We gave up some recent gains today, but all in all it was not unexpected and it certainly didn't do any technical damage.

There were a number of things contributing to the downward bias. First, the Dollar Index hit a fresh two-month high, pulled back some, but still finished with a .7% gain against major currencies. Second, the November Producer Price Index increased 1.8%, which was much higher than expected. Excluding food and energy, the increase came in at .5%, but still stronger than the .2% that was forcast. Third, the Empire Manufacturing Index for December came in at 2.55. This was not even close to the 24.00 that was expected, and was much weaker than the November reading.

But aside from these data points, stocks really held their own. Tormorrow we have the CPI and Core CPI data release along with the always important FOMC policy statement. If today's market action was any indication, tomorrow would seem to indicate more of the same. The FOMC policy statement should not reveal anything different than what's already been offered all year. So unless something really unexpected happens, it could be another boring day of market activity.

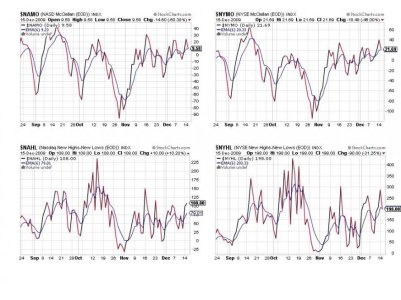

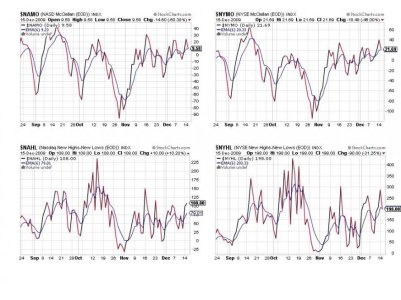

The Seven Sentinels flipped some signals today, but with the tight trading ranges we've had it really does not take much to push any signal above or below its respective moving average. Here's the charts:

Two of these signals are right at their 6 day EMA, while one is a clear buy and the other a sell.

TRIN and TRINQ flipped to sells today, but BPCOMPQ actually inched above the upper bollinger band.

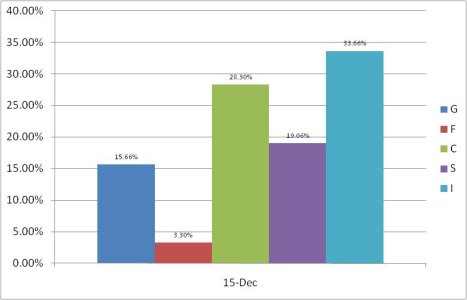

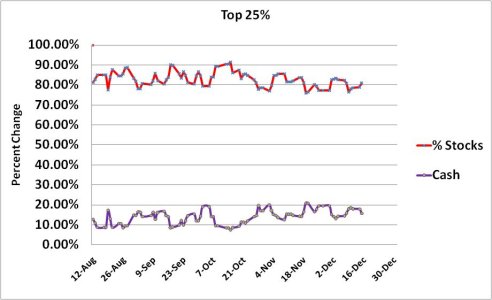

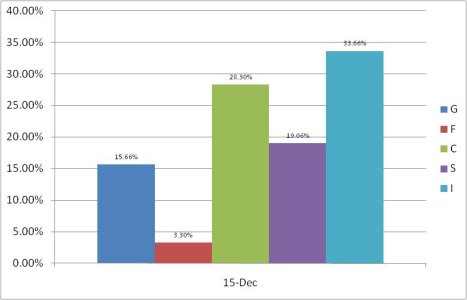

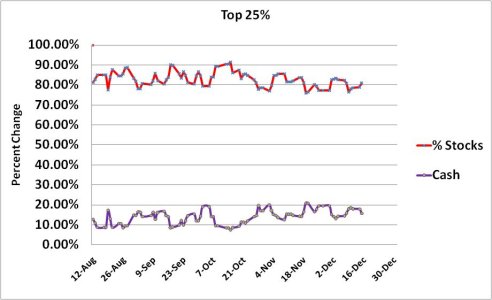

No surprises from our Top 25%, although I'm surprised the I fund is still attracting a lot of investment dollars given dollar strength of late.

So the Seven Sentinels remain on a buy, with small movement among the signals. We actually could get a sell signal with any follow-through weakness, but we could also flip back to 7 of 7 buy signals with moderate upward pricing pressure too. That's how tight this market is trading. Still long for now. See you tomorrow.

There were a number of things contributing to the downward bias. First, the Dollar Index hit a fresh two-month high, pulled back some, but still finished with a .7% gain against major currencies. Second, the November Producer Price Index increased 1.8%, which was much higher than expected. Excluding food and energy, the increase came in at .5%, but still stronger than the .2% that was forcast. Third, the Empire Manufacturing Index for December came in at 2.55. This was not even close to the 24.00 that was expected, and was much weaker than the November reading.

But aside from these data points, stocks really held their own. Tormorrow we have the CPI and Core CPI data release along with the always important FOMC policy statement. If today's market action was any indication, tomorrow would seem to indicate more of the same. The FOMC policy statement should not reveal anything different than what's already been offered all year. So unless something really unexpected happens, it could be another boring day of market activity.

The Seven Sentinels flipped some signals today, but with the tight trading ranges we've had it really does not take much to push any signal above or below its respective moving average. Here's the charts:

Two of these signals are right at their 6 day EMA, while one is a clear buy and the other a sell.

TRIN and TRINQ flipped to sells today, but BPCOMPQ actually inched above the upper bollinger band.

No surprises from our Top 25%, although I'm surprised the I fund is still attracting a lot of investment dollars given dollar strength of late.

So the Seven Sentinels remain on a buy, with small movement among the signals. We actually could get a sell signal with any follow-through weakness, but we could also flip back to 7 of 7 buy signals with moderate upward pricing pressure too. That's how tight this market is trading. Still long for now. See you tomorrow.