It may not be the "official" holiday trading period, but it's still an abbreviated trading week and the holiday bias does seem to be with us. Since OPEX expiration the stock market has posted two days in a row of gains. The Nasdaq is leading the pack, which is what we want to see.

Can it be this easy? In spite of bullish sentiment?

I don't know, but I'm impressed so far. We have a Seven Sentinels buy signal in force right now and today saw fresh 52 week highs posted by the major indicies. If I had another IFT this month I would have followed that last buy signal.

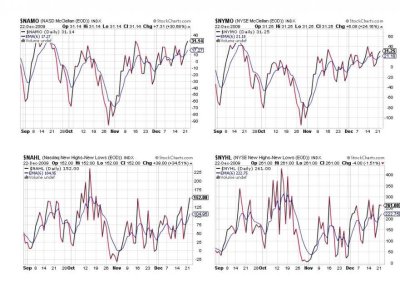

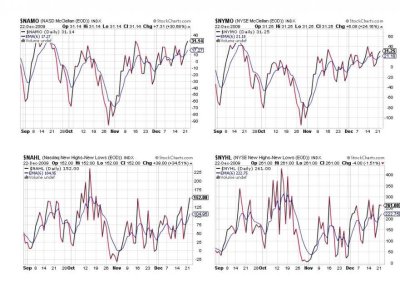

Since the market seems to be bent on pushing higher, I'd follow it. Here's today's charts:

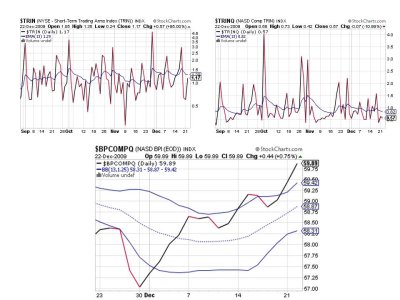

No changes here, we can see the NAZ portion of these signals (NAHL and NAMO) are leading the NYSE signals here. I will point out once again that NAMO and NYMO look toppy to me, but with this holiday bias there's no telling how high they may go.

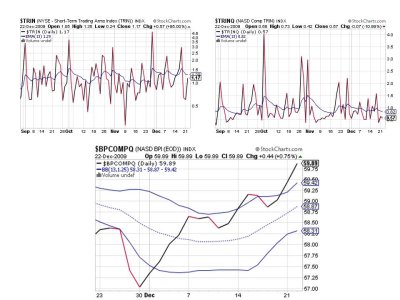

TRIN and TRINQ remain on a buy as does BPCOMPQ.

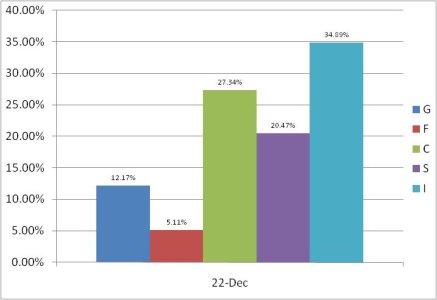

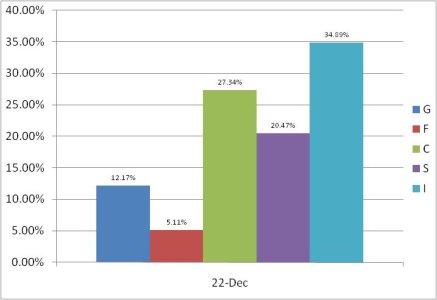

Our Top 25% have made some ajustments which I found interesting. The I fund holdings have crept back up again, which tells me that not everyone is buying the longer term dollar strength scenario. The F fund has picked up some favor too. But in spite of recent S fund strength, that fund is lagging in allocation.

So the SS remain on a buy with all signals flashing buys. If you're in stocks you're enjoying the front end of this holiday season. The trend is up and weakness has continued to be shallow and brief. See you tomorrow.

Can it be this easy? In spite of bullish sentiment?

I don't know, but I'm impressed so far. We have a Seven Sentinels buy signal in force right now and today saw fresh 52 week highs posted by the major indicies. If I had another IFT this month I would have followed that last buy signal.

Since the market seems to be bent on pushing higher, I'd follow it. Here's today's charts:

No changes here, we can see the NAZ portion of these signals (NAHL and NAMO) are leading the NYSE signals here. I will point out once again that NAMO and NYMO look toppy to me, but with this holiday bias there's no telling how high they may go.

TRIN and TRINQ remain on a buy as does BPCOMPQ.

Our Top 25% have made some ajustments which I found interesting. The I fund holdings have crept back up again, which tells me that not everyone is buying the longer term dollar strength scenario. The F fund has picked up some favor too. But in spite of recent S fund strength, that fund is lagging in allocation.

So the SS remain on a buy with all signals flashing buys. If you're in stocks you're enjoying the front end of this holiday season. The trend is up and weakness has continued to be shallow and brief. See you tomorrow.