a point and a half of confirming a sell signal.

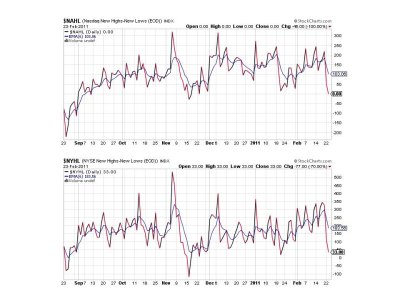

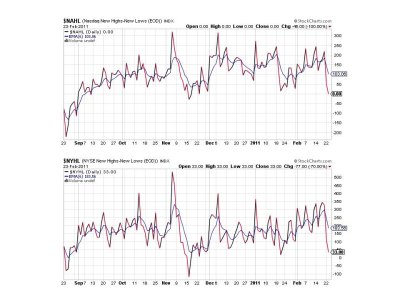

NAHL and NYHL also remain on sells.

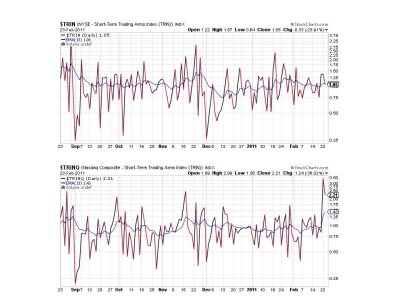

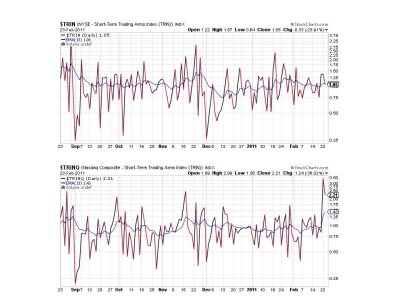

TRIN managed to flip to a buy (barely), while TRINQ worked off a bit of its overbought reading from yesterday, but still remains on a sell.

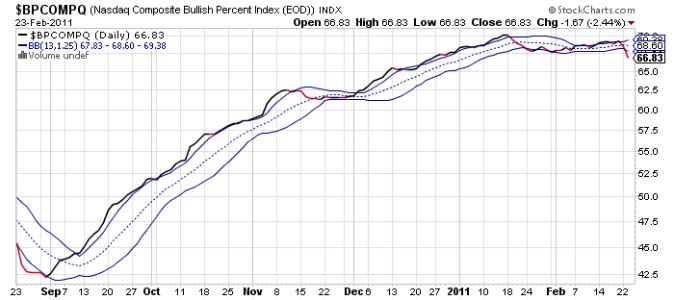

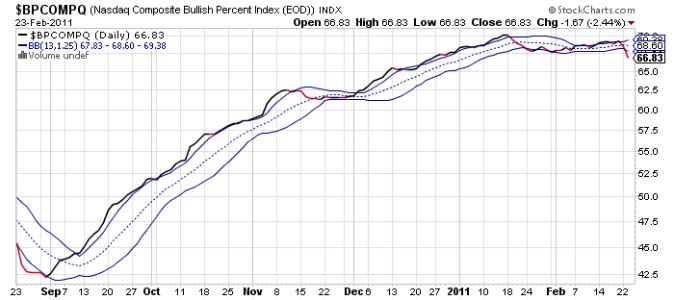

BPCOMPQ looks bearish after two consecutive down days. Obviously it remains on a sell.

So the system remains on a buy, but the action in the markets has gotten volatile and has raised whipsaw risk. It is possible that we can go much lower, but I don't expect that scenario given the liquidity that this market has been receiving. But at the same time it may also depend on how ugly things get overseas. And I never mentioned the contentious politics at play here, including what's looking more and more like a Government shut down looming on the horizon.

It's never felt more like a casino than right now.

I attributed yesterday's decline to fears centering in the Middle East and North Africa. Libya is at the center of the current storm, but what is happening in Libya is not isolated. Several other countries are experiencing some degree of unrest, which could escalate and perhaps even spread to other counties not currently affected.

These unpredictable events can make it very challenging to chart what the market may do through technical analysis, and our very restricted ability to respond to them in TSP complicates our decisions. No one can say for certainty whether the current weakness will be short lived or not, and the volatility we are seeing in the markets suggests fear is rising.

In the short term, I don't think market data means a hill of beans, but longer term it will. For now the market is focused on oil and fear is probably being used as a tool to clear out some weak hands. And with the increased volatility we are now seeing we also have an increased possibility of whipsaw action. This would allow the big money to reload and take the market higher, but from what level? Understand this is speculation on my part, but I am very concerned about whipsaws here.

Yes, risk is now elevated, but while the short and intermediate term is under attack, the longer term trend is still up. But I look at the intermediate term with the seven sentinels and because I am seeing so many signals, both unconfirmed and confirmed, I cannot be sure what this market is planning on doing next. It now looks ready to roll over, and after the long, sustained move we saw over the past 6 months, that would seem to make sense. But liquidity hasn't yet stopped, and that's another factor that suggests the powers that be want to take this market higher. So it appears to be a battle between liquidity and fear at the moment.

So we have hit a rough patch and it doesn't look good, but as I've tried to point out the big picture is quite complicated and nothing can be assumed.

Let's look at the charts:

Still on a sell here, and NYMO is within about a point and a half of confirming a sell signal.

NAHL and NYHL also remain on sells.

TRIN managed to flip to a buy (barely), while TRINQ worked off a bit of its overbought reading from yesterday, but still remains on a sell.

BPCOMPQ looks bearish after two consecutive down days. Obviously it remains on a sell.

So the system remains on a buy, but the action in the markets has gotten volatile and has raised whipsaw risk. It is possible that we can go much lower, but I don't expect that scenario given the liquidity that this market has been receiving. But at the same time it may also depend on how ugly things get overseas. And I never mentioned the contentious politics at play here, including what's looking more and more like a Government shut down looming on the horizon.

It's never felt more like a casino than right now.