The market opened in positive territory today and for most of the day continued to march higher until the final few minutes of trade when a flurry of profit taking took the major averages off their highs of the day. Still, the DOW tacked on 3.95%, while the Nasdaq and S&P 500 ended the day withe gains of 4.69% and 4.63% respectively.

Given the extreme volatility we've seen in recent weeks, it is not surprising to see that end-of-day profit taking as these big moves tend to reverse quickly.

There was some good news for change early on in the trading day as initial jobless claims came in at 395,000, which was less than forecast by 14,000.

Treasuries were down hard, which pushed the yield on the benchmark 10-year note up to a close of 2.30%.

Let's see what the charts have to say:

After a modest dip yesterday, NAMO and NYMO rebounded much higher. I expect more upside based on these two signals as we were sitting at historic lows. I would think we'd at least get back to the neutral line before we run into trouble. And as fast as these signals are rising, that could be very soon. But I also have reason to believe they may go well into positive territory, as I'll explain in a moment.

NAHL and NYHL look bullish again. Both are flashing buys.

It's one extreme to the other for TRIN and TRINQ. Both are back in buy territory and are showing a market that is more oversold in the short term today than it was two days ago when last they probed these levels. I would think based on these readings that we're in for more short term selling pressure. More on these signals in a moment.

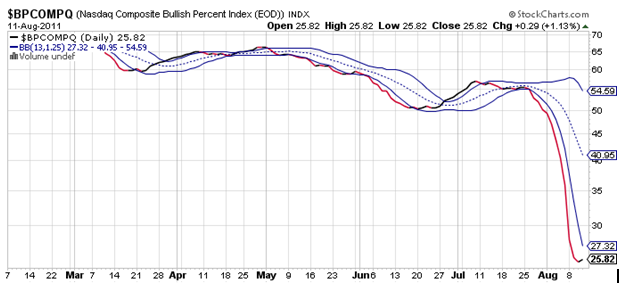

BPCOMPQ turned the corner today and moved just a bit higher. It's been showing an oversold market in the longer term ever since it fell below 30 on the chart. While this signal remains in a sell condition, that lower bollinger band is getting very close to touching it, which means it could flip to a buy signal with some follow-through to the upside over the coming days.

So the Seven Sentinels remain in an intermediate term sell condition, but 6 of 7 signals are flashing buys, and the one sell is not far off triggering a buy if we can break out to the upside. But even if this market breaks harder to the upside, it would take a NYMO reading of about +75 to confirm a buy signal, and that's quite a ways off yet. But that +75 target will only last about three more trading days. Otherwise it begins to drop quickly towards zero, which makes the potential of getting a confirmed buy signal much easier. So for now I would continue to look at this market from a short term perspective, and these charts suggest we move higher in the short term.

Here's what I'm looking for. Given TRIN and TRINQ are showing a very overbought market, I need to see this market hold its current gains in large measure. I'd like to see a sell-off tomorrow that reverses back to the upside. That would work off those short term overbought conditions. Since NAMO and NYMO have upside momentum in their favor, I see that modest curl up on on BPCOMPQ as a short term indication that higher prices may be coming. The one thing I'm concerned about is sentiment. It's looking a bit too "obvious" to market participants that a low is in. Our own sentiment survey is showing 51% bulls at this writing. That's not overly bullish, but given how much decline we've seen in the past two weeks, it could be problematic.