On Tuesday, the Seven Sentinels triggered an unconfirmed sell condition and one more day of significant selling pressure could have made it an official signal. But the market has rallied the past two days since that unconfirmed sell was issued.

Stocks did see some selling pressure not long after the open and went from gains of about 1% to losses after the first half hour of trade. But the selling didn't last long at all as the market instead chopped its way higher and closed near the highs of the day.

The European Central Bank lowered its key lending rate today, dropping it from 1.5% to 1.25%.

And Greece backed off its plans for a referendum and now appears to be moving towards acceptance of the bailout plan after all. I'll believe it when I see it though. There's still some serious political pressure surrounding this issue.

Here at home, the October ISM Services Index posted a 52.9, which was under expectations of 53.9. However, factory orders in September actually rose by 0.3%, which beat estimates of a 0.2% drop.

Finally, initial jobless claims fell below 400,000 for the previous week with a total of 397,000 claims. That was largely in-line with estimates.

Here's the charts:

NAMO and NYMO have crossed back up through their 6 day EMA, which puts them back into a buy condition.

NAHL and NYHL are also back on buys.

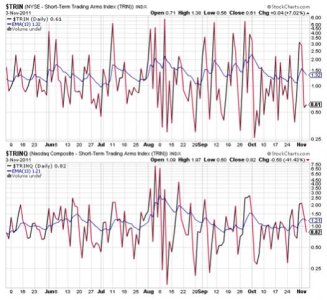

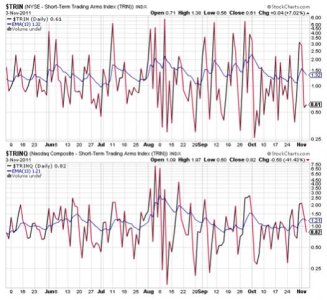

TRIN remained on a buy and continues to suggest a moderately overbought market. TRINQ crossed back down through its 13 day EMA and flipped to a buy in the process.

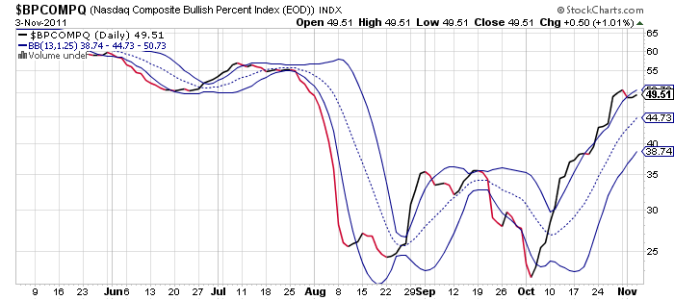

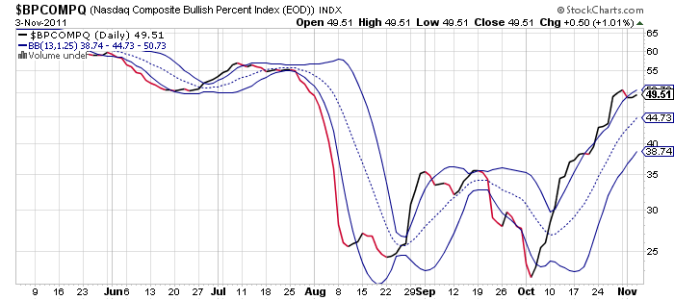

BPCOMPQ turned up a bit more today, but still remains on a sell.

So the signals remain mixed, but the system stays on an official buy. The unconfirmed sell signal triggered Tuesday is still in play as a warning, however.

Has tomorrow's jobs number been priced into the market now? Perhaps. Of concern to me is the fact that the Seven Sentinels appear to be moving towards a possible confirmed sell signal. It may take a few more days, but BPCOMPQ is already on a sell (albeit not a very convincing one), but if this market was to move back down again in the coming days, NYMO would not have to fall as far to tag a fresh 28 day trading low, which could trigger an official sell signal. I think there is a good possibility we could get there sometime next week on a move back down. For now though, it's just something to watch for.

Stocks did see some selling pressure not long after the open and went from gains of about 1% to losses after the first half hour of trade. But the selling didn't last long at all as the market instead chopped its way higher and closed near the highs of the day.

The European Central Bank lowered its key lending rate today, dropping it from 1.5% to 1.25%.

And Greece backed off its plans for a referendum and now appears to be moving towards acceptance of the bailout plan after all. I'll believe it when I see it though. There's still some serious political pressure surrounding this issue.

Here at home, the October ISM Services Index posted a 52.9, which was under expectations of 53.9. However, factory orders in September actually rose by 0.3%, which beat estimates of a 0.2% drop.

Finally, initial jobless claims fell below 400,000 for the previous week with a total of 397,000 claims. That was largely in-line with estimates.

Here's the charts:

NAMO and NYMO have crossed back up through their 6 day EMA, which puts them back into a buy condition.

NAHL and NYHL are also back on buys.

TRIN remained on a buy and continues to suggest a moderately overbought market. TRINQ crossed back down through its 13 day EMA and flipped to a buy in the process.

BPCOMPQ turned up a bit more today, but still remains on a sell.

So the signals remain mixed, but the system stays on an official buy. The unconfirmed sell signal triggered Tuesday is still in play as a warning, however.

Has tomorrow's jobs number been priced into the market now? Perhaps. Of concern to me is the fact that the Seven Sentinels appear to be moving towards a possible confirmed sell signal. It may take a few more days, but BPCOMPQ is already on a sell (albeit not a very convincing one), but if this market was to move back down again in the coming days, NYMO would not have to fall as far to tag a fresh 28 day trading low, which could trigger an official sell signal. I think there is a good possibility we could get there sometime next week on a move back down. For now though, it's just something to watch for.